District of Columbia Nonresident Request for Refund TaxFormFinder 2021

What is the D-40B Form?

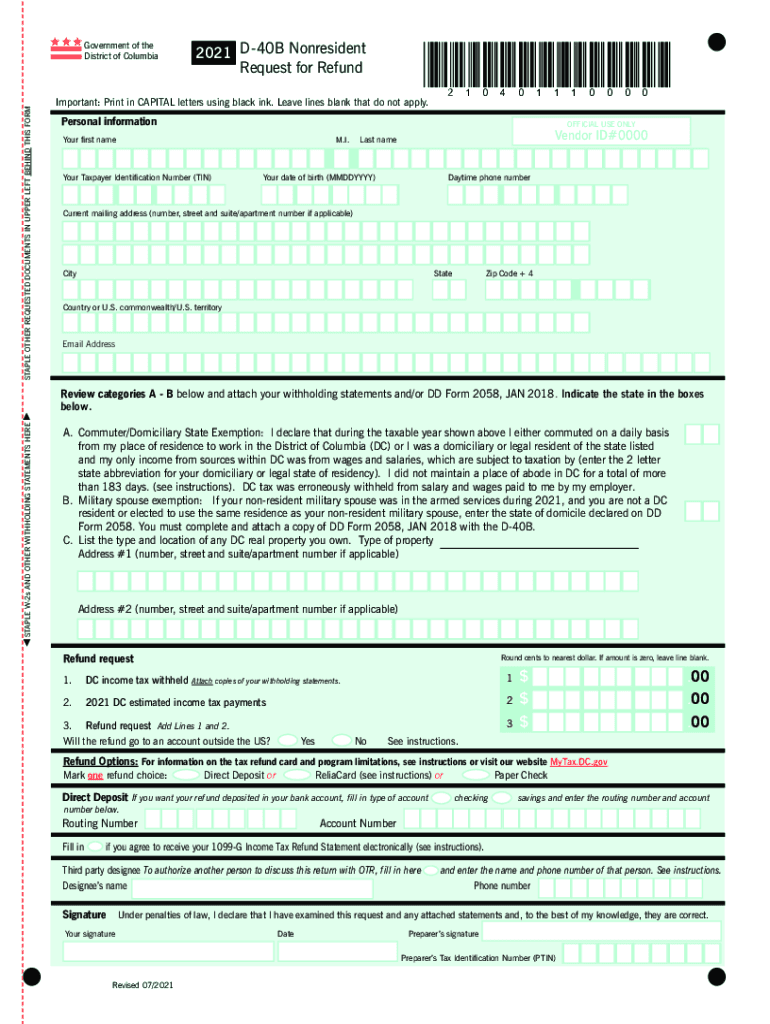

The D-40B form, also known as the District of Columbia Nonresident Request for Refund, is a tax document used by nonresidents who have overpaid their income taxes in Washington, D.C. This form allows individuals who earned income in the District but do not reside there to request a refund of any excess taxes withheld. Understanding this form is crucial for ensuring that nonresidents can reclaim their rightful funds efficiently.

Steps to Complete the D-40B Form

Completing the D-40B form involves several key steps:

- Gather necessary documentation, including W-2s and 1099s that show income earned in D.C.

- Fill out personal information, including your name, address, and Social Security number.

- Provide details of your income earned in Washington, D.C., and the taxes withheld.

- Calculate the amount of refund you are requesting based on the overpayment.

- Sign and date the form to certify that the information provided is accurate.

Ensure that all information is accurate to avoid delays in processing your request.

Eligibility Criteria for the D-40B Form

To qualify for filing the D-40B form, you must meet specific eligibility criteria:

- You must be a nonresident of Washington, D.C., who earned income within the District.

- Taxes must have been withheld from your income, resulting in an overpayment.

- You need to file your request within the designated time frame, typically within three years of the original due date of the tax return.

Meeting these criteria is essential for a successful refund request.

Required Documents for the D-40B Form

When submitting the D-40B form, you will need to include several important documents:

- Copy of your W-2 forms from employers who withheld D.C. taxes.

- Any 1099 forms that report income earned in the District.

- Proof of residency in another state, if applicable.

- Any additional documentation that supports your claim for a refund.

Having these documents ready can expedite the processing of your refund request.

Form Submission Methods for the D-40B Form

The D-40B form can be submitted through various methods:

- Online submission through the District of Columbia Office of Tax and Revenue website.

- Mailing the completed form to the appropriate tax office in D.C.

- In-person submission at designated tax offices, if available.

Choosing the right submission method can help ensure timely processing of your refund.

Legal Use of the D-40B Form

The D-40B form is legally recognized as a valid request for a tax refund for nonresidents. It complies with the tax laws of Washington, D.C., and must be filled out accurately to be considered valid. Submitting this form allows nonresidents to reclaim funds that were mistakenly withheld, ensuring compliance with tax regulations while protecting taxpayer rights.

Quick guide on how to complete district of columbia nonresident request for refund taxformfinder

Complete District Of Columbia Nonresident Request For Refund TaxFormFinder effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage District Of Columbia Nonresident Request For Refund TaxFormFinder on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign District Of Columbia Nonresident Request For Refund TaxFormFinder without hassle

- Find District Of Columbia Nonresident Request For Refund TaxFormFinder and click Get Form to begin.

- Utilize the features we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and eSign District Of Columbia Nonresident Request For Refund TaxFormFinder and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct district of columbia nonresident request for refund taxformfinder

Create this form in 5 minutes!

People also ask

-

What is the d 40b form, and why is it important?

The d 40b form is a vital document used for reporting specific tax-related information. Understanding its requirements can streamline your filing process and ensure compliance. Using airSlate SignNow, you can easily prepare and eSign your d 40b form, helping you save time and avoid potential penalties.

-

How can airSlate SignNow help with the d 40b form?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your d 40b form online. Its features include templates and automated workflows that streamline the process, reducing the hassle of paperwork. This way, you can focus on your core business activities while ensuring your documents are professionally handled.

-

What are the pricing options for airSlate SignNow for managing the d 40b form?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including those requiring frequent handling of the d 40b form. Plans range from basic options for small businesses to advanced features for larger enterprises. You can choose a plan that fits your budget while ensuring you have the tools needed for efficient document management.

-

Can I integrate airSlate SignNow with other applications for the d 40b form?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage the d 40b form efficiently. Whether you use accounting software, CRM systems, or document management tools, integrations ensure that your data flows smoothly across platforms. This enhances productivity and simplifies your operations.

-

What are the benefits of using airSlate SignNow for the d 40b form?

Using airSlate SignNow for your d 40b form offers numerous benefits, such as increased efficiency and enhanced document security. With electronic signatures, you can speed up the signing process and reduce the time spent on handling paperwork. Additionally, airSlate SignNow ensures your documents are stored securely and are easily accessible.

-

Is there a mobile app for airSlate SignNow to manage the d 40b form on the go?

Absolutely! airSlate SignNow offers a mobile app that allows you to manage your d 40b form anytime, anywhere. Whether you're in the office or on the move, you can create, send, and eSign documents directly from your smartphone or tablet. This flexibility ensures that you remain productive, regardless of your location.

-

How does airSlate SignNow ensure the security of the d 40b form?

airSlate SignNow prioritizes the security of your documents, including the d 40b form. It uses advanced encryption methods and complies with industry standards to protect your data. With features like secure cloud storage and user authentication, you can be confident that your sensitive information is safe.

Get more for District Of Columbia Nonresident Request For Refund TaxFormFinder

- Foundation contract for contractor montana form

- Plumbing contract for contractor montana form

- Brick mason contract for contractor montana form

- Roofing contract for contractor montana form

- Electrical contract for contractor montana form

- Sheetrock drywall contract for contractor montana form

- Flooring contract for contractor montana form

- Montana new home construction contract montana form

Find out other District Of Columbia Nonresident Request For Refund TaxFormFinder

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple