D 40B DC Office of Tax and Revenue 2022-2026

What is the D 40B DC Office of Tax and Revenue

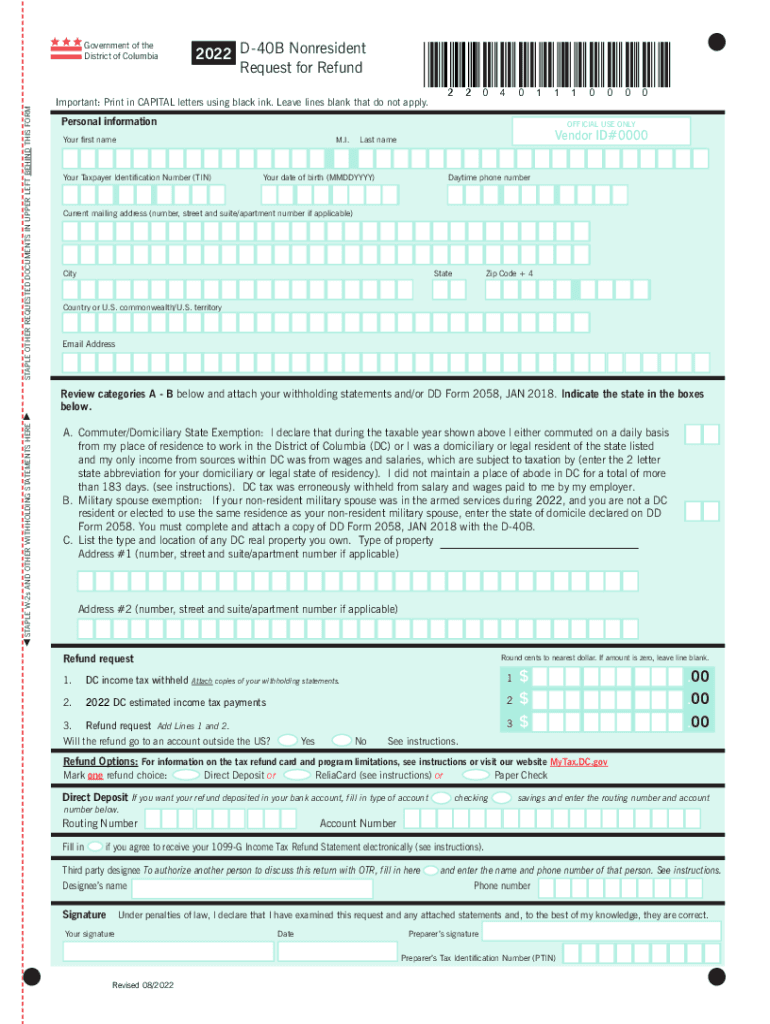

The D 40B is a form utilized by nonresidents to request a refund of overpaid taxes in Washington, D.C. This form is specifically issued by the DC Office of Tax and Revenue, which is responsible for collecting taxes and administering tax laws within the District. The D 40B form is crucial for nonresidents who have earned income in D.C. and wish to reclaim any excess taxes withheld. Understanding this form is essential for ensuring compliance and facilitating the refund process.

Steps to Complete the D 40B DC Office of Tax and Revenue

Completing the D 40B form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including your W-2 forms and any other relevant tax documents. Next, accurately fill out the personal information section, ensuring that your name, address, and Social Security number are correct. Then, calculate your total income earned in D.C. and the amount of tax withheld. Finally, review the form for completeness and accuracy before submitting it. Errors can lead to delays in processing your refund.

Required Documents for the D 40B DC Office of Tax and Revenue

When submitting the D 40B form, certain documents are essential for a successful application. You will need to provide copies of your W-2 forms that detail your income and taxes withheld. Additionally, any other tax documents that support your claim for a refund should be included. It is also advisable to attach a copy of your federal tax return, as this can provide further context for your refund request. Ensuring that all required documents are submitted will help expedite the review process.

Form Submission Methods for the D 40B DC Office of Tax and Revenue

The D 40B form can be submitted through various methods, accommodating different preferences. You can file the form online through the DC Office of Tax and Revenue's official website, which offers a streamlined process for electronic submissions. Alternatively, you can print the completed form and mail it to the designated address provided on the form. In-person submissions are also an option at the Office of Tax and Revenue, allowing for direct interaction with tax officials if you have questions or need assistance.

Eligibility Criteria for the D 40B DC Office of Tax and Revenue

To be eligible to file the D 40B form, you must meet specific criteria set by the DC Office of Tax and Revenue. Primarily, you must be a nonresident who earned income in Washington, D.C., and had taxes withheld from that income. Additionally, you should not have a permanent residence in D.C. during the tax year in question. Understanding these eligibility requirements is crucial for ensuring that your refund request is valid and will be processed without complications.

Penalties for Non-Compliance with the D 40B DC Office of Tax and Revenue

Failing to comply with the regulations surrounding the D 40B form can result in various penalties. If you do not file the form within the specified deadlines, you may face late fees and interest on any unpaid taxes. Additionally, providing false information on the form can lead to severe penalties, including fines and potential legal action. It is essential to adhere to all guidelines and deadlines to avoid these consequences and ensure a smooth refund process.

Quick guide on how to complete d 40b dc office of tax and revenue

Effortlessly Complete D 40B DC Office Of Tax And Revenue on Any Device

Digital document management has gained traction among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely preserve it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without delays. Manage D 40B DC Office Of Tax And Revenue on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and eSign D 40B DC Office Of Tax And Revenue with Ease

- Locate D 40B DC Office Of Tax And Revenue and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Edit and eSign D 40B DC Office Of Tax And Revenue while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct d 40b dc office of tax and revenue

Create this form in 5 minutes!

How to create an eSignature for the d 40b dc office of tax and revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a DC refund request?

A DC refund request is a formal process to request a refund for overpaid taxes or fees in Washington, D.C. Utilizing the airSlate SignNow platform, you can efficiently prepare and submit your DC refund request documents. This enables quick processing and ensures your refund is handled accurately.

-

How can airSlate SignNow help with my DC refund request?

airSlate SignNow simplifies the entire process of managing a DC refund request by providing an easy-to-use eSignature tool. You can easily create, send, and sign necessary documents securely from anywhere. This streamlines the refund process, making it faster and more efficient.

-

Is there a cost associated with using airSlate SignNow for DC refund requests?

Yes, there is a pricing structure for using airSlate SignNow, which offers various plans based on your needs. However, the platform is designed to save you time and money by simplifying document management tasks like a DC refund request. Explore our pricing page for more details on plan features and costs.

-

What features does airSlate SignNow offer for managing documents related to DC refund requests?

airSlate SignNow provides features such as customizable templates, real-time tracking, and audit trails for documents related to your DC refund request. You can also enjoy cloud storage and the ability to integrate with other applications. This makes document management seamless and organized.

-

Can I integrate airSlate SignNow with other software for my DC refund requests?

Absolutely! airSlate SignNow offers integration options with various third-party applications that can assist you with your DC refund request. This allows you to sync data from accounting or tax software, creating a more connected and efficient workflow for managing your refunds.

-

What are the benefits of using airSlate SignNow for my DC refund request compared to traditional methods?

Using airSlate SignNow for your DC refund request offers signNow advantages over traditional paper methods. It enhances efficiency, reduces processing time, and minimizes errors associated with manual handling. Plus, the eSignature feature ensures your documents are signed and submitted securely at any time.

-

How do I get started with airSlate SignNow for my DC refund request?

Getting started with airSlate SignNow is easy! You can sign up for an account, choose the plan that best fits your needs, and begin creating your DC refund request documents immediately. Our user-friendly interface guides you through the process, ensuring a smooth experience.

Get more for D 40B DC Office Of Tax And Revenue

- Unfair competition form

- Cancellation form 497328102

- Purchase order with terms and conditions for medical supplies form

- International master purchase agreement form

- Letter acceptance template form

- Continuance form

- Officer resignation letter form

- Preventative maintenance agreement air conditioning equipment form

Find out other D 40B DC Office Of Tax And Revenue

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free