SDLT46 Notice of Appeal Against a Penalty Stamp Duty Land Tax 2019-2026

What is the SDLT46 Notice of Appeal Against a Penalty Stamp Duty Land Tax

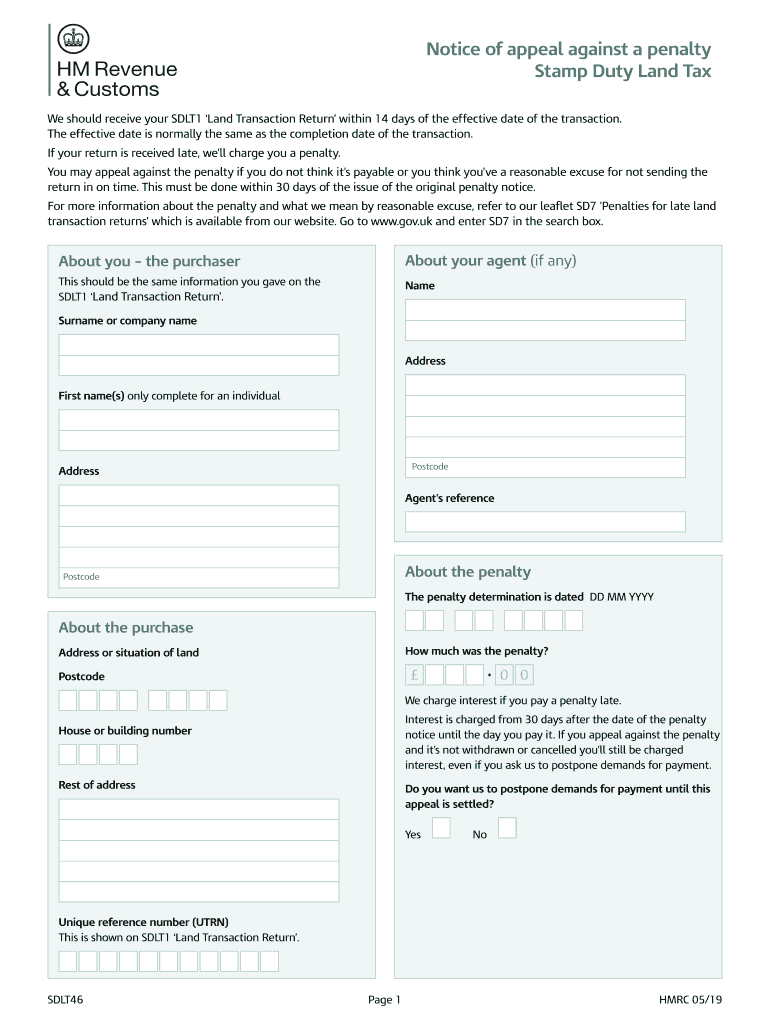

The SDLT46 Notice of Appeal is a formal document used by taxpayers in the United Kingdom to contest penalties imposed under the Stamp Duty Land Tax (SDLT) regulations. This notice allows individuals or entities to present their case against the penalty, providing reasons and supporting evidence. Understanding this form is crucial for those who believe they have been wrongly penalized, as it serves as a means to seek redress and clarify their position regarding the tax obligations.

How to Use the SDLT46 Notice of Appeal Against a Penalty Stamp Duty Land Tax

To effectively use the SDLT46 Notice of Appeal, taxpayers must first ensure they have received a penalty notice from HM Revenue and Customs (HMRC). Upon receiving this notice, the taxpayer should carefully review the details of the penalty, including the reasons for its issuance. The next step involves filling out the SDLT46 form, clearly stating the grounds for the appeal, and providing any relevant documentation to support their case. Once completed, the form should be submitted to HMRC within the specified timeframe to ensure the appeal is considered valid.

Key Elements of the SDLT46 Notice of Appeal Against a Penalty Stamp Duty Land Tax

The SDLT46 form includes several key elements that must be addressed for a successful appeal. These elements typically include:

- Personal Information: The taxpayer's name, address, and contact details.

- Penalty Details: Information regarding the penalty, including the amount and the date it was issued.

- Grounds for Appeal: A detailed explanation of why the taxpayer believes the penalty is unjust, supported by facts and evidence.

- Supporting Documentation: Any relevant documents that bolster the appeal, such as correspondence with HMRC or proof of compliance.

Steps to Complete the SDLT46 Notice of Appeal Against a Penalty Stamp Duty Land Tax

Completing the SDLT46 form involves several important steps:

- Review the Penalty Notice: Understand the reasons for the penalty and gather any relevant information.

- Obtain the SDLT46 Form: This form can typically be downloaded from the HMRC website or requested directly from HMRC.

- Fill Out the Form: Provide all required personal information and clearly articulate the reasons for the appeal.

- Attach Supporting Documents: Include any evidence that supports your case, ensuring all documents are relevant and clearly labeled.

- Submit the Form: Send the completed SDLT46 form to HMRC by the specified deadline, ensuring it is sent to the correct address.

Penalties for Non-Compliance with SDLT46 Notice of Appeal

Failing to comply with the SDLT46 process can lead to several consequences. If an appeal is not submitted within the designated timeframe, the taxpayer may lose the right to contest the penalty. Additionally, non-compliance could result in further penalties or interest accruing on the original tax owed. It is essential for taxpayers to adhere to all timelines and requirements outlined in the penalty notice to avoid these repercussions.

Form Submission Methods for SDLT46 Notice of Appeal

The SDLT46 Notice of Appeal can typically be submitted through various methods, including:

- Online Submission: Some taxpayers may have the option to submit their appeal electronically through HMRC's online services.

- Mail: The completed form can be printed and sent via postal mail to the appropriate HMRC address.

- In-Person Submission: In certain cases, taxpayers may choose to deliver the form directly to an HMRC office.

Quick guide on how to complete sdlt46 notice of appeal against a penalty stamp duty land tax

Complete SDLT46 Notice Of Appeal Against A Penalty Stamp Duty Land Tax seamlessly on any device

Managing documents online has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without hold-ups. Handle SDLT46 Notice Of Appeal Against A Penalty Stamp Duty Land Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to edit and eSign SDLT46 Notice Of Appeal Against A Penalty Stamp Duty Land Tax effortlessly

- Acquire SDLT46 Notice Of Appeal Against A Penalty Stamp Duty Land Tax and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign SDLT46 Notice Of Appeal Against A Penalty Stamp Duty Land Tax and ensure exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sdlt46 notice of appeal against a penalty stamp duty land tax

Create this form in 5 minutes!

People also ask

-

What is the 2018 UK stamp duty?

The 2018 UK stamp duty refers to a tax imposed on property transactions in the United Kingdom. This tax is crucial for buyers to understand, as it can signNowly impact the overall cost of purchasing property. Knowing the 2018 UK stamp duty rates can help you budget effectively during your home buying process.

-

How does airSlate SignNow simplify the eSigning process for documents related to 2018 UK stamp duty?

airSlate SignNow provides an efficient platform for eSigning documents, including those relevant to the 2018 UK stamp duty. With features like templates and customizable workflows, businesses can streamline their document management while ensuring compliance with the latest regulations. This simplicity can save valuable time and reduce the stress associated with property transactions.

-

What features does airSlate SignNow offer to assist with 2018 UK stamp duty documentation?

airSlate SignNow offers a range of features that cater to the documentation needed for 2018 UK stamp duty. This includes form templates specifically designed for property transactions and an easy-to-navigate dashboard. You can also track document status and manage signatures in real-time, all of which can enhance your compliance with stamp duty regulations.

-

Are there any costs associated with using airSlate SignNow for 2018 UK stamp duty paperwork?

Yes, there are costs associated with using airSlate SignNow, but the pricing plans are designed to be cost-effective for businesses dealing with 2018 UK stamp duty documents. By utilizing this solution, you can save on printing and mailing costs, making it a financially savvy option. Explore different pricing tiers to find the best fit for your needs.

-

Can I integrate airSlate SignNow with other tools I use for managing 2018 UK stamp duty processes?

Absolutely! airSlate SignNow offers integrations with various software tools commonly used in real estate and legal industries. This means you can link your existing systems for an efficient workflow while managing your 2018 UK stamp duty paperwork digitally. Integrating tools can lead to better data accuracy and improved efficiency.

-

What are the benefits of using airSlate SignNow for paperwork associated with 2018 UK stamp duty?

Using airSlate SignNow for 2018 UK stamp duty paperwork offers several benefits. It minimizes paperwork through digital solutions, enhances security with encrypted documents, and simplifies collaboration among stakeholders. This leads to a faster and more efficient process in handling your stamp duty requirements.

-

Is airSlate SignNow compliant with UK regulations for eSigning in relation to 2018 UK stamp duty?

Yes, airSlate SignNow is compliant with UK regulations governing electronic signatures, making it a trusted choice for managing 2018 UK stamp duty documents. The platform ensures that all electronically signed agreements hold legal validity, essential for any property transaction. Trusting airSlate SignNow helps you maintain compliance while streamlining your documentation process.

Get more for SDLT46 Notice Of Appeal Against A Penalty Stamp Duty Land Tax

- Letter from landlord to tenant as notice of abandoned personal property colorado form

- Guaranty or guarantee of payment of rent colorado form

- Letter from landlord to tenant as notice of default on commercial lease colorado form

- Residential or rental lease extension agreement colorado form

- Commercial rental lease application questionnaire colorado form

- Apartment lease rental application questionnaire colorado form

- Residential rental lease application colorado form

- Salary verification form for potential lease colorado

Find out other SDLT46 Notice Of Appeal Against A Penalty Stamp Duty Land Tax

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy