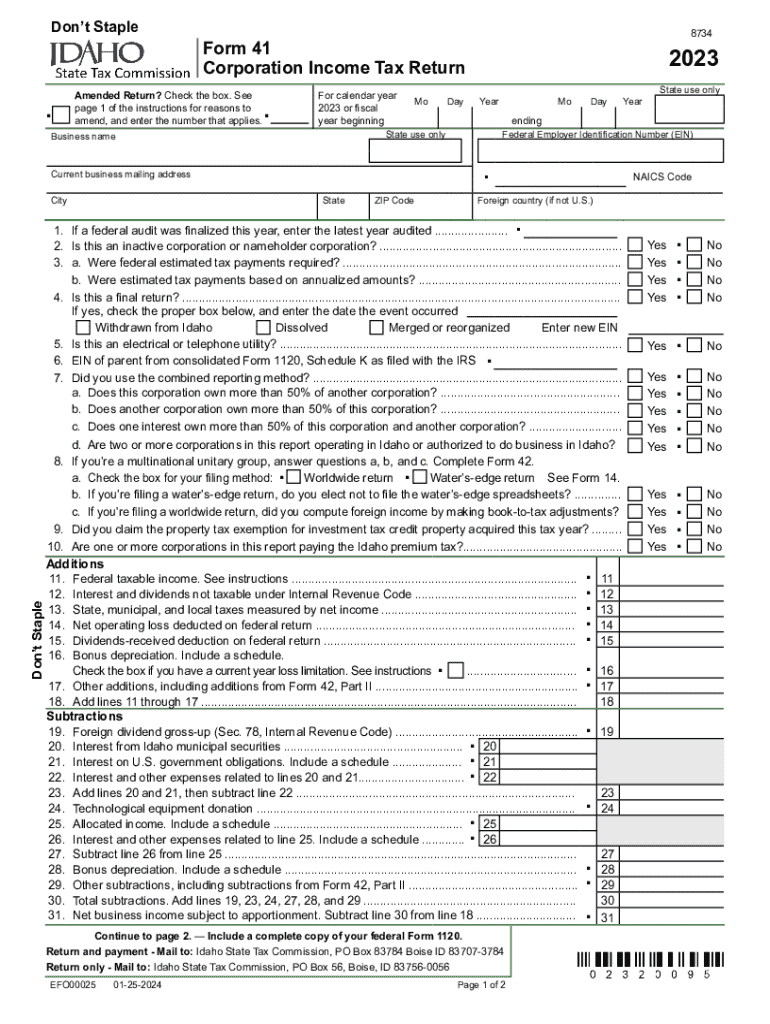

Form 41, Corporation Income Tax Return and Instructions 2023

What is the Idaho Form 41?

The Idaho Form 41 is the Corporation Income Tax Return used by corporations operating in Idaho. This form is essential for reporting income, deductions, and credits to the Idaho State Tax Commission. Corporations must file this form annually to comply with state tax regulations. The information provided on the Idaho Form 41 helps determine the corporation's tax liability based on its net income for the tax year.

Steps to Complete the Idaho Form 41

Completing the Idaho Form 41 involves several key steps:

- Gather Financial Records: Collect all necessary financial documents, including income statements, balance sheets, and records of deductions.

- Fill Out the Form: Accurately enter all required information, including gross income, deductions, and credits. Ensure that all figures are correct to avoid discrepancies.

- Review the Form: Double-check all entries for accuracy. Mistakes can lead to delays or penalties.

- Submit the Form: File the completed Idaho Form 41 by the due date, either online, by mail, or in person.

How to Obtain the Idaho Form 41

The Idaho Form 41 can be obtained directly from the Idaho State Tax Commission's website. It is available as a downloadable PDF, which can be printed and filled out manually. Alternatively, businesses can access the form through tax preparation software that supports Idaho tax filings. Ensure that you are using the most current version of the form to comply with state regulations.

Legal Use of the Idaho Form 41

The Idaho Form 41 is legally required for corporations operating within the state. Filing this form is part of the corporation's obligation to report its financial activities to the state government. Failure to file the form on time may result in penalties, including fines and interest on unpaid taxes. It is crucial for corporations to understand their legal responsibilities regarding tax reporting and compliance.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the Idaho Form 41. The annual filing deadline is typically the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. It is essential for businesses to mark their calendars and ensure timely submission to avoid penalties.

Form Submission Methods

The Idaho Form 41 can be submitted through various methods:

- Online Submission: Corporations can file electronically through the Idaho State Tax Commission's online portal, which offers a streamlined process.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Idaho State Tax Commission.

- In-Person: Corporations may also choose to deliver the form in person at designated tax commission offices.

Create this form in 5 minutes or less

Find and fill out the correct form 41 corporation income tax return and instructions

Create this form in 5 minutes!

How to create an eSignature for the form 41 corporation income tax return and instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Idaho Form 41?

The Idaho Form 41 is a tax form used by corporations to report their income and calculate their tax liability in the state of Idaho. It is essential for businesses operating in Idaho to accurately complete this form to comply with state tax regulations.

-

How can airSlate SignNow help with the Idaho Form 41?

airSlate SignNow simplifies the process of completing and submitting the Idaho Form 41 by allowing users to eSign documents securely and efficiently. With its user-friendly interface, businesses can easily manage their tax forms and ensure timely submissions.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger enterprises. Each plan provides access to features that can assist with the completion of forms like the Idaho Form 41, ensuring cost-effective solutions.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are beneficial for managing forms like the Idaho Form 41. These tools help streamline the document workflow, making it easier for businesses to stay organized.

-

Is airSlate SignNow compliant with Idaho state regulations?

Yes, airSlate SignNow is designed to comply with various state regulations, including those specific to Idaho. This ensures that when you use the platform for the Idaho Form 41, you are adhering to the necessary legal requirements for document submission.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with popular software applications, enhancing your workflow. This means you can easily connect your existing tools to streamline the process of preparing and submitting the Idaho Form 41.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the Idaho Form 41 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and document sharing, making tax season less stressful for businesses.

Get more for Form 41, Corporation Income Tax Return And Instructions

- Aflac accidental injury claim form

- Phcs provider enrollment form

- Reading circle certificate form

- Dshs 14 532 form

- Woodcock johnson test sample pdf form

- Certificate of visual impairment partsight org ukcertificate of visual impairment partsight org ukregistering vision impairment form

- Sales tax forms dor

- 29 0309 form

Find out other Form 41, Corporation Income Tax Return And Instructions

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself