Tax Idaho 2016

What is the Tax Idaho

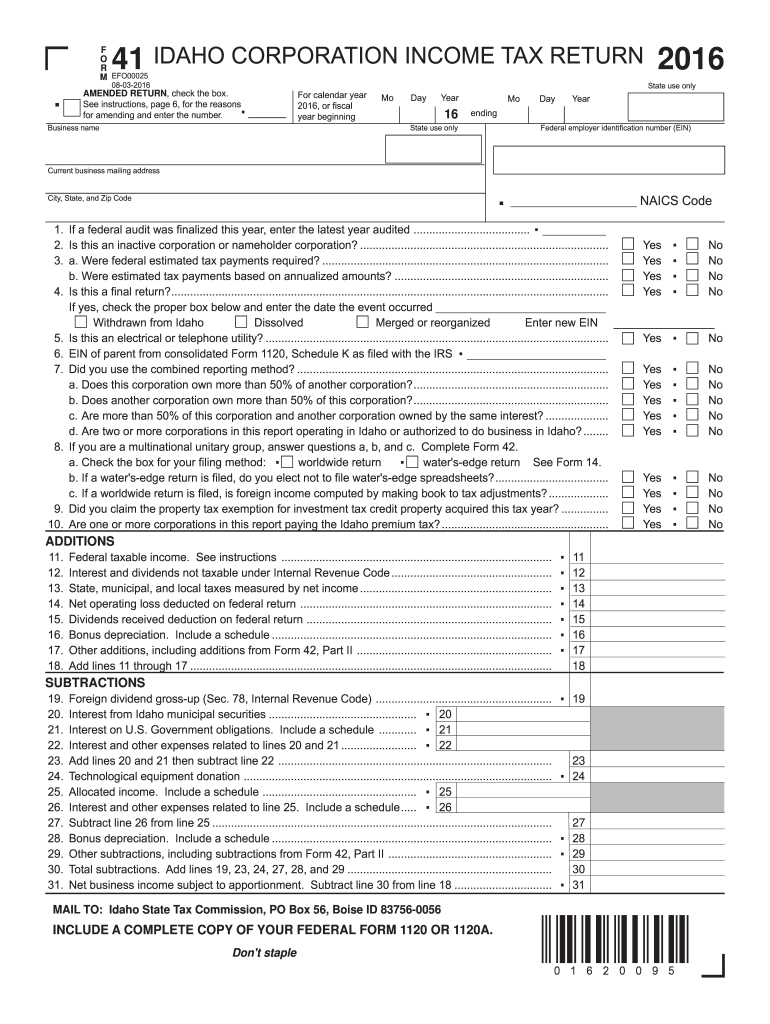

The Tax Idaho form is a crucial document used for various tax-related purposes within the state of Idaho. This form is primarily utilized by individuals and businesses to report income, claim deductions, and fulfill state tax obligations. Understanding the specifics of the Tax Idaho form is essential for compliance with state tax laws and ensuring that all financial responsibilities are met accurately.

How to use the Tax Idaho

Using the Tax Idaho form involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements, receipts for deductions, and any previous tax returns. Next, fill out the form carefully, ensuring that all information is complete and accurate. After completing the form, review it for any errors before submission. Depending on your preference, you can file the form electronically or submit a paper version to the appropriate tax authority.

Steps to complete the Tax Idaho

Completing the Tax Idaho form requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather necessary documents, such as W-2s, 1099s, and proof of deductions.

- Obtain the latest version of the Tax Idaho form from the appropriate state tax authority.

- Fill in personal information, including name, address, and Social Security number.

- Report all sources of income accurately, ensuring to include all taxable earnings.

- Claim any eligible deductions and credits, providing supporting documentation as needed.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or via mail, ensuring it is sent to the correct address.

Legal use of the Tax Idaho

The legal use of the Tax Idaho form is governed by state tax laws and regulations. It is essential to ensure that the form is filled out accurately and submitted within the designated deadlines to avoid penalties. The form serves as a legal document that can be used in case of audits or disputes with the tax authority. Proper use of the form helps maintain compliance with Idaho's tax laws and protects taxpayers from legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Idaho form are critical for compliance. Typically, the deadline for individual tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these deadlines, as well as any extensions that may be available for specific circumstances, such as natural disasters or other emergencies.

Required Documents

To complete the Tax Idaho form, several documents are required to support the information provided. These documents include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any other documentation that supports income and deductions claimed.

Who Issues the Form

The Tax Idaho form is issued by the Idaho State Tax Commission. This agency is responsible for administering state tax laws, collecting taxes, and ensuring compliance among taxpayers. The Tax Commission provides resources and guidance for individuals and businesses to navigate their tax obligations effectively.

Quick guide on how to complete tax idaho

Streamline Tax Idaho effortlessly on any device

The management of digital documents has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents quickly and without hassle. Manage Tax Idaho on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Tax Idaho with ease

- Find Tax Idaho and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Choose your preferred method to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax Idaho to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax idaho

Create this form in 5 minutes!

How to create an eSignature for the tax idaho

How to create an eSignature for the Tax Idaho in the online mode

How to make an electronic signature for the Tax Idaho in Chrome

How to make an electronic signature for putting it on the Tax Idaho in Gmail

How to create an eSignature for the Tax Idaho from your smart phone

How to create an eSignature for the Tax Idaho on iOS

How to generate an eSignature for the Tax Idaho on Android

People also ask

-

What is airSlate SignNow and how does it relate to Tax Idaho?

airSlate SignNow is a versatile eSignature platform designed to streamline the signing process of documents. For those dealing with Tax Idaho forms, it simplifies document storage and signing, ensuring compliance and efficiency in handling tax-related paperwork.

-

How does airSlate SignNow support Tax Idaho professionals?

airSlate SignNow provides Tax Idaho professionals with a user-friendly interface for sending and receiving signed documents. Its automation features minimize the risk of errors and speed up the preparation of tax documents, making tax season less stressful and more efficient.

-

What pricing options are available for airSlate SignNow for Tax Idaho users?

airSlate SignNow offers flexible pricing plans, catering to both individuals and businesses needing to handle Tax Idaho documents. Users can choose from monthly or yearly subscriptions, ensuring that they pay only for the features they require for their tax needs.

-

Can I integrate airSlate SignNow with other tools for managing Tax Idaho documentation?

Yes, airSlate SignNow seamlessly integrates with popular applications such as Google Drive, Salesforce, and Dropbox. This ensures that Tax Idaho users can easily manage their documents within their existing workflows without hassle.

-

What features does airSlate SignNow offer for electronically signing Tax Idaho forms?

airSlate SignNow provides a range of powerful features, including customizable templates, real-time tracking, and secure cloud storage. These tools facilitate the signing process for Tax Idaho forms, ensuring that users can complete their documentation swiftly and securely.

-

Is airSlate SignNow compliant with Tax Idaho regulations?

Absolutely, airSlate SignNow adheres to industry standards and regulations, including those specific to Tax Idaho. This compliance provides peace of mind that your electronic signatures and documents are legally valid and secure.

-

How does using airSlate SignNow benefit Tax Idaho businesses?

Using airSlate SignNow helps Tax Idaho businesses optimize their operations by reducing paperwork and accelerating the signing process. This results in increased productivity, lower operational costs, and a smoother experience during tax preparation and filing.

Get more for Tax Idaho

- Guam nursing license renewal 2011 form

- Gcaar rental application fillable form

- Massachusetts non payment of wage and workplace complaint form

- Ri 060 form

- American legion temporary financial assistance form

- Sample court oder forms for custody classes

- Rv f1317001 2005 form

- Mu shoe physics guided njctl form

Find out other Tax Idaho

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer