How Does a Life Insurance Beneficiary File a Claim 2021-2026

Understanding the Thrivent Claim Process

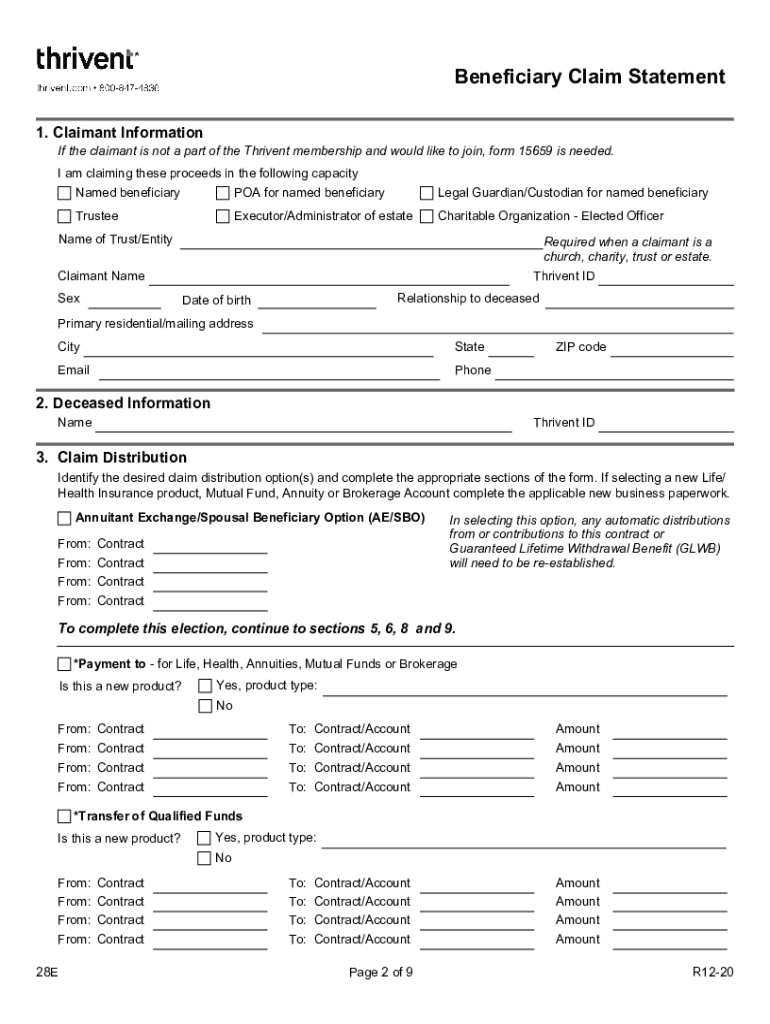

The Thrivent claim form is essential for beneficiaries seeking to file a claim on a life insurance policy. To initiate the claim process, the beneficiary must complete the Thrivent claim form accurately. This form requires personal information about the deceased, including their policy number, date of death, and details about the beneficiary. It is crucial to ensure all information is correct to avoid delays in processing.

Steps to Complete the Thrivent Claim Form

Filling out the Thrivent claim form involves several key steps:

- Gather necessary documents, such as the death certificate and policy details.

- Provide accurate personal information, including the beneficiary's name, address, and contact information.

- Fill out the Thrivent claim form, ensuring all sections are completed.

- Review the form for accuracy and completeness before submission.

- Submit the form along with any required documents through the designated method.

Required Documents for Claim Submission

When submitting the Thrivent claim form, certain documents are typically required to support the claim:

- A certified copy of the death certificate.

- The original insurance policy or a copy, if available.

- Identification documents for the beneficiary.

- Any additional documentation requested by Thrivent.

Form Submission Methods

The Thrivent claim form can be submitted through various methods, providing flexibility for beneficiaries:

- Online: Beneficiaries can complete and submit the form electronically through the Thrivent website.

- Mail: The completed form can be printed and mailed to the address specified by Thrivent.

- In-Person: Beneficiaries may also visit a local Thrivent office to submit the form directly.

Legal Considerations for Claim Filing

Filing a claim using the Thrivent claim form must comply with relevant legal requirements. Beneficiaries should be aware of the following:

- The claim must be filed within the time frame specified by Thrivent and state laws.

- All information provided must be truthful and accurate to avoid legal repercussions.

- Beneficiaries may need to consult with legal professionals if there are disputes regarding the claim.

Filing Deadlines and Important Dates

It is important for beneficiaries to be aware of filing deadlines associated with the Thrivent claim form. Generally, claims should be filed as soon as possible after the policyholder's death. Specific deadlines may vary based on state regulations and the terms of the insurance policy. Delaying the submission could result in complications or denial of the claim.

Eligibility Criteria for Filing a Claim

To file a claim using the Thrivent claim form, the beneficiary must meet certain eligibility criteria. Typically, the claimant must be a named beneficiary on the policy. Additionally, they should be able to provide necessary documentation to support their claim, including proof of identity and relationship to the deceased. Understanding these criteria can help streamline the claim process.

Quick guide on how to complete how does a life insurance beneficiary file a claim

Effortlessly Prepare How Does A Life Insurance Beneficiary File A Claim on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an excellent environmentally-friendly alternative to conventional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle How Does A Life Insurance Beneficiary File A Claim on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

Edit and eSign How Does A Life Insurance Beneficiary File A Claim with Ease

- Find How Does A Life Insurance Beneficiary File A Claim and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you prefer to deliver your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign How Does A Life Insurance Beneficiary File A Claim to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how does a life insurance beneficiary file a claim

Create this form in 5 minutes!

People also ask

-

What is the Thrivent Form 28E and how is it used?

The Thrivent Form 28E is a crucial document used for various financial transactions and approvals within Thrivent Financial. This form typically requires signatures from multiple parties to authorize actions such as account changes or transactions. Using airSlate SignNow to eSign the Thrivent Form 28E streamlines the process, ensuring quick and secure approvals.

-

How does airSlate SignNow help with the Thrivent Form 28E signing process?

airSlate SignNow simplifies the signing process for the Thrivent Form 28E by allowing users to send, track, and eSign the document quickly and efficiently. With its user-friendly interface, you can also create templates for the Thrivent Form 28E to speed up future transactions. This ensures a seamless experience, reducing delays and enhancing productivity.

-

What are the pricing options for using airSlate SignNow for the Thrivent Form 28E?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses, including options for high-volume users needing to process the Thrivent Form 28E frequently. With straightforward pricing, you can select a plan that suits your budget while still gaining access to essential features for handling your forms smoothly. Trials may also be available for you to experience the services before committing.

-

Are there any integrations available with airSlate SignNow for managing the Thrivent Form 28E?

Yes, airSlate SignNow provides numerous integrations with popular applications, ensuring an efficient workflow when managing the Thrivent Form 28E. You can easily connect with platforms such as Google Drive, Dropbox, and CRM systems to retrieve or store your forms securely. This aspect allows you to enhance your document management processes with minimal disruption.

-

What benefits does using airSlate SignNow bring for the Thrivent Form 28E?

Using airSlate SignNow for the Thrivent Form 28E offers signNow benefits, including increased efficiency, security, and cost-effectiveness. The platform allows for real-time collaboration, easy management of documents, and complies with industry standards to protect sensitive information. With robust tracking features, you'll always know the status of your forms.

-

Is airSlate SignNow secure for signing the Thrivent Form 28E?

Absolutely! airSlate SignNow uses advanced encryption and security protocols to ensure that all eSignatures, including those on the Thrivent Form 28E, are securely transmitted and stored. This high level of security is critical for maintaining the integrity of your documents and protecting personal information throughout the signing process.

-

Can I track the status of the Thrivent Form 28E once it is sent for signing?

Yes, airSlate SignNow offers real-time tracking capabilities for the Thrivent Form 28E, so you can monitor its status at any time. You’ll receive notifications as the document moves through each stage of the signing process, keeping you informed until all signatures are completed. This feature enhances accountability and ensures timely follow-ups.

Get more for How Does A Life Insurance Beneficiary File A Claim

Find out other How Does A Life Insurance Beneficiary File A Claim

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online