Individual NonresidentPart Year Income Tax Return Packet 2021

What is the Individual Nonresident Part Year Income Tax Return Packet

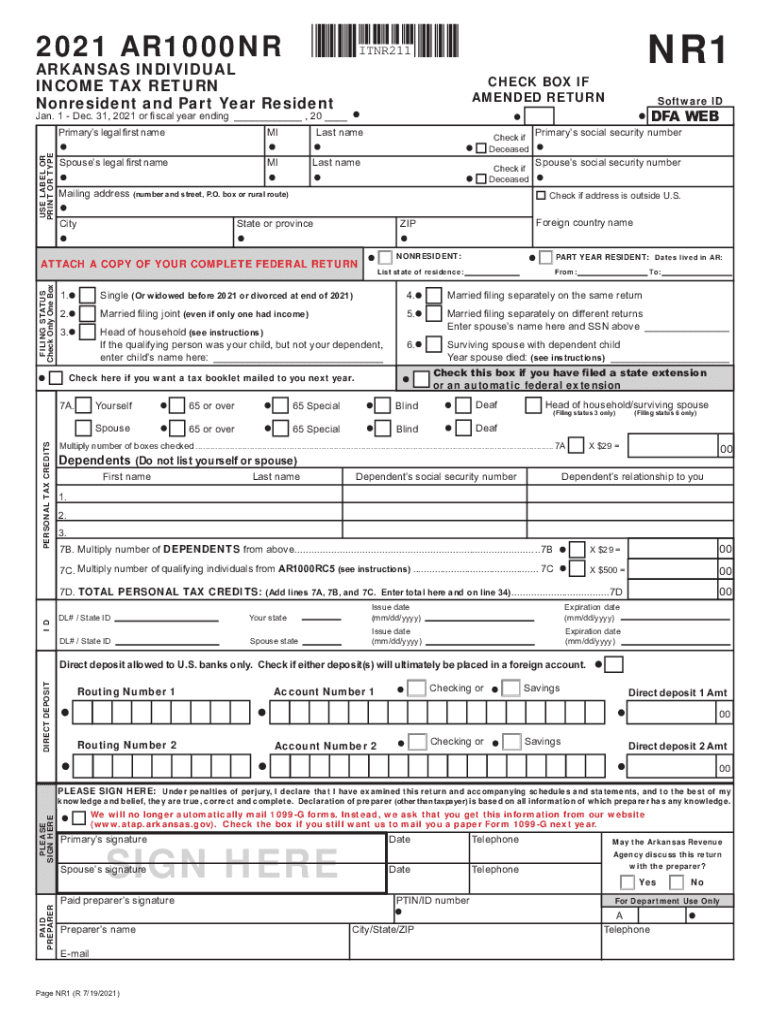

The Individual Nonresident Part Year Income Tax Return Packet is a specialized tax form designed for individuals who have earned income in the United States but do not meet the criteria for full-year residency. This form allows nonresidents and part-year residents to report their income accurately, ensuring compliance with U.S. tax laws. It typically includes sections for reporting various types of income, deductions, and credits applicable to the individual's specific circumstances.

Steps to complete the Individual Nonresident Part Year Income Tax Return Packet

Completing the Individual Nonresident Part Year Income Tax Return Packet involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your residency status and the period for which you are filing.

- Fill out the form, ensuring all income sources are accurately reported.

- Calculate any deductions or credits for which you may be eligible.

- Review the completed form for accuracy before submission.

How to obtain the Individual Nonresident Part Year Income Tax Return Packet

The Individual Nonresident Part Year Income Tax Return Packet can be obtained through various channels. It is typically available on the official IRS website, where taxpayers can download the form directly. Additionally, local tax offices and accounting firms may provide physical copies or assistance in completing the form. Ensure you have the most current version to comply with recent tax regulations.

Legal use of the Individual Nonresident Part Year Income Tax Return Packet

The legal use of the Individual Nonresident Part Year Income Tax Return Packet is crucial for ensuring compliance with federal tax obligations. This form must be filled out accurately and submitted by the designated deadlines to avoid penalties. It is essential that individuals understand the legal implications of their residency status and the income they report, as inaccuracies can lead to audits or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Individual Nonresident Part Year Income Tax Return Packet typically align with the general tax filing season. Generally, the deadline for submission is April 15 of the following year. However, if you are a nonresident, you may need to check specific state deadlines as they can vary. It is advisable to be aware of any extensions that may apply, especially for individuals living abroad.

Required Documents

To complete the Individual Nonresident Part Year Income Tax Return Packet, certain documents are essential:

- W-2 forms from employers for reported income.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income.

- Documentation for deductions, such as receipts for business expenses.

Examples of using the Individual Nonresident Part Year Income Tax Return Packet

Examples of scenarios where the Individual Nonresident Part Year Income Tax Return Packet is applicable include:

- An individual who worked in the U.S. for part of the year but resides in another country.

- A student who studied in the U.S. for a portion of the year and earned income through part-time employment.

- A foreign national who was temporarily in the U.S. for work and earned income during that time.

Quick guide on how to complete individual nonresidentpart year income tax return packet

Complete Individual NonresidentPart Year Income Tax Return Packet seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Individual NonresidentPart Year Income Tax Return Packet on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Individual NonresidentPart Year Income Tax Return Packet with ease

- Find Individual NonresidentPart Year Income Tax Return Packet and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to misplaced or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign Individual NonresidentPart Year Income Tax Return Packet and ensure exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual nonresidentpart year income tax return packet

Create this form in 5 minutes!

People also ask

-

What is the Individual NonresidentPart Year Income Tax Return Packet?

The Individual NonresidentPart Year Income Tax Return Packet is a comprehensive document package designed for individuals who need to file taxes as nonresidents or part-year residents. It consolidates all necessary forms and instructions to streamline your filing process, ensuring compliance with state and federal regulations.

-

How does airSlate SignNow facilitate the Individual NonresidentPart Year Income Tax Return Packet process?

airSlate SignNow empowers you to easily send and eSign your Individual NonresidentPart Year Income Tax Return Packet. With a user-friendly interface, you can quickly upload, sign, and send your tax documents, making the overall process both efficient and secure.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans tailored to meet the needs of individuals and businesses. By choosing a plan, you can access features that enhance your experience with the Individual NonresidentPart Year Income Tax Return Packet while keeping costs manageable.

-

Are there any integrations available for managing the Individual NonresidentPart Year Income Tax Return Packet?

Yes, airSlate SignNow seamlessly integrates with various accounting and CRM software, allowing for streamlined management of your Individual NonresidentPart Year Income Tax Return Packet. This ensures that all your documents can be efficiently handled within your existing workflows.

-

What are the benefits of using airSlate SignNow with my Individual NonresidentPart Year Income Tax Return Packet?

Utilizing airSlate SignNow for your Individual NonresidentPart Year Income Tax Return Packet provides security, efficiency, and ease of use. The platform ensures your documents are securely signed and stored, while also drastically reducing turnaround time for completing your tax filings.

-

Can electronic signatures be used for the Individual NonresidentPart Year Income Tax Return Packet?

Absolutely! airSlate SignNow allows you to use legally binding electronic signatures for the Individual NonresidentPart Year Income Tax Return Packet. This streamlines the signing process, making it convenient and compliant with legal requirements.

-

Is there customer support available when using airSlate SignNow for tax returns?

Yes, airSlate SignNow provides comprehensive customer support to assist you with any questions regarding your Individual NonresidentPart Year Income Tax Return Packet. Their knowledgeable team is available through various channels to ensure you receive the help you need.

Get more for Individual NonresidentPart Year Income Tax Return Packet

- Montana mediator 497316367 form

- Montana mediation form

- Selection of mediator montana 497316369 form

- Statement of position montana form

- Montana bankruptcy guide and forms package for chapters 7 or 13 montana

- Bill of sale with warranty by individual seller montana form

- Bill of sale with warranty for corporate seller montana form

- Misc 05 form

Find out other Individual NonresidentPart Year Income Tax Return Packet

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document