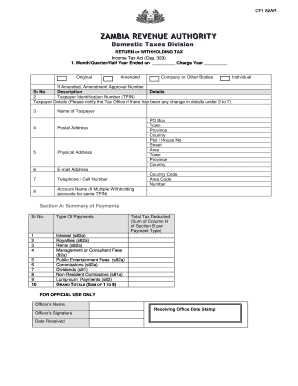

Zambia Revenue Authority ZRA Form

What is the Zambia Revenue Authority (ZRA)?

The Zambia Revenue Authority (ZRA) is the government agency responsible for tax collection and enforcement in Zambia. It plays a crucial role in ensuring compliance with tax laws and regulations, facilitating revenue generation for national development. The ZRA oversees various tax types, including income tax, value-added tax (VAT), and customs duties, among others. Understanding the ZRA's functions is essential for individuals and businesses operating within Zambia, as it directly impacts their tax obligations and compliance requirements.

Steps to Complete the General Affidavit Form Zambia PDF

Completing the general affidavit form in Zambia requires careful attention to detail. Follow these steps to ensure accuracy:

- Download the general affidavit form Zambia PDF from a reliable source.

- Read the instructions carefully to understand the requirements for completion.

- Fill in your personal details, including your full name, address, and contact information.

- Provide the specific information relevant to the affidavit, ensuring all statements are truthful and accurate.

- Sign the form in the designated area, ensuring your signature matches your legal name.

- Have the affidavit notarized if required by law or the institution requesting it.

- Submit the completed form to the relevant authority or institution as specified.

Legal Use of the General Affidavit Form Zambia PDF

The general affidavit form serves as a legally binding document in various contexts, such as legal proceedings, financial transactions, or personal declarations. To ensure its legal validity, the form must be completed accurately and signed in the presence of a notary public, if required. The affidavit must also comply with local laws governing sworn statements and declarations. Failure to adhere to these legal requirements may result in the affidavit being deemed invalid, which can have significant consequences for the parties involved.

Required Documents for the General Affidavit Form Zambia PDF

When preparing to complete the general affidavit form, it is essential to gather the necessary documents to support your statements. Commonly required documents may include:

- A valid form of identification, such as a passport or national ID.

- Proof of residence, such as a utility bill or lease agreement.

- Any relevant legal documents that pertain to the statements made in the affidavit.

- Additional documentation as requested by the authority or institution requiring the affidavit.

Examples of Using the General Affidavit Form Zambia PDF

The general affidavit form can be utilized in various scenarios, including:

- Affirming the truthfulness of statements in court proceedings.

- Confirming identity or marital status for legal purposes.

- Providing evidence of financial transactions or agreements.

- Supporting applications for loans or financial assistance.

Form Submission Methods for the General Affidavit Form Zambia PDF

Submitting the general affidavit form can be done through various methods, depending on the requirements of the receiving authority. Common submission methods include:

- In-person submission at the relevant office or institution.

- Mailing the completed form to the designated address.

- Submitting the form electronically, if the authority allows for digital submissions.

Quick guide on how to complete zambia revenue authority zra

Effortlessly Complete Zambia Revenue Authority ZRA on Any Device

Managing documents online has gained considerable traction among companies and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly, without unnecessary hold-ups. Handle Zambia Revenue Authority ZRA on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to Modify and eSign Zambia Revenue Authority ZRA with Ease

- Locate Zambia Revenue Authority ZRA and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information using the tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Edit and eSign Zambia Revenue Authority ZRA to ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the zambia revenue authority zra

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a general affidavit form Zambia PDF?

A general affidavit form Zambia PDF is a legal document used to declare facts and provide evidence in various situations, like court proceedings or financial matters. This form can be customized to suit specific needs and is essential for ensuring that your declarations are legally binding in Zambia.

-

How can I obtain a general affidavit form Zambia PDF?

You can easily obtain a general affidavit form Zambia PDF by visiting official legal websites or using platforms like airSlate SignNow, where templates are readily available for download and customization. This convenience ensures you have immediate access to the necessary documentation.

-

Is the general affidavit form Zambia PDF available for free?

While some websites may offer a general affidavit form Zambia PDF for free, using airSlate SignNow provides added features and benefits, like eSigning capabilities and cloud storage. This may come with a minimal fee but can enhance the overall efficiency and security of your document management.

-

What features does airSlate SignNow offer for handling general affidavit forms?

airSlate SignNow offers features such as electronic signatures, customizable templates, and secure cloud storage for managing your general affidavit forms Zambia PDF. These capabilities streamline the process and ensure that your documents are both legally compliant and easily accessible.

-

Can I integrate other tools with the airSlate SignNow platform?

Yes, airSlate SignNow allows integration with various tools and applications, enabling seamless workflows for your general affidavit form Zambia PDF processing. You can connect with CRM systems, cloud storage solutions, and productivity apps to enhance efficiency.

-

What are the benefits of using airSlate SignNow for my general affidavit forms?

Using airSlate SignNow for your general affidavit forms Zambia PDF provides a cost-effective solution that reduces paperwork and saves time. The platform ensures a user-friendly experience with advanced features like reminders for signing and tracking document status.

-

Is airSlate SignNow secure for signing general affidavit forms?

Absolutely. AirSlate SignNow employs advanced security measures, including encryption and secure data storage, to protect your general affidavit form Zambia PDF and personal information. This assures you that your documents are handled safely and securely.

Get more for Zambia Revenue Authority ZRA

- Washington deed in lieu of foreclosure husband and wife to corporation form

- Washington legal last will and testament form for single person with adult children

- Washington legal last will and testament form for divorced person not remarried with no children

- Washington legal will form

- Washington legal last will and testament form for married person with adult and minor children

- Washington legal last will and testament form with all property to trust called a pour over will

- Wisconsin agreement form

- Last will testament 481376735 form

Find out other Zambia Revenue Authority ZRA

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile