Australia Carer Allowance Income 2022-2026

Understanding the Australia Carer Allowance Income

The Australia Carer Allowance is a financial support program designed for individuals who provide care to someone with a disability or a medical condition. This allowance is intended to help cover the costs associated with caring for a person who requires additional support. The income from this allowance is not taxable, which means it does not contribute to your assessable income for tax purposes. Understanding the nature of this income is crucial for caregivers, as it can affect their financial planning and eligibility for other benefits.

Steps to Complete the Australia Carer Allowance Income Form

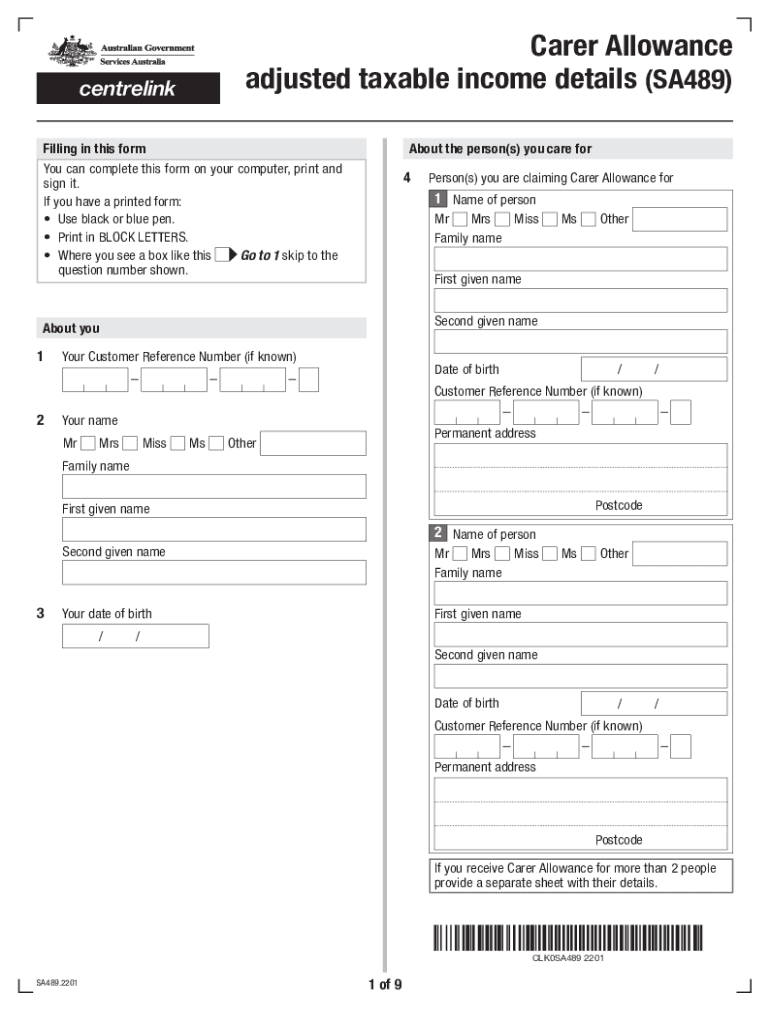

Filling out the carer allowance form SA489 requires careful attention to detail. Here are the steps to ensure a smooth completion:

- Gather necessary documentation, including identification and details about the person you are caring for.

- Provide accurate information regarding your income and any other relevant financial details.

- Complete all sections of the SA489 form, ensuring that no fields are left blank.

- Review the form for accuracy before submission to avoid delays.

- Submit the completed form either online, by mail, or in-person at your local service center.

Eligibility Criteria for the Australia Carer Allowance Income

To qualify for the Australia Carer Allowance, applicants must meet specific eligibility criteria. These include:

- Being a resident of Australia.

- Providing care for a person with a disability or a medical condition that requires additional support.

- Meeting the income and asset tests set by the Department of Human Services.

It is essential to ensure that all criteria are met to avoid issues during the application process.

Required Documents for the Australia Carer Allowance Income

When applying for the carer allowance, several documents are necessary to support your application. These typically include:

- Proof of identity, such as a driver's license or passport.

- Details of the person you are caring for, including their medical condition and any relevant assessments.

- Income statements or payslips to demonstrate your financial situation.

Having these documents ready can facilitate a smoother application process.

Form Submission Methods for the Australia Carer Allowance Income

The SA489 form can be submitted through various methods, providing flexibility for applicants. The available submission methods include:

- Online submission through the Department of Human Services website.

- Mailing the completed form to the designated address.

- In-person submission at local service centers.

Choosing the method that best suits your needs can help expedite the processing of your application.

Legal Use of the Australia Carer Allowance Income

Understanding the legal aspects of the carer allowance is important for recipients. This income is considered a government benefit and is not subject to taxation. However, recipients must report this income accurately if required by other government agencies or programs. Compliance with reporting requirements ensures that caregivers remain eligible for the allowance and do not face penalties.

Quick guide on how to complete australia carer allowance income

Complete Australia Carer Allowance Income effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without hold-ups. Handle Australia Carer Allowance Income on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Australia Carer Allowance Income effortlessly

- Locate Australia Carer Allowance Income and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Australia Carer Allowance Income while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct australia carer allowance income

Create this form in 5 minutes!

People also ask

-

What is the SA489 form?

The SA489 form is an essential document used for applying for a Business Visa in Australia. This form provides necessary information about the applicants and their business activities, making it crucial for anyone seeking to relocate to Australia for business purposes.

-

How can airSlate SignNow help me with the SA489 form?

airSlate SignNow simplifies the process of managing and eSigning the SA489 form. With its user-friendly interface, you can easily upload, send, and electronically sign documents, ensuring compliance and reducing processing time.

-

What are the pricing options for airSlate SignNow when using the SA489 form?

airSlate SignNow offers flexible pricing plans that accommodate different business needs. Whether you’re a startup or an established enterprise, you can choose a plan that fits your budget while providing access to essential features for processing your SA489 form.

-

Is the SA489 form legally valid when signed electronically?

Yes, the SA489 form is legally valid when signed electronically using airSlate SignNow. The platform complies with electronic signature laws, ensuring that your signed documents are legally binding and recognized by authorities.

-

Can I integrate airSlate SignNow with other applications while processing the SA489 form?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and CRM systems. This makes it easy to manage files and streamline your workflow while preparing the SA489 form.

-

What are the benefits of using airSlate SignNow for the SA489 form?

Using airSlate SignNow for the SA489 form provides numerous benefits, including time savings, enhanced document security, and easy collaboration. You can track the status of your document in real-time, ensuring a smooth application process.

-

How secure is airSlate SignNow when handling the SA489 form?

airSlate SignNow prioritizes security and employs advanced encryption methods to protect your documents, including the SA489 form. With features like secure access codes and audit trails, your sensitive information remains safe and confidential.

Get more for Australia Carer Allowance Income

Find out other Australia Carer Allowance Income

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors