Vat1614a Printable Form

What is the Vat1614a Printable

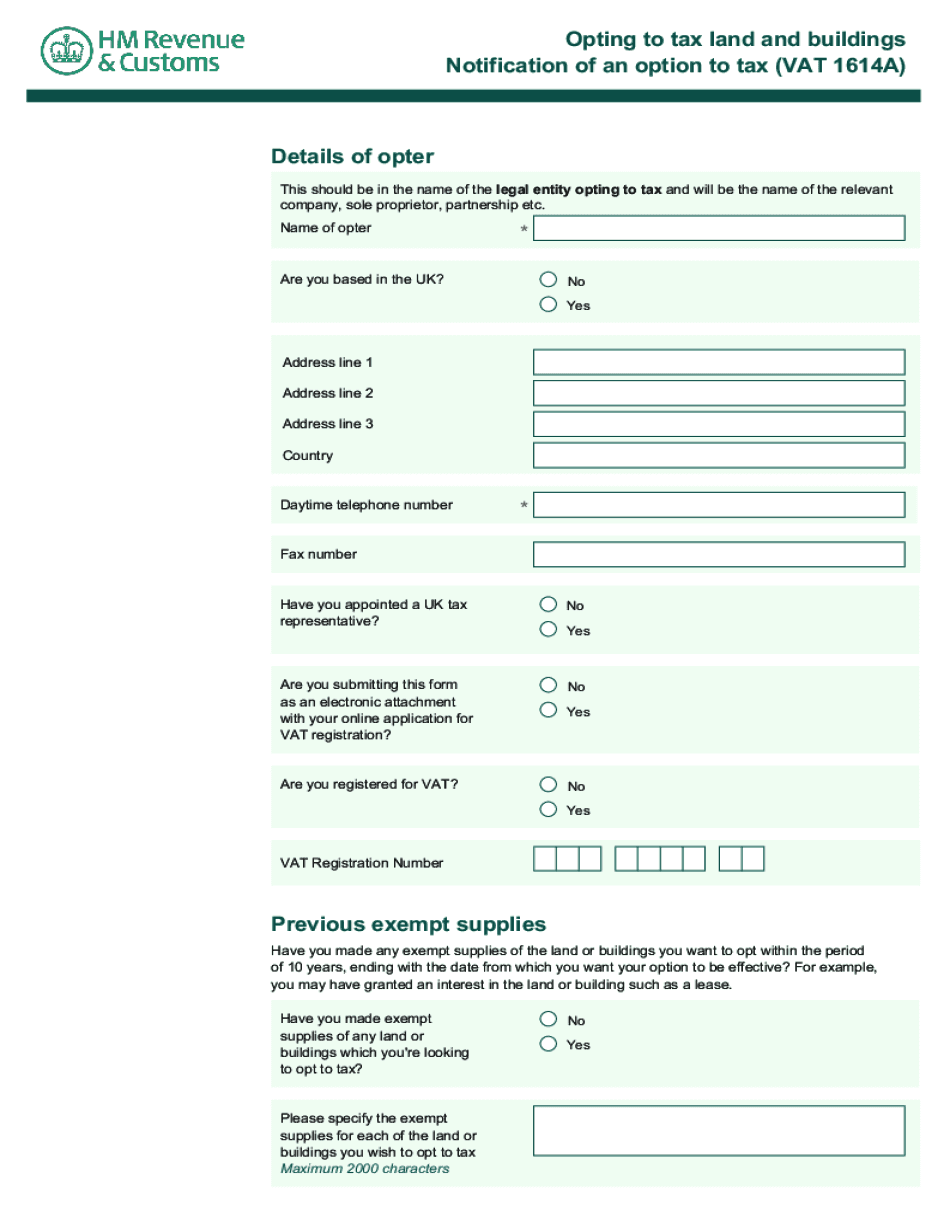

The Vat1614a printable is a specific tax form used in the United States for notifying the tax authorities about certain tax options. This form is essential for individuals and businesses who need to declare their eligibility for specific tax benefits or exemptions. The Vat1614a serves as a formal request to opt into a particular tax status, which can significantly affect tax liabilities and compliance requirements.

How to use the Vat1614a Printable

Using the Vat1614a printable involves several straightforward steps. First, download the form from a reliable source. Next, fill out the required fields with accurate information, including personal identification details and the specific tax options you are opting for. Ensure that all information is clear and legible. Once completed, you can submit the form according to the guidelines provided by the tax authorities, either online or via mail.

Steps to complete the Vat1614a Printable

Completing the Vat1614a printable requires careful attention to detail. Follow these steps:

- Download the latest version of the Vat1614a form.

- Provide your personal information, including name, address, and taxpayer identification number.

- Indicate the specific tax option you are selecting.

- Review the form for accuracy and completeness.

- Sign and date the form where required.

Legal use of the Vat1614a Printable

The Vat1614a printable is legally recognized as a valid document when filled out correctly and submitted according to the regulations set forth by the IRS. It is important to adhere to all legal guidelines to ensure that the form is accepted and that the tax options selected are valid. Non-compliance with the requirements can lead to penalties or denial of the requested tax status.

Filing Deadlines / Important Dates

Filing deadlines for the Vat1614a printable can vary based on the specific tax option being selected. It is crucial to be aware of these deadlines to avoid late submissions, which may incur penalties. Typically, forms should be submitted by the end of the tax year or as specified by the IRS guidelines. Keeping track of these important dates ensures compliance and helps to maintain good standing with tax authorities.

Who Issues the Form

The Vat1614a printable is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and resources for taxpayers to understand how to properly fill out and submit this form, ensuring that all necessary information is provided for processing.

Quick guide on how to complete vat1614a printable

Complete Vat1614a Printable seamlessly on any gadget

Online document organization has become favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you require to generate, modify, and eSign your documents swiftly without hold-ups. Manage Vat1614a Printable on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Vat1614a Printable effortlessly

- Find Vat1614a Printable and click on Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Highlight signNow sections of the documents or conceal sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to secure your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or missing documents, tedious form hunting, or errors requiring new copies to be printed. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Edit and eSign Vat1614a Printable and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the notification option tax feature in airSlate SignNow?

The notification option tax feature allows users to set personalized alerts and reminders regarding documents that require their attention. This ensures that you never miss any crucial deadlines or updates. By utilizing this feature, businesses can streamline their workflow and maintain compliance with important tax-related activities.

-

How does airSlate SignNow help with tax document management?

airSlate SignNow simplifies the management of tax documents by providing an effective notification option tax. Users can easily organize and track their documents, set reminders, and ensure timely completion of necessary forms. This not only enhances productivity but also minimizes the risk of tax-related errors.

-

Are there any costs associated with the notification option tax in airSlate SignNow?

The notification option tax is included in all airSlate SignNow plans, making it a cost-effective tool for businesses. By incorporating this feature, companies can improve their document workflows without incurring additional charges. For tailored pricing, exploring different plans will help you find the one that best meets your needs.

-

Can I customize notifications related to tax documents in airSlate SignNow?

Yes, airSlate SignNow allows for full customization of the notification option tax. Users can adjust settings for reminders, choose specific timelines for alerts, and define what actions trigger notifications. This flexibility ensures users can manage their tax documents according to their unique requirements.

-

What are the benefits of using airSlate SignNow's notification option tax?

The benefits of using the notification option tax include enhanced compliance, reduced stress over missed deadlines, and improved productivity. Users are kept informed about essential tax document status updates, which aids in timely submission and processing. Overall, it supports better financial management for businesses.

-

Is airSlate SignNow's notification option tax compatible with other software?

Yes, airSlate SignNow’s notification option tax seamlessly integrates with various business applications, facilitating a smoother workflow. This compatibility allows users to synchronize their notifications with other tools they use for tax processing. Such integrations help centralize information and enhance overall operational efficiency.

-

How can I set up the notification option tax in airSlate SignNow?

Setting up the notification option tax in airSlate SignNow is straightforward. Users can navigate to the settings section of their account, where they will find options to customize alerts for tax-related documents. Detailed instructions and support are available to guide users through the setup process, ensuring it meets their needs.

Get more for Vat1614a Printable

- Legal documents package form

- Md standby form

- Affidavit survivor 497310380 form

- Maryland bankruptcy guide and forms package for chapters 7 or 13 maryland

- Bill of sale with warranty by individual seller maryland form

- Bill of sale with warranty for corporate seller maryland form

- Bill of sale without warranty by individual seller maryland form

- Bill of sale without warranty by corporate seller maryland form

Find out other Vat1614a Printable

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure