One Time IRA Distribution Form 2021-2026

What is the One Time IRA Distribution Form

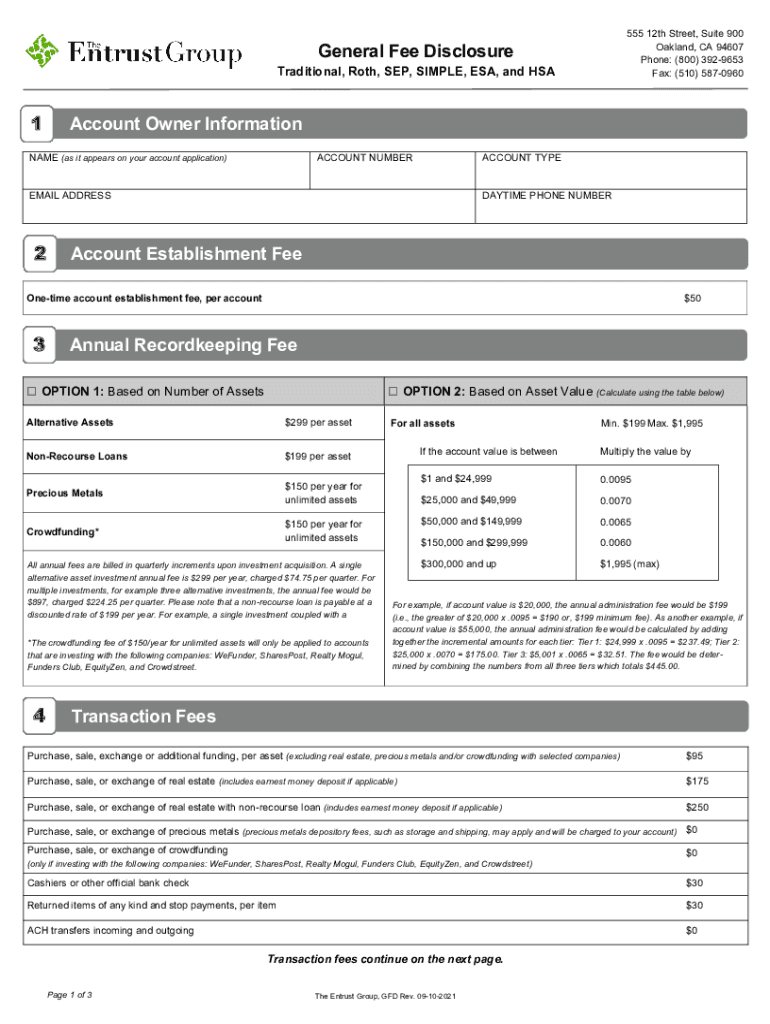

The One Time IRA Distribution Form is a crucial document used by individuals to request a single distribution from their Individual Retirement Account (IRA). This form is typically required when account holders wish to withdraw funds from their IRA for specific purposes, such as purchasing a home, funding education, or covering medical expenses. Understanding the purpose of this form is essential for ensuring compliance with IRS regulations and for managing tax implications effectively.

How to use the One Time IRA Distribution Form

Using the One Time IRA Distribution Form involves several straightforward steps. First, ensure that you have the correct form, which can often be obtained from your financial institution. Next, fill out the required fields, including your personal information, IRA account details, and the amount you wish to withdraw. It's important to specify the reason for the distribution, as this may affect tax treatment. Finally, submit the completed form to your IRA custodian, either online or via mail, depending on the institution's submission methods.

Steps to complete the One Time IRA Distribution Form

Completing the One Time IRA Distribution Form requires careful attention to detail. Follow these steps:

- Obtain the correct form from your financial institution.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your IRA account, such as the account number and type of IRA.

- Indicate the amount you wish to withdraw and the reason for the distribution.

- Review the form for accuracy and completeness.

- Submit the form according to your financial institution's guidelines.

Legal use of the One Time IRA Distribution Form

The One Time IRA Distribution Form must be used in accordance with IRS regulations to ensure that the distribution is legally valid. This includes adhering to guidelines regarding the timing of distributions, allowable reasons for withdrawal, and tax implications. Misuse of the form can lead to penalties, including taxes on early distributions if the account holder is under the age of fifty-nine and a half. It is advisable to consult a tax professional if there are any uncertainties regarding legal compliance.

Eligibility Criteria

To use the One Time IRA Distribution Form, individuals must meet certain eligibility criteria. Generally, account holders must be at least eighteen years old and have an established IRA. Additionally, the reason for the distribution must align with IRS guidelines, such as first-time home purchase, educational expenses, or medical costs. Understanding these criteria is essential for a smooth withdrawal process and to avoid potential tax penalties.

Form Submission Methods

The submission methods for the One Time IRA Distribution Form can vary by financial institution. Common methods include:

- Online Submission: Many institutions offer a secure portal for electronic submission.

- Mail: You can send the completed form via postal service to your IRA custodian's designated address.

- In-Person: Some institutions allow for in-person submissions at local branches.

It is important to verify the preferred submission method with your financial institution to ensure timely processing of your request.

Quick guide on how to complete one time ira distribution form

Complete One Time IRA Distribution Form effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly and without interruptions. Manage One Time IRA Distribution Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign One Time IRA Distribution Form with ease

- Locate One Time IRA Distribution Form and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or redact confidential information with the tools offered by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes moments and possesses the same legal authority as a conventional wet ink signature.

- Verify all the information and click on the Done button to preserve your updates.

- Select your preferred method to send your form, whether via email, SMS, an invitation link, or download it to your PC.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign One Time IRA Distribution Form and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct one time ira distribution form

Create this form in 5 minutes!

People also ask

-

What are entrust group forms?

Entrust group forms are customizable digital documents designed for easy completion and electronic signature collection. These forms streamline workflows, allowing users to collect information and signatures seamlessly, thus enhancing efficiency.

-

How much does it cost to use entrust group forms with airSlate SignNow?

The cost of using entrust group forms with airSlate SignNow varies based on the pricing plan selected. Each plan includes different features tailored to business needs, making it a cost-effective solution for those looking to optimize their document management processes.

-

What features do entrust group forms offer?

Entrust group forms come with various features including customizable templates, drag-and-drop form builders, and automated workflow capabilities. These features allow you to create and manage forms quickly, ensuring a smooth signing process for all parties involved.

-

How can entrust group forms benefit my business?

Using entrust group forms can signNowly enhance your business's efficiency by reducing the time spent on paperwork. With easy eSigning and automated reminders, you can ensure that documents get signed promptly, thus improving overall productivity.

-

Can I integrate entrust group forms with other applications?

Yes, entrust group forms can be integrated with various applications such as CRMs, project management tools, and productivity software. This integration allows for seamless data flow and better management of your documents, making your workflow more efficient.

-

Is it safe to use entrust group forms for sensitive documents?

Absolutely. Entrust group forms are designed with advanced security features, including encryption and secure cloud storage. Your sensitive documents are protected at all times, ensuring that your information remains confidential and secure.

-

How do I get started with entrust group forms?

Getting started with entrust group forms is simple. You can sign up for a free trial on the airSlate SignNow website, where you will find user-friendly guides to help you create and send your first forms quickly.

Get more for One Time IRA Distribution Form

- Minnesota support child form

- Minnesota responsibilities form

- Motion intervene form

- Minnesota notice intervention form

- Affidavit of service intervention as a matter of right minnesota form

- Affidavit service motion form

- Guardian ad litem 497312690 form

- Correction statement and agreement minnesota form

Find out other One Time IRA Distribution Form

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile