Income and Franchise Tax Forms and Instructions Oklahoma 2021

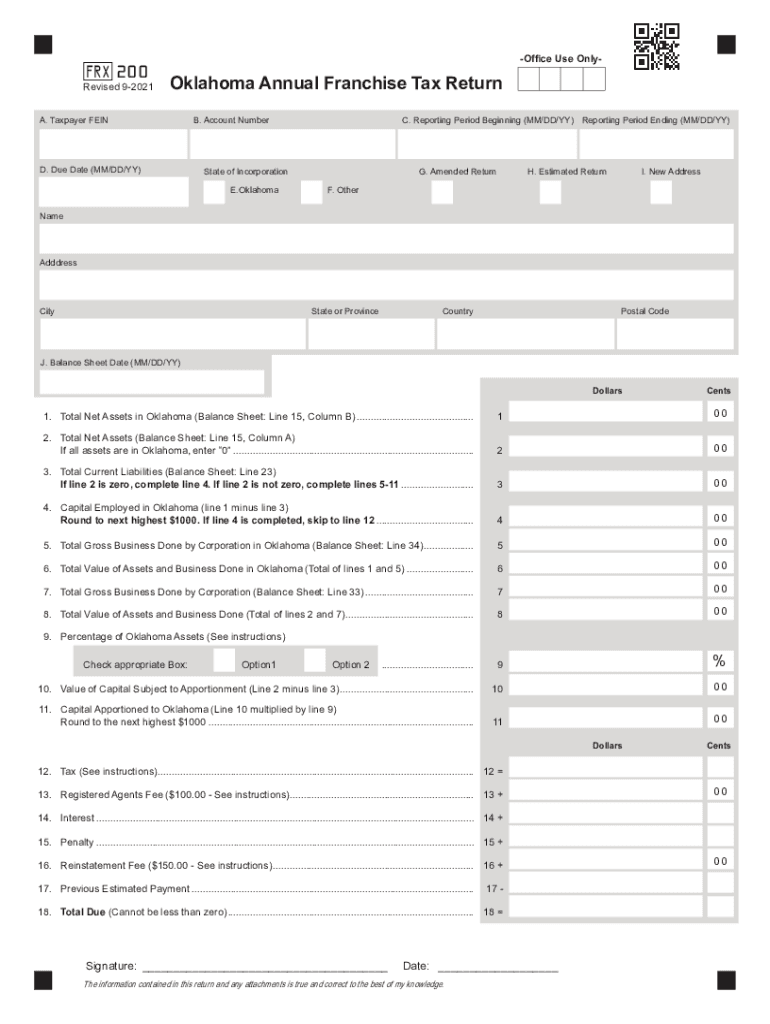

What is the Oklahoma Form 200?

The Oklahoma Form 200 is an essential document used for filing the franchise tax return in the state of Oklahoma. This form is primarily designed for corporations, limited liability companies (LLCs), and other business entities operating within the state. It serves to report the income earned by the business and calculate the corresponding franchise tax owed to the state. Understanding the purpose and requirements of Form 200 is crucial for compliance with Oklahoma tax laws.

Steps to Complete the Oklahoma Form 200

Completing the Oklahoma Form 200 involves several key steps to ensure accuracy and compliance. Here’s a streamlined process for filling out the form:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill in the business identification details, such as the name, address, and federal tax identification number.

- Report total income and allowable deductions as per Oklahoma tax guidelines.

- Calculate the franchise tax based on the provided income figures.

- Review the completed form for accuracy before submission.

Legal Use of the Oklahoma Form 200

The Oklahoma Form 200 is legally binding when completed and submitted according to state regulations. To ensure its legal validity, businesses must adhere to the guidelines set forth by the Oklahoma Tax Commission. This includes providing accurate information and submitting the form by the established deadlines. Additionally, electronic signatures may be utilized for the form's submission, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA).

Filing Deadlines for the Oklahoma Form 200

Timely filing of the Oklahoma Form 200 is critical to avoid penalties and interest. The annual franchise tax return is generally due on the fifteenth day of the fourth month following the close of the tax year. For most businesses, this means the deadline falls on April 15. It is advisable to check for any updates or changes to deadlines each year, as these can vary based on specific circumstances or state regulations.

Required Documents for Oklahoma Form 200

To complete the Oklahoma Form 200, several documents are typically required. These include:

- Financial statements, including income statements and balance sheets.

- Records of any deductions or credits claimed.

- Previous year’s tax return for reference.

- Any supporting documentation related to income sources and expenses.

Having these documents readily available will facilitate a smoother filing process and help ensure compliance with state tax laws.

Who Issues the Oklahoma Form 200?

The Oklahoma Form 200 is issued by the Oklahoma Tax Commission, the state agency responsible for administering tax laws and collecting revenue. This agency provides the necessary resources and guidelines for businesses to accurately complete and submit the form. It is essential for businesses to refer to the Oklahoma Tax Commission’s official resources for any updates or changes regarding the form and its requirements.

Quick guide on how to complete income and franchise tax forms and instructions oklahoma

Complete Income And Franchise Tax Forms And Instructions Oklahoma effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents quickly without delays. Manage Income And Franchise Tax Forms And Instructions Oklahoma on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The simplest way to modify and eSign Income And Franchise Tax Forms And Instructions Oklahoma with ease

- Obtain Income And Franchise Tax Forms And Instructions Oklahoma and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Income And Franchise Tax Forms And Instructions Oklahoma to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income and franchise tax forms and instructions oklahoma

Create this form in 5 minutes!

How to create an eSignature for the income and franchise tax forms and instructions oklahoma

The best way to create an electronic signature for a PDF file online

The best way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to generate an e-signature right from your mobile device

The way to create an e-signature for a PDF file on iOS

How to generate an e-signature for a PDF on Android devices

People also ask

-

What is the Oklahoma Form 200 and why is it important?

The Oklahoma Form 200 is a critical document used for various official purposes within the state. It is essential for ensuring compliance with state regulations and is often required for legal and financial transactions. Using airSlate SignNow, you can easily fill out and eSign this form, making the process seamless and efficient.

-

How can airSlate SignNow help me with Oklahoma Form 200?

airSlate SignNow simplifies the process of completing and signing the Oklahoma Form 200. With its user-friendly interface, you can quickly input information and securely eSign the document. This saves you time and reduces the hassle of printing and scanning.

-

Is there a cost associated with using airSlate SignNow for Oklahoma Form 200?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, making it a cost-effective solution for handling the Oklahoma Form 200. With the subscription, you gain access to additional features that enhance document workflows, ensuring you get great value.

-

What features does airSlate SignNow offer for managing Oklahoma Form 200?

airSlate SignNow includes features such as template creation, document tracking, and secure storage specifically for documents like Oklahoma Form 200. These tools streamline the eSigning process and ensure you can manage your documents efficiently.

-

Can I integrate airSlate SignNow with other applications for Oklahoma Form 200?

Absolutely! airSlate SignNow offers integrations with numerous applications, allowing you to sync data and streamline processes related to the Oklahoma Form 200. This enables you to work within your existing workflow and enhances overall efficiency.

-

How does airSlate SignNow ensure the security of Oklahoma Form 200?

airSlate SignNow prioritizes security with advanced encryption and compliance measures to protect your Oklahoma Form 200 and other sensitive documents. You can eSign with confidence knowing that your data is secure and accessible only to authorized individuals.

-

What advantages does eSigning the Oklahoma Form 200 through airSlate SignNow provide?

eSigning the Oklahoma Form 200 with airSlate SignNow provides numerous benefits, including faster processing times and the elimination of paper waste. It enhances accessibility, as you can sign documents on-the-go, making it an ideal solution for busy professionals.

Get more for Income And Franchise Tax Forms And Instructions Oklahoma

Find out other Income And Franchise Tax Forms And Instructions Oklahoma

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors