Form 41, Corporation Income Tax Return and Tax Idaho Gov 2021

What is the Form 41, Corporation Income Tax Return and Tax Idaho Gov

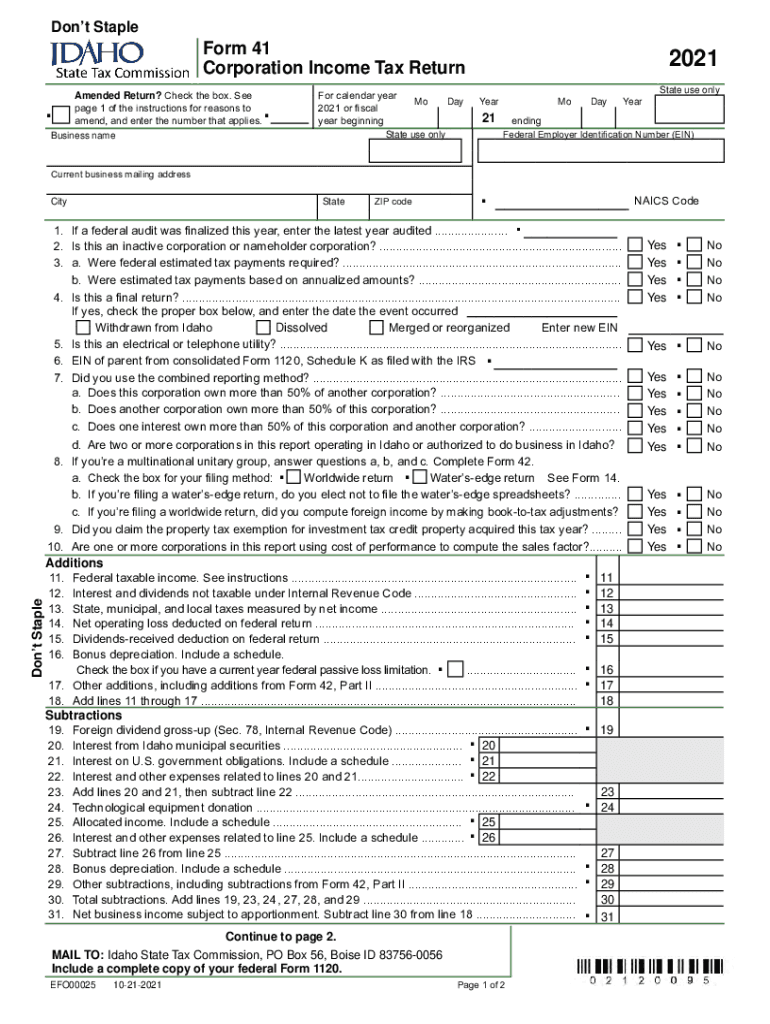

The Form 41, Corporation Income Tax Return, is a crucial document for corporations operating in Idaho. It is used to report the income, gains, losses, deductions, and credits of corporations doing business in the state. This form ensures compliance with Idaho state tax laws and provides the necessary information for the Idaho State Tax Commission to assess tax liabilities accurately. The form is essential for both domestic and foreign corporations that have established a presence in Idaho.

Steps to Complete the Form 41, Corporation Income Tax Return and Tax Idaho Gov

Completing the Form 41 involves several important steps to ensure accuracy and compliance. First, gather all relevant financial documents, including income statements, balance sheets, and records of deductions. Next, accurately fill out each section of the form, detailing your corporation's income, expenses, and applicable credits. Pay close attention to the instructions provided with the form to avoid common errors. After completing the form, review it thoroughly and ensure all required signatures are included before submission.

Legal Use of the Form 41, Corporation Income Tax Return and Tax Idaho Gov

The Form 41 is legally binding when completed and submitted according to Idaho tax regulations. It must be filed by the due date to avoid penalties. The form serves as a declaration of the corporation's financial status and tax obligations. Accurate completion is essential, as any misrepresentation can lead to legal consequences, including audits or fines. Utilizing secure digital tools for e-signatures can enhance the legitimacy of the submission, ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines for filing the Form 41 to avoid penalties. Typically, the form is due on the 15th day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the deadline is April 15. If additional time is needed, corporations may file for an extension, but it is important to note that this does not extend the time for payment of taxes owed.

Form Submission Methods (Online / Mail / In-Person)

The Form 41 can be submitted through various methods to accommodate different preferences. Corporations may choose to file electronically through the Idaho State Tax Commission's online portal, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate tax office or submitted in person. Each method has its own requirements, so it is essential to follow the guidelines provided with the form to ensure successful submission.

Required Documents

When completing the Form 41, several supporting documents are necessary to substantiate the information provided. These documents typically include financial statements, such as profit and loss statements, balance sheets, and records of any deductions claimed. Additionally, corporations should have documentation for any credits being applied. Keeping these documents organized and readily available can facilitate a smoother filing process.

Key Elements of the Form 41, Corporation Income Tax Return and Tax Idaho Gov

The Form 41 consists of several key sections that require detailed information. These include the corporation's identifying information, income details, deductions, and credits. Each section is designed to capture specific financial data, ensuring that the Idaho State Tax Commission has a comprehensive view of the corporation's financial activities. Understanding these elements is crucial for accurate reporting and compliance with state tax laws.

Quick guide on how to complete form 41 corporation income tax return and taxidahogov

Complete Form 41, Corporation Income Tax Return And Tax idaho gov effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents promptly without delays. Handle Form 41, Corporation Income Tax Return And Tax idaho gov on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Form 41, Corporation Income Tax Return And Tax idaho gov with ease

- Find Form 41, Corporation Income Tax Return And Tax idaho gov and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select how you would like to deliver your form, via email, text message (SMS), an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any preferred device. Modify and eSign Form 41, Corporation Income Tax Return And Tax idaho gov and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 41 corporation income tax return and taxidahogov

Create this form in 5 minutes!

People also ask

-

What is Form 41, Corporation Income Tax Return and how is it related to Idaho?

Form 41, Corporation Income Tax Return, is a tax document that corporations in Idaho must file with the Idaho State Tax Commission. It is essential for reporting the corporation's income, deductions, and tax liabilities. By understanding this form, businesses can ensure compliance with tax regulations set by idaho gov.

-

How can airSlate SignNow help with filing Form 41, Corporation Income Tax Return?

airSlate SignNow provides a user-friendly platform to eSign and send essential documents, including Form 41, Corporation Income Tax Return, quickly and securely. Our solution streamlines the process, making it easier for businesses to manage their tax returns efficiently.

-

What are the pricing options for using airSlate SignNow for Form 41 eSigning?

airSlate SignNow offers various pricing plans to fit different business needs, making it an affordable option for simplifying the eSigning of Form 41, Corporation Income Tax Return. You can choose from monthly or annual subscriptions based on your usage and requirements.

-

Are the signed documents for Form 41, Corporation Income Tax Return secure with airSlate SignNow?

Yes, airSlate SignNow prioritizes document security, including the signed Form 41, Corporation Income Tax Return. Our platform complies with industry standards, ensuring that your sensitive information remains protected with robust security measures.

-

Can I integrate airSlate SignNow with other tools for handling Form 41 submissions?

Absolutely! airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your workflow when filing Form 41, Corporation Income Tax Return. Connect with tools like Google Drive, Dropbox, and more to streamline your document management.

-

What features does airSlate SignNow offer that could benefit the filing of Form 41?

airSlate SignNow offers features such as templates, bulk sending, and real-time tracking of your signed documents, which are beneficial for managing Form 41, Corporation Income Tax Return. These features help reduce complexity and improve efficiency when dealing with tax filings.

-

Is there customer support available for questions related to Form 41 in airSlate SignNow?

Yes, airSlate SignNow provides excellent customer support to assist users with any queries related to Form 41, Corporation Income Tax Return. Our team is ready to guide you through the eSigning process and address any concerns you may have.

Get more for Form 41, Corporation Income Tax Return And Tax idaho gov

- Contractors forms package mississippi

- Power of attorney for sale of motor vehicle mississippi form

- Wedding planning or consultant package mississippi form

- Hunting forms package mississippi

- Identity theft recovery package mississippi form

- Aging parent package mississippi form

- Sale of a business package mississippi form

- Mississippi minor form

Find out other Form 41, Corporation Income Tax Return And Tax idaho gov

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template