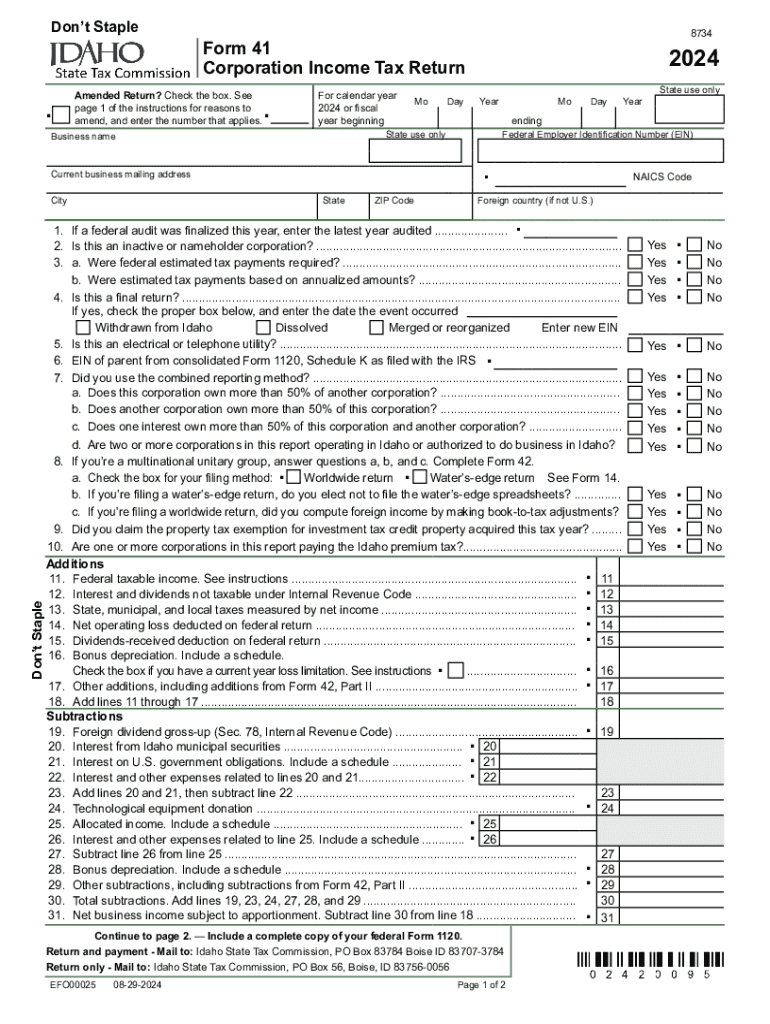

Form 41, Corporation Income Tax Return and Instructions 2024-2026

What is the Idaho Form 41?

The Idaho Form 41 is the Corporation Income Tax Return used by corporations operating in Idaho. This form is essential for reporting a corporation's income, deductions, and credits to the Idaho State Tax Commission. It provides a comprehensive overview of a corporation's financial activities for the tax year, enabling the state to assess the appropriate tax liability. Understanding this form is crucial for compliance with Idaho tax laws and ensuring accurate tax reporting.

How to Use the Idaho Form 41

Using the Idaho Form 41 involves several key steps. First, gather all necessary financial information, including income statements, balance sheets, and documentation of deductions. Next, download the form from the Idaho State Tax Commission website or obtain a physical copy. Carefully fill out the form, ensuring all sections are completed accurately. After completing the form, review it for any errors or omissions before submitting it to the tax authority. Proper use of this form helps avoid penalties and ensures compliance with state regulations.

Steps to Complete the Idaho Form 41

Completing the Idaho Form 41 requires attention to detail. Follow these steps:

- Begin with the corporation's identifying information, including name, address, and federal employer identification number (FEIN).

- Report total income earned during the tax year, including sales, services, and other revenue streams.

- Detail allowable deductions, such as operating expenses, cost of goods sold, and other business-related costs.

- Calculate the corporation's taxable income by subtracting total deductions from total income.

- Determine the tax liability based on the applicable tax rates for Idaho corporations.

- Complete any additional schedules or forms required for specific deductions or credits.

- Sign and date the form before submission.

Filing Deadlines and Important Dates

Corporations must adhere to specific filing deadlines for the Idaho Form 41. Generally, the form is due on the 15th day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this typically means the form is due by April 15. It is essential to be aware of these deadlines to avoid late fees and penalties. Corporations may also apply for an extension, but it is important to file the extension request before the original due date.

Required Documents for Idaho Form 41

To successfully complete the Idaho Form 41, corporations must gather various documents, including:

- Financial statements, such as income statements and balance sheets.

- Records of all income sources and amounts.

- Documentation for all deductions claimed, including receipts and invoices.

- Any relevant schedules or forms that provide additional information on specific deductions or credits.

Penalties for Non-Compliance

Failure to file the Idaho Form 41 on time or inaccuracies in the submitted information can result in significant penalties. Late filing penalties may accrue, and interest may be charged on any unpaid taxes. Additionally, providing false information can lead to further legal consequences. It is crucial for corporations to ensure timely and accurate filing to avoid these penalties and maintain compliance with state tax laws.

Create this form in 5 minutes or less

Find and fill out the correct form 41 corporation income tax return and instructions 772050839

Create this form in 5 minutes!

How to create an eSignature for the form 41 corporation income tax return and instructions 772050839

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Idaho Form 41?

The Idaho Form 41 is a tax form used by corporations to report their income and calculate their tax liability in the state of Idaho. It is essential for businesses operating in Idaho to accurately complete this form to comply with state tax regulations.

-

How can airSlate SignNow help with the Idaho Form 41?

airSlate SignNow streamlines the process of completing and eSigning the Idaho Form 41 by providing an easy-to-use platform for document management. With our solution, you can quickly fill out the form, gather necessary signatures, and submit it electronically, saving time and reducing errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our plans include features that support the completion and eSigning of documents like the Idaho Form 41, ensuring you get the best value for your investment.

-

Are there any features specifically for tax forms like the Idaho Form 41?

Yes, airSlate SignNow includes features tailored for tax forms, including templates, automated workflows, and secure storage. These features make it easier to manage forms like the Idaho Form 41 and ensure compliance with state requirements.

-

Can I integrate airSlate SignNow with other software for filing the Idaho Form 41?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing you to streamline the filing process for the Idaho Form 41. This integration helps ensure that your data is consistent and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for the Idaho Form 41?

Using airSlate SignNow for the Idaho Form 41 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to manage your documents digitally, making it easier to track submissions and maintain compliance.

-

Is airSlate SignNow secure for handling sensitive documents like the Idaho Form 41?

Yes, airSlate SignNow prioritizes security and employs advanced encryption protocols to protect your sensitive documents, including the Idaho Form 41. You can trust our platform to keep your information safe while you eSign and manage your tax forms.

Get more for Form 41, Corporation Income Tax Return And Instructions

Find out other Form 41, Corporation Income Tax Return And Instructions

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document