Oklahoma Annual Franchise Tax Return Instruction Sheet 2023-2026

Understanding the Oklahoma Annual Franchise Tax Return Instruction Sheet

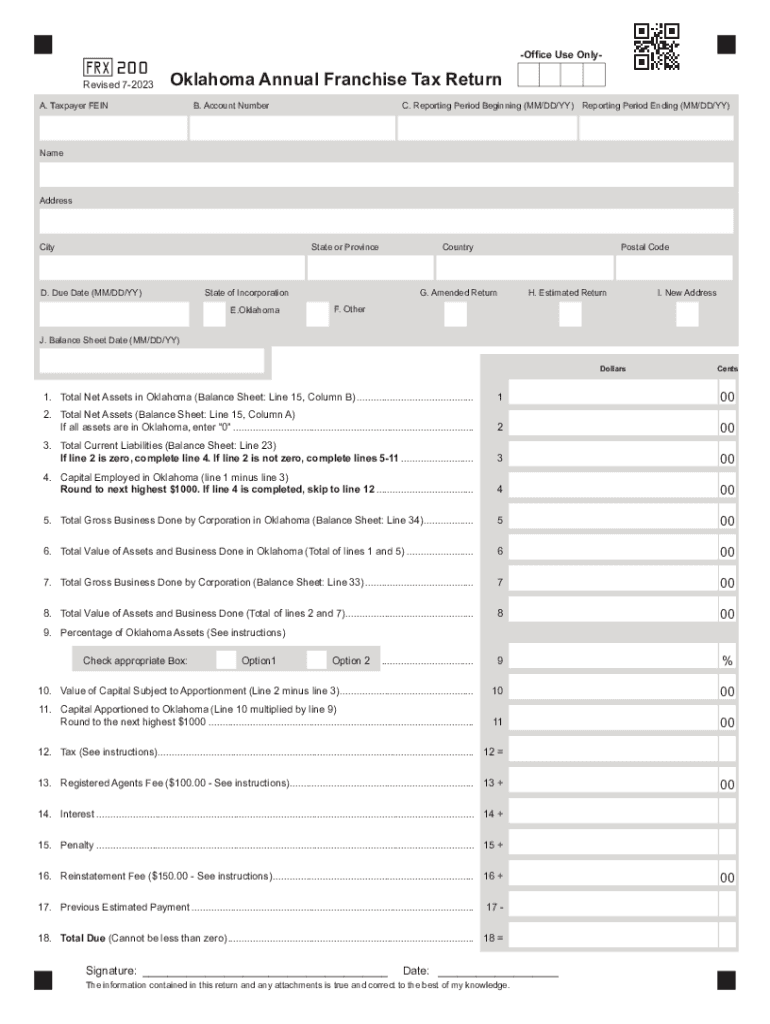

The Oklahoma Annual Franchise Tax Return Instruction Sheet provides essential guidance for businesses required to file the Oklahoma franchise tax return. This document outlines the necessary steps, forms, and information needed to ensure compliance with state tax regulations. It is crucial for businesses operating in Oklahoma to familiarize themselves with these instructions to avoid penalties and ensure accurate filings.

Steps to Complete the Oklahoma Annual Franchise Tax Return Instruction Sheet

Completing the Oklahoma Annual Franchise Tax Return involves several key steps:

- Gather required financial documents, including profit and loss statements and balance sheets.

- Access the Oklahoma franchise tax form 200, which is the primary document for reporting.

- Follow the instructions provided on the instruction sheet to fill out the form accurately.

- Review your completed form for any errors or omissions.

- Submit the form by the designated deadline to avoid late fees.

Filing Deadlines and Important Dates

It is vital for businesses to be aware of the filing deadlines associated with the Oklahoma franchise tax return. Typically, the annual franchise tax return is due on the last day of the month following the end of the fiscal year. For most businesses operating on a calendar year, this means the return is due by April 15. Late submissions may incur penalties, so timely filing is essential.

Required Documents for Filing

When preparing to file the Oklahoma franchise tax return, businesses need to gather several key documents:

- Financial statements, including income statements and balance sheets.

- Previous year’s franchise tax return for reference.

- Any supporting documentation required for deductions or credits claimed.

Penalties for Non-Compliance

Failure to file the Oklahoma franchise tax return by the deadline can result in significant penalties. Businesses may face late fees, which can accumulate over time, leading to increased financial liability. Additionally, non-compliance may result in the loss of good standing with the state, affecting the ability to conduct business legally in Oklahoma.

Form Submission Methods

Businesses have several options for submitting the Oklahoma franchise tax return. The form can be filed online through the Oklahoma Tax Commission’s website, mailed directly to the appropriate office, or submitted in person at designated locations. Each method has its own processing times and requirements, so businesses should choose the one that best suits their needs.

Quick guide on how to complete oklahoma annual franchise tax return instruction sheet

Complete Oklahoma Annual Franchise Tax Return Instruction Sheet effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Oklahoma Annual Franchise Tax Return Instruction Sheet on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Oklahoma Annual Franchise Tax Return Instruction Sheet effortlessly

- Find Oklahoma Annual Franchise Tax Return Instruction Sheet and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and eSign Oklahoma Annual Franchise Tax Return Instruction Sheet to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oklahoma annual franchise tax return instruction sheet

Create this form in 5 minutes!

How to create an eSignature for the oklahoma annual franchise tax return instruction sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Oklahoma franchise return?

An Oklahoma franchise return is a tax return that businesses in Oklahoma must file to report their franchise tax obligations. This return is essential for compliance with state regulations and helps ensure your business stays in good standing. By submitting your Oklahoma franchise return accurately and on time, you can avoid penalties and maintain your operational status.

-

How can airSlate SignNow help with my Oklahoma franchise return?

AirSlate SignNow simplifies the process of preparing and filing your Oklahoma franchise return by allowing you to securely sign and send necessary documents electronically. Our platform includes templates that can streamline your tax preparation process. With features designed for efficiency, airSlate SignNow ensures your filing is stress-free.

-

What are the pricing options for airSlate SignNow's services?

AirSlate SignNow offers flexible pricing options that cater to businesses of all sizes. Our plans are designed to fit different budgets while providing value through unlimited eSigning and document storage. Investing in airSlate SignNow can help you manage your Oklahoma franchise return without overspending.

-

Is my data secure when using airSlate SignNow for my Oklahoma franchise return?

Yes, airSlate SignNow prioritizes the security of your data. Our platform uses advanced encryption protocols to protect your sensitive information during the eSigning process of your Oklahoma franchise return. We comply with industry standards to ensure your data remains confidential and secure.

-

Can I integrate airSlate SignNow with other tax software for my Oklahoma franchise return?

AirSlate SignNow offers various integrations with popular tax software that can facilitate the management of your Oklahoma franchise return. This seamless integration allows you to import and export data efficiently, making the tax filing process much less cumbersome. Enhancing your workflow by connecting tools can lead to a more organized approach to your tax obligations.

-

What features does airSlate SignNow provide for managing documents related to Oklahoma franchise returns?

AirSlate SignNow includes a range of features such as customizable templates, bulk sending, and real-time tracking for your document management needs related to Oklahoma franchise returns. These features ensure that organizations can streamline their processes while maintaining compliance. With airSlate SignNow, managing these essential documents becomes easier and more efficient.

-

Are there any benefits to using airSlate SignNow for electronic signatures for my Oklahoma franchise return?

Using airSlate SignNow for electronic signatures signNowly speeds up the process of signing documents related to your Oklahoma franchise return. It allows for faster turnaround times and eliminates the need for printing, scanning, or mailing files. This not only enhances efficiency but also reduces costs associated with paper-based processes.

Get more for Oklahoma Annual Franchise Tax Return Instruction Sheet

Find out other Oklahoma Annual Franchise Tax Return Instruction Sheet

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple