American Equity Partial Withdrawal Request Form

What is the American Equity Partial Withdrawal Request

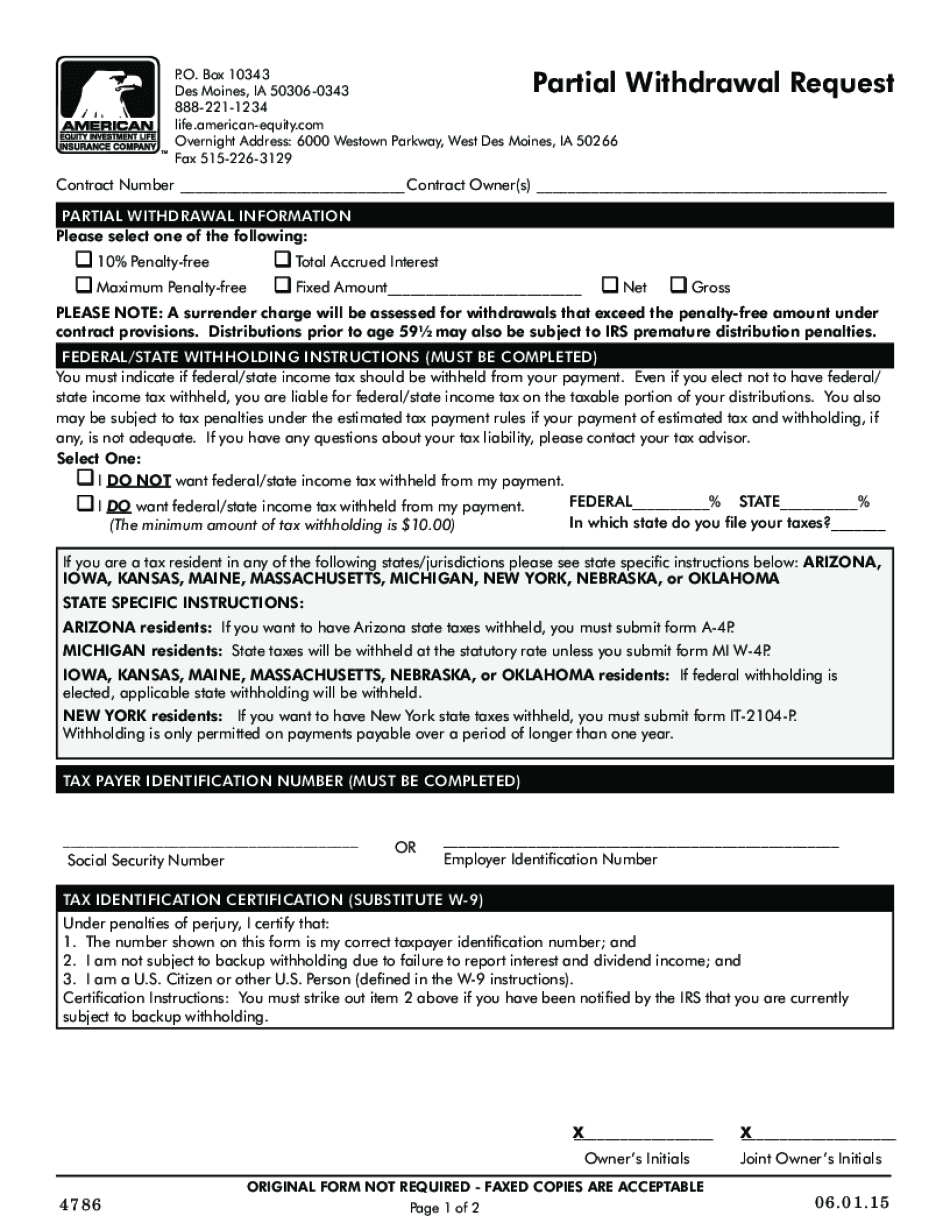

The American Equity Partial Withdrawal Request is a formal document that allows policyholders to withdraw a portion of their funds from their American Equity insurance or investment products. This request is essential for individuals looking to access their accumulated cash value while keeping the policy active. It is important to understand that this process may have implications for the policy's benefits and future performance.

How to use the American Equity Partial Withdrawal Request

To utilize the American Equity Partial Withdrawal Request, individuals must first obtain the form from American Equity’s official resources. Once in possession of the form, the policyholder should fill out their personal information, including policy number and contact details. The next step involves specifying the amount to be withdrawn and understanding any potential fees or tax implications associated with the withdrawal. After completing the form, it should be submitted according to the provided instructions, ensuring that all necessary signatures are included.

Steps to complete the American Equity Partial Withdrawal Request

Completing the American Equity Partial Withdrawal Request involves several key steps:

- Obtain the withdrawal request form from American Equity.

- Fill in your personal information accurately, including your policy number.

- Indicate the amount you wish to withdraw.

- Review the terms and conditions associated with the partial withdrawal.

- Sign and date the form to validate your request.

- Submit the completed form via the designated method (online, mail, or in-person).

Required Documents

When submitting the American Equity Partial Withdrawal Request, certain documents may be required to process the request efficiently. These typically include:

- A completed partial withdrawal request form.

- Proof of identity, such as a government-issued ID.

- Any additional documentation specified by American Equity, which may vary based on the policy type.

Legal use of the American Equity Partial Withdrawal Request

The American Equity Partial Withdrawal Request is legally binding once completed and submitted according to the company’s guidelines. It is crucial for policyholders to ensure that they understand the legal implications of their withdrawal, including any effects on their policy benefits and potential tax consequences. Compliance with all relevant laws and regulations is essential to ensure the withdrawal is processed without complications.

Eligibility Criteria

To be eligible for the American Equity Partial Withdrawal Request, policyholders must meet specific criteria, which typically include:

- Being the owner of an active American Equity policy.

- Having sufficient cash value in the policy to cover the requested withdrawal amount.

- Adhering to any waiting periods or conditions set by American Equity regarding withdrawals.

Quick guide on how to complete american equity partial withdrawal request

Complete American Equity Partial Withdrawal Request seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents promptly without delays. Manage American Equity Partial Withdrawal Request on any device using airSlate SignNow's Android or iOS applications and streamline your document-centered tasks today.

How to edit and electronically sign American Equity Partial Withdrawal Request with ease

- Locate American Equity Partial Withdrawal Request and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign American Equity Partial Withdrawal Request and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an American equity partial withdrawal request?

An American equity partial withdrawal request allows policyholders to withdraw a portion of their funds while maintaining their policy. This option provides flexibility for those who need cash without fully surrendering their investment. Utilizing this feature can be an effective way to manage finances while keeping your coverage active.

-

How do I submit an American equity partial withdrawal request using airSlate SignNow?

To submit an American equity partial withdrawal request with airSlate SignNow, simply log in to your account and access the relevant document. You can easily fill out the necessary information and eSign it for submission. Our platform ensures a seamless and quick process, allowing you to manage your requests efficiently.

-

What fees are associated with the American equity partial withdrawal request?

Fees related to an American equity partial withdrawal request may vary depending on your policy and the amount withdrawn. It’s important to review your policy documents or consult with your financial advisor for specific details. airSlate SignNow provides transparent information regarding costs to help you make informed decisions.

-

Can I track the status of my American equity partial withdrawal request?

Yes, once you submit your American equity partial withdrawal request through airSlate SignNow, you can easily track its status. Our platform offers real-time updates, so you’ll stay informed about the progress of your request. This feature enhances your experience by keeping you in the loop at every step.

-

What are the benefits of using airSlate SignNow for my American equity partial withdrawal request?

Using airSlate SignNow for your American equity partial withdrawal request offers several benefits, including ease of use and efficiency. Our user-friendly interface simplifies document management and eSigning, making the process quick and hassle-free. Additionally, our secure platform ensures that your sensitive information remains protected.

-

Are there any limits on the amount I can withdraw with an American equity partial withdrawal request?

There may be limits on the amount eligible for withdrawal with an American equity partial withdrawal request, which vary by policy. It’s essential to check your specific policy guidelines to determine the maximum allowable withdrawal amount. airSlate SignNow can assist in providing clarity on these limits during your process.

-

Does submitting an American equity partial withdrawal request affect my policy benefits?

Yes, submitting an American equity partial withdrawal request may affect the benefits of your policy. Withdrawals can reduce the cash value and overall death benefit, so it's crucial to understand these implications. airSlate SignNow encourages you to consult your policy documentation or a financial professional to fully understand the consequences.

Get more for American Equity Partial Withdrawal Request

- Affidavit by attorney in fact nontermination or nonrevocation in support of real property transaction ucbc form 10021 minnesota

- Notice foreclose 497312134 form

- Pendency form

- Notice foreclosure mn form

- Minnesota mortgage foreclosure form

- Minnesota homestead form

- Minnesota affidavit form

- Minnesota affidavit 497312140 form

Find out other American Equity Partial Withdrawal Request

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online