OK FRX 200 Fill Out Tax Template Online US Legal Forms 2022

Key elements of the OK FRX 200

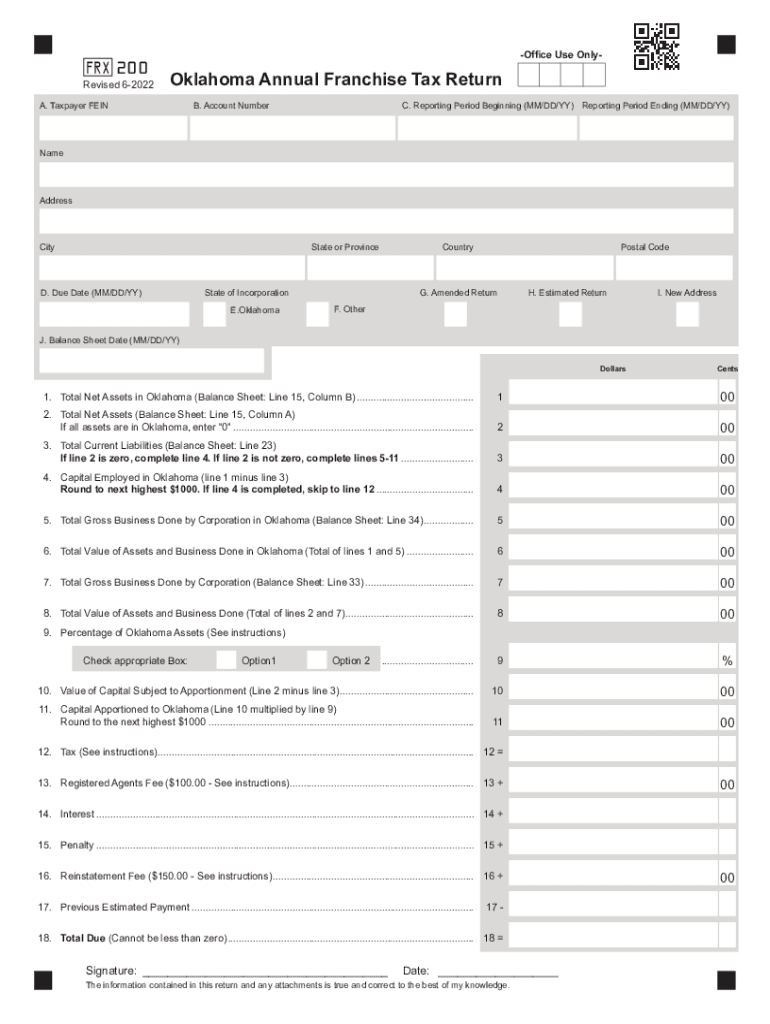

The OK FRX 200 is an essential form for businesses operating in Oklahoma, specifically designed for franchise tax reporting. Understanding its key elements is crucial for accurate completion. The form typically includes sections for reporting gross receipts, deductions, and calculating the franchise tax owed. Additionally, it requires basic information about the business entity, such as its name, address, and federal identification number. Accurate data entry in these sections ensures compliance with state regulations and avoids potential penalties.

Steps to complete the OK FRX 200

Completing the OK FRX 200 involves several structured steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and balance sheets. Next, fill out the business identification section accurately, including the entity type, which could be a corporation, LLC, or partnership. Then, report gross receipts and allowable deductions in the respective sections. After calculations, determine the total franchise tax due. Finally, review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Awareness of filing deadlines is vital for compliance with Oklahoma tax regulations. The OK FRX 200 is typically due on the first day of the fourth month following the end of the business's fiscal year. For most businesses operating on a calendar year, this means the form is due by April 1. Late submissions may incur penalties and interest, so it is advisable to file on time or request an extension if necessary.

Required Documents

When preparing to complete the OK FRX 200, specific documents are essential for accurate reporting. These include financial statements, such as profit and loss statements and balance sheets, which provide the necessary data for gross receipts and deductions. Additionally, businesses should have their federal tax identification number and any previous year’s franchise tax returns on hand to ensure consistency and accuracy in reporting.

Legal use of the OK FRX 200

The legal use of the OK FRX 200 is governed by Oklahoma state tax laws, which mandate that all businesses operating within the state file this form annually. Proper completion of the form is essential for maintaining compliance and avoiding legal penalties. The form serves as an official declaration of the business's franchise tax liability, ensuring that the entity fulfills its obligations under state law.

Form Submission Methods

Businesses have several options for submitting the OK FRX 200. The form can be filed online through the Oklahoma Tax Commission's website, which offers a streamlined process for electronic submissions. Alternatively, businesses may choose to mail a paper copy of the completed form to the appropriate tax office. In-person submissions are also accepted at designated tax offices, providing flexibility for business owners in how they choose to file their franchise tax return.

Quick guide on how to complete ok frx 200 2020 2022 fill out tax template online us legal forms

Complete OK FRX 200 Fill Out Tax Template Online US Legal Forms effortlessly on any device

Web-based document administration has become increasingly favored among businesses and individuals. It offers an ideal sustainable alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly and without holdups. Manage OK FRX 200 Fill Out Tax Template Online US Legal Forms across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign OK FRX 200 Fill Out Tax Template Online US Legal Forms with ease

- Obtain OK FRX 200 Fill Out Tax Template Online US Legal Forms and click Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize relevant portions of the documents or redact sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes moments and holds the same legal authority as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign OK FRX 200 Fill Out Tax Template Online US Legal Forms and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ok frx 200 2020 2022 fill out tax template online us legal forms

Create this form in 5 minutes!

People also ask

-

What are the ok frx 200 instructions for setting up airSlate SignNow?

To set up airSlate SignNow using the ok frx 200 instructions, begin by creating your account on the platform. Then, follow the guided setup process to integrate with your existing applications. Ensure you review the user-friendly interface that supports eSigning and document management.

-

How can I ensure the security of my documents according to the ok frx 200 instructions?

The ok frx 200 instructions emphasize utilizing airSlate SignNow's encryption and secure access features to protect your documents. Implement two-factor authentication and regularly update user permissions for optimal security. Always audit access logs to monitor who views and signs your documents.

-

Are there any subscription costs described in the ok frx 200 instructions?

The ok frx 200 instructions provide insights into various subscription plans for airSlate SignNow, which are designed to fit different budget levels. Each plan includes a range of features, and you can choose based on your organization’s needs. Check the pricing page for specific details and potential discounts.

-

What features are highlighted in the ok frx 200 instructions?

According to the ok frx 200 instructions, airSlate SignNow includes features such as customized templates, bulk sending, real-time tracking, and detailed analytics. These features enhance document workflow and efficiency for your business. Familiarizing yourself with these features will signNowly improve your signing and document management processes.

-

How does airSlate SignNow integrate with other tools as per the ok frx 200 instructions?

The ok frx 200 instructions detail that airSlate SignNow offers seamless integration with various popular applications such as Google Drive, Salesforce, and Microsoft Office. This integration allows for streamlined document workflows and improves overall productivity by syncing data across platforms. Verify your app compatibility during the setup process for a smooth experience.

-

What benefits do businesses gain from using airSlate SignNow, as per the ok frx 200 instructions?

Businesses utilizing airSlate SignNow, as outlined in the ok frx 200 instructions, experience enhanced efficiency, reduced turnaround times, and improved customer satisfaction. The platform's ease of use ensures that even non-technical users can manage document signing effortlessly. Ultimately, this leads to a more productive work environment.

-

Can I customize my signing experience following the ok frx 200 instructions?

Yes, the ok frx 200 instructions indicate that airSlate SignNow allows users to customize their signing experience. You can create personalized signing workflows, including adding your branding and specific signing requirements. Customization ensures that the solution meets your business's unique needs and enhances the user experience.

Get more for OK FRX 200 Fill Out Tax Template Online US Legal Forms

- Legal last will and testament form for a widow or widower with adult children mississippi

- Legal last will and testament form for widow or widower with minor children mississippi

- Legal last will form for a widow or widower with no children mississippi

- Legal last will and testament form for a widow or widower with adult and minor children mississippi

- Legal last will and testament form for divorced and remarried person with mine yours and ours children mississippi

- Legal last will and testament form with all property to trust called a pour over will mississippi

- Written revocation of will mississippi form

- Last will and testament for other persons mississippi form

Find out other OK FRX 200 Fill Out Tax Template Online US Legal Forms

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure