PDF Form CG1Capital Gains Tax Return Revenue

Understanding the PDF Form CG1 Capital Gains Tax Return

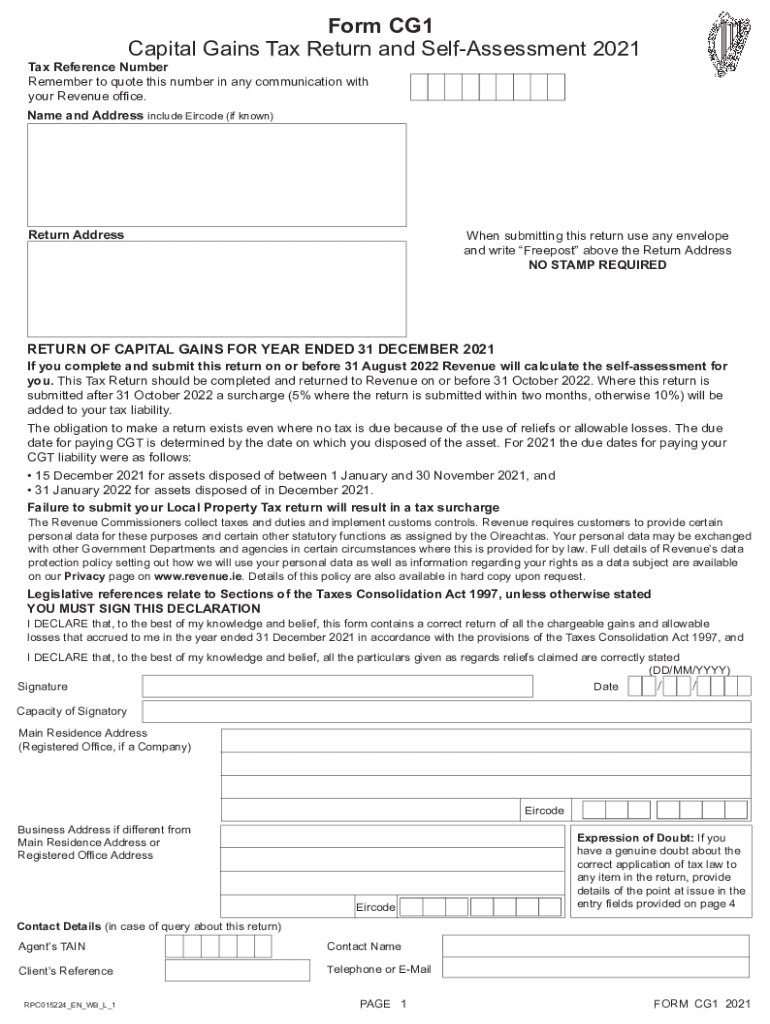

The PDF Form CG1 is utilized for reporting capital gains tax in the United States. This form is essential for individuals who have sold assets such as real estate, stocks, or other investments that may have appreciated in value. By accurately completing the CG1 form, taxpayers can report their gains or losses, ensuring compliance with tax regulations. The form captures vital information about the transactions, including the date of sale, sale price, purchase price, and any applicable deductions or exemptions.

Steps to Complete the PDF Form CG1 Capital Gains Tax Return

Completing the PDF Form CG1 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the assets sold, including purchase and sale records. Next, fill in your personal information, such as your name, address, and Social Security number. Then, detail each transaction by entering the date of acquisition, date of sale, sale price, and purchase price. Be sure to include any adjustments for improvements or costs associated with the sale. Finally, review the form for completeness and accuracy before submission.

Legal Use of the PDF Form CG1 Capital Gains Tax Return

The PDF Form CG1 is legally binding when filled out correctly and submitted to the appropriate tax authority. It is crucial to adhere to IRS guidelines and ensure that all information is truthful and accurate. Misrepresentation or errors on the form can lead to penalties, audits, or other legal repercussions. Utilizing electronic signature solutions, like those offered by signNow, can enhance the security and legality of your submission by providing a verifiable record of your signature and consent.

Filing Deadlines and Important Dates for the CG1 Form

Filing deadlines for the PDF Form CG1 are typically aligned with the general tax filing deadlines in the United States. Taxpayers should be aware of the annual deadline, which is usually April 15 for individual tax returns. If additional time is needed, taxpayers may file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest. Keeping track of these dates is essential for maintaining compliance and avoiding unnecessary fees.

Form Submission Methods for the CG1 Capital Gains Tax Return

The PDF Form CG1 can be submitted through various methods, including online filing, mail, or in-person submission at designated tax offices. Online filing is often the most efficient method, allowing for immediate processing and confirmation of receipt. For those opting to mail the form, it is advisable to use a trackable mailing service to ensure it reaches the tax authority. In-person submissions may be available at local IRS offices, providing an opportunity for direct assistance if needed.

Key Elements of the PDF Form CG1 Capital Gains Tax Return

Key elements of the PDF Form CG1 include sections for personal identification, details of each asset sold, calculations of capital gains or losses, and any applicable deductions. The form also requires the taxpayer's signature, affirming that the information provided is accurate and complete. Understanding these elements is crucial for ensuring that the form is filled out correctly and that all necessary information is included to avoid delays or issues during processing.

Quick guide on how to complete pdf form cg1capital gains tax return 2021 revenue

Effortlessly Prepare PDF Form CG1Capital Gains Tax Return Revenue on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without delays. Handle PDF Form CG1Capital Gains Tax Return Revenue on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The Easiest Way to Alter and Electronically Sign PDF Form CG1Capital Gains Tax Return Revenue

- Locate PDF Form CG1Capital Gains Tax Return Revenue and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign PDF Form CG1Capital Gains Tax Return Revenue and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the form cg1 2021, and why do I need it?

The form cg1 2021 is a vital document required for various business processes, including compliance and record-keeping. Using airSlate SignNow, you can easily fill out, sign, and manage this form digitally. This not only saves time but also ensures that your documents are securely stored and accessible.

-

How can airSlate SignNow help me with form cg1 2021?

airSlate SignNow simplifies the process of managing the form cg1 2021 by allowing users to fill, sign, and share the document electronically. Our platform ensures that you stay compliant with eSignature laws, making it a reliable solution for your business transactions. Additionally, the user-friendly interface helps anyone to navigate the document easily.

-

What features does airSlate SignNow offer for managing form cg1 2021?

With airSlate SignNow, you get features such as customizable templates, real-time collaboration, and secure cloud storage specifically for documents like form cg1 2021. Our platform also supports automated workflows that help streamline the signing process, ensuring efficiency and organization in managing your documents.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial period, allowing you to explore our features and see how it can assist you with form cg1 2021 management. During this trial, you can test functionalities like eSignature, document sharing, and template creation without any commitment. This helps you determine if our solution meets your needs before subscribing.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers several pricing plans to fit various business needs, specifically tailored for those needing to handle documents like form cg1 2021. Our plans range from basic to advanced, with features that scale up based on your requirements, ensuring you only pay for what you need. Furthermore, our cost-effective approach makes it a budget-friendly choice.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers numerous integrations with popular business applications, allowing you to automate workflows and improve efficiency. Whether you are using CRM systems, project management tools, or document storage solutions, our platform can connect seamlessly to manage documents like form cg1 2021 alongside your existing tools.

-

How secure is my data when using airSlate SignNow for form cg1 2021?

Security is a top priority at airSlate SignNow. When using our platform for form cg1 2021, your data is protected with industry-standard encryption, secure servers, and strict access controls. This ensures that your sensitive documents are safe while you enjoy the benefits of digital signatures and document management.

Get more for PDF Form CG1Capital Gains Tax Return Revenue

- Sample corporate records for a hawaii professional corporation hawaii form

- Organizational minutes for a hawaii professional corporation hawaii form

- Sample transmittal letter for articles of incorporation hawaii form

- Acknowledgment for corporation by another corporation as its attorney hawaii form

- New resident guide hawaii form

- Satisfaction release or cancellation of mortgage by corporation hawaii form

- Satisfaction release or cancellation of mortgage by individual hawaii form

- Partial release of property from mortgage for corporation hawaii form

Find out other PDF Form CG1Capital Gains Tax Return Revenue

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online