Oklahoma Form 200 2017

What is the Oklahoma Form 200

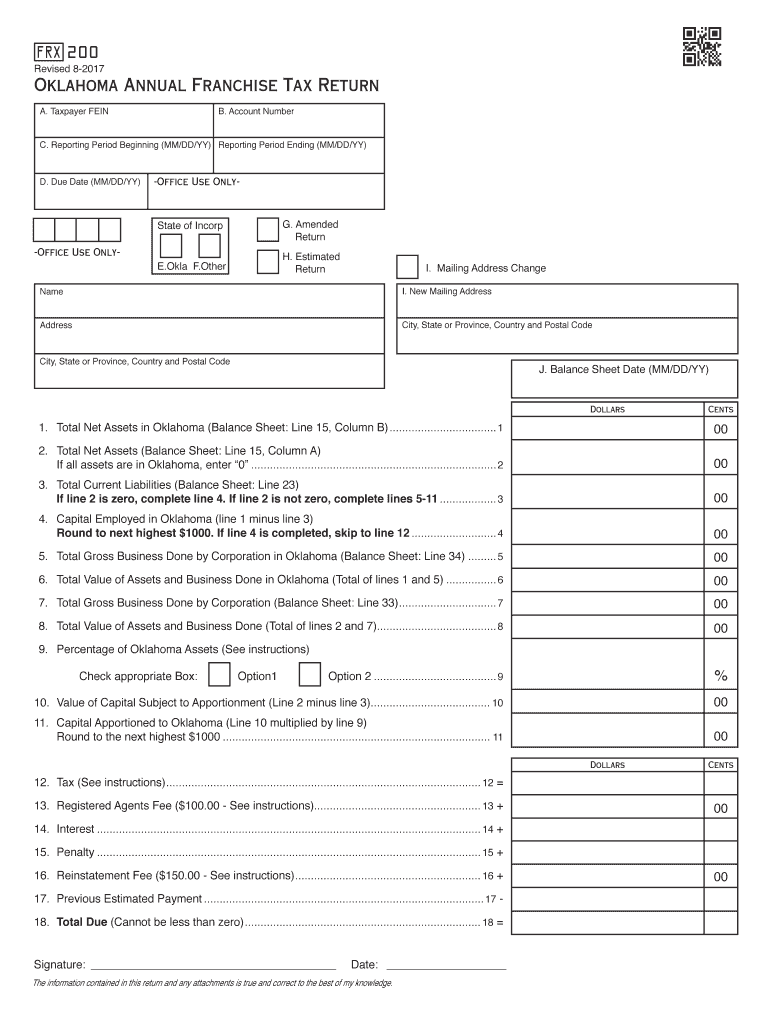

The Oklahoma Form 200, also known as the Oklahoma franchise tax return form, is a crucial document for businesses operating in Oklahoma. This form is used to report and pay the annual franchise tax owed to the state. The franchise tax is based on the company's capital or net worth, and it applies to various business entities, including corporations and limited liability companies (LLCs). Understanding the purpose and requirements of Form 200 is essential for compliance with state tax regulations.

Steps to complete the Oklahoma Form 200

Completing the Oklahoma Form 200 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information, including your business's total assets and liabilities. Next, fill out the form by providing details such as the business name, address, and type of entity. Calculate the franchise tax based on the provided information, ensuring you follow the specific guidelines set by the Oklahoma Tax Commission. Finally, review the form for completeness and accuracy before submission.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Oklahoma Form 200 to avoid penalties. Typically, the form must be submitted by the last day of the month following the end of your business's fiscal year. For most businesses operating on a calendar year, this means the deadline is April 15. Staying informed about these dates helps ensure timely compliance and prevents unnecessary fees.

Key elements of the Oklahoma Form 200

The Oklahoma Form 200 includes several key elements that must be accurately reported. These elements typically encompass the business's legal name, address, type of entity, and the total amount of capital or net worth. Additionally, the form requires the calculation of the franchise tax owed, which is based on the business's financial information. Understanding these components is vital for completing the form correctly and fulfilling tax obligations.

Legal use of the Oklahoma Form 200

The legal use of the Oklahoma Form 200 is governed by state tax laws and regulations. Submitting this form accurately and on time is essential for maintaining compliance with the Oklahoma Tax Commission. An eSignature can be used to validate the form electronically, provided that all legal requirements for electronic signatures are met. This ensures that the form is considered legally binding and protects the business from potential legal issues.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the Oklahoma Form 200, including online, by mail, or in person. The online submission process is often the most efficient, allowing for quick processing and confirmation of receipt. For those opting to submit by mail, it is important to send the form to the correct address and allow sufficient time for delivery. In-person submissions can be made at designated tax commission offices, providing an opportunity for immediate assistance if needed.

Quick guide on how to complete oklahoma form 200

Complete Oklahoma Form 200 effortlessly on any device

Web-based document administration has become increasingly favored by organizations and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Oklahoma Form 200 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered operation today.

The easiest method to modify and eSign Oklahoma Form 200 without hassle

- Locate Oklahoma Form 200 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form navigation, or errors that require new document copies to be printed. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and eSign Oklahoma Form 200 to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oklahoma form 200

Create this form in 5 minutes!

How to create an eSignature for the oklahoma form 200

How to make an eSignature for your PDF document in the online mode

How to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the frx200 and how can it benefit my business?

The frx200 is an innovative eSignature solution provided by airSlate SignNow, designed to help businesses streamline document signing processes. With its user-friendly interface, the frx200 allows for fast and secure signing, enhancing productivity and reducing turnaround times.

-

How does the pricing of frx200 compare to other eSignature solutions?

The frx200 offers competitive pricing that ensures high value for businesses looking to implement eSigning capabilities. By choosing the frx200, organizations can access premium features without breaking the bank, making it a cost-effective solution for all sizes.

-

What features are included with the frx200?

The frx200 comes packed with features like customizable templates, advanced security measures, and seamless integrations with other tools. These features make it easy for businesses to create, send, and sign documents securely and efficiently.

-

Can the frx200 integrate with other applications?

Yes, the frx200 has the capability to integrate seamlessly with various applications, including CRM and project management solutions. This integration helps enhance workflow efficiency and ensures that all your documents are managed in one central place.

-

Is the frx200 suitable for both small and large businesses?

Absolutely! The frx200 is designed to cater to the needs of both small and large businesses. Its flexibility and scalability make it an ideal choice for any organization looking to transition to digital document signing.

-

How secure is the frx200 for sensitive documents?

The frx200 prioritizes security with advanced encryption technologies and compliance with eSignature regulations. This ensures that sensitive documents are protected, and only authorized individuals can access the signing process.

-

What support options are available with the frx200?

airSlate SignNow provides robust customer support for the frx200, including live chat, email assistance, and comprehensive online resources. This ensures that users can quickly resolve any issues and make the most of the eSignature features.

Get more for Oklahoma Form 200

- Wy company form

- Wyoming statement form

- Quitclaim deed from individual to husband and wife wyoming form

- Warranty deed from individual to husband and wife wyoming form

- Quitclaim deed from corporation to husband and wife wyoming form

- Warranty deed from corporation to husband and wife wyoming form

- Quitclaim deed from corporation to individual wyoming form

- Warranty deed from corporation to individual wyoming form

Find out other Oklahoma Form 200

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure