INCOME TAX RETURN 2022

What is the income tax return?

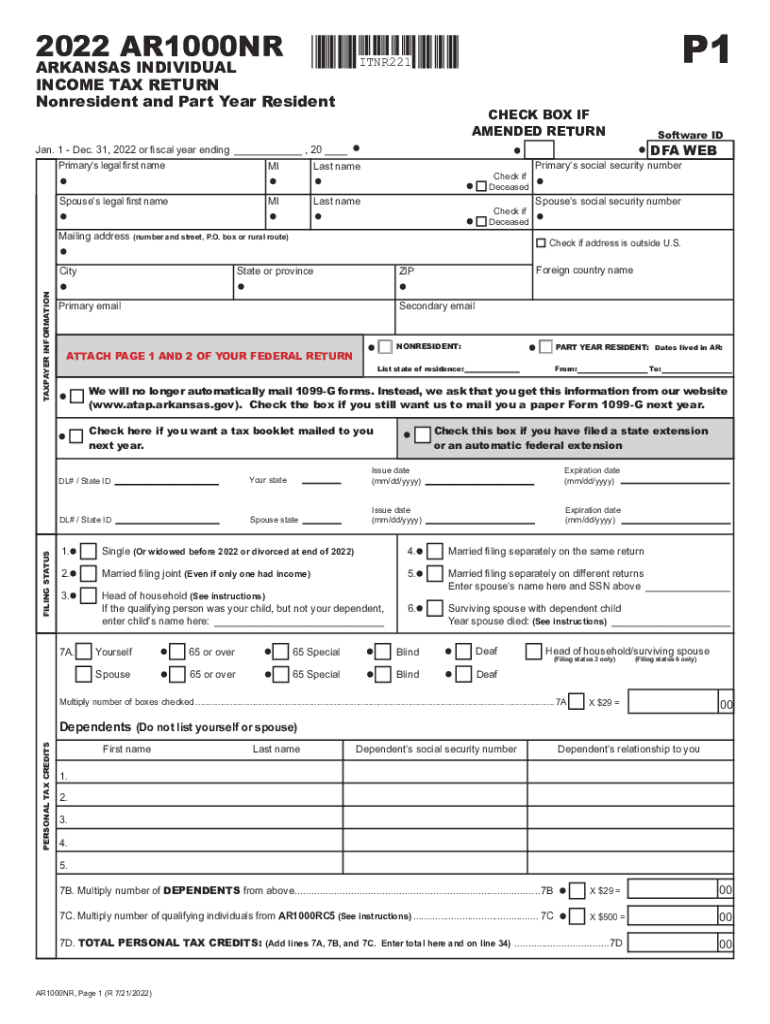

The income tax return is a formal document filed with the Internal Revenue Service (IRS) that reports an individual's or business's income, expenses, and other pertinent tax information. This document is essential for determining the amount of tax owed or the refund due. For residents in the United States, including those filing the AR1000NR form, it is crucial to accurately report all sources of income, including wages, dividends, and interest, as well as any deductions or credits applicable to their situation.

Steps to complete the income tax return

Completing an income tax return involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2 forms, 1099 forms, and records of any other income.

- Choose the correct form: Depending on your residency status and income sources, select the appropriate form, such as the AR1000NR for Arkansas residents.

- Fill out the form: Carefully enter your income, deductions, and credits. Ensure that all information is accurate to avoid issues with the IRS.

- Review your return: Double-check all entries for accuracy and completeness. Mistakes can lead to delays or penalties.

- Submit your return: File your income tax return electronically or by mail, adhering to the deadlines set by the IRS.

Key elements of the income tax return

Several key elements must be included in an income tax return to ensure compliance and accuracy:

- Personal information: This includes your name, address, and Social Security number.

- Income details: Report all income sources, including wages, self-employment income, and investment earnings.

- Deductions and credits: Identify any eligible deductions, such as student loan interest or mortgage interest, and tax credits that can reduce your tax liability.

- Signature: Ensure the return is signed and dated, as an unsigned return may be considered invalid.

Filing deadlines / Important dates

Filing deadlines are crucial for compliance with tax regulations. For most taxpayers, the deadline to file an income tax return is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers can request an extension, typically until October 15, but this does not extend the time to pay any taxes owed. It is essential to stay informed about any changes to these dates each tax year.

Required documents

When preparing to file an income tax return, certain documents are necessary to ensure accurate reporting:

- W-2 forms: These forms report wages and tax withheld by employers.

- 1099 forms: Used for reporting various types of income received, such as freelance earnings or interest income.

- Receipts for deductions: Keep receipts for any expenses you plan to deduct, such as medical expenses or charitable contributions.

- Previous year’s tax return: This can provide a reference for your current filing.

Legal use of the income tax return

The income tax return serves as a legal document that not only reports your income but also determines your tax obligations. Filing an accurate return is essential to avoid penalties and legal issues with the IRS. It is also important to keep copies of your returns and supporting documents for at least three years, as the IRS may audit returns within this timeframe. Understanding the legal implications of your tax return can help ensure compliance and protect your rights as a taxpayer.

Quick guide on how to complete income tax return

Complete INCOME TAX RETURN effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any hold-ups. Manage INCOME TAX RETURN on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to adjust and eSign INCOME TAX RETURN with ease

- Obtain INCOME TAX RETURN and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Select your preferred method for sending your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns of lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs within a few clicks from any device of your choosing. Edit and eSign INCOME TAX RETURN and ensure exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax return

Create this form in 5 minutes!

How to create an eSignature for the income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AR1000NR tax form and who needs it?

The AR1000NR tax form is required for non-residents who earn income in certain states. Businesses utilizing services like airSlate SignNow often need this form for compliance purposes. Ensuring correct completion of the AR1000NR tax form is essential to avoid penalties.

-

How can airSlate SignNow assist with filing the AR1000NR tax form?

airSlate SignNow streamlines the eSigning and document management process, making it easier to gather necessary signatures for the AR1000NR tax form. With its straightforward interface, users can quickly send the form for eSignature, ensuring timely compliance. Efficient document handling helps reduce errors in tax submissions.

-

What features does airSlate SignNow offer for managing tax documents like AR1000NR?

airSlate SignNow provides several features tailored for tax documents, including eSignature capabilities, document templates, and secure storage. The platform allows businesses to create and customize documents related to the AR1000NR tax form, enhancing productivity. Advanced tracking features ensure you never lose sight of an important submission.

-

Is airSlate SignNow cost-effective for small businesses dealing with AR1000NR tax forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. The platform offers various pricing plans that cater to different needs, making it accessible for users who frequently deal with the AR1000NR tax form. Investing in airSlate SignNow can save time and reduce potential tax-related fines.

-

Can airSlate SignNow integrate with other tax software while handling AR1000NR?

Absolutely, airSlate SignNow integrates seamlessly with various tax software solutions. This makes it easier to manage the AR1000NR tax form within your existing workflow, synchronizing data and reducing manual entry. The integration feature improves efficiency, ensuring you're always compliant.

-

What are the benefits of using airSlate SignNow for AR1000NR tax-related tasks?

Using airSlate SignNow for AR1000NR tax tasks simplifies the document workflow by providing signature requests and document tracking in one place. The platform reduces the time spent on paperwork and increases accuracy with its automated solutions. This means less stress when it comes to meeting tax obligations.

-

How secure is airSlate SignNow when dealing with sensitive tax information like the AR1000NR?

airSlate SignNow takes security seriously, employing industry-standard encryption to protect sensitive documents, including the AR1000NR tax form. All eSignature processes are compliant with legal regulations, ensuring your data is safe. Businesses can confidently manage their tax documents without worrying about bsignNowes.

Get more for INCOME TAX RETURN

- Identity theft by known imposter package missouri form

- Missouri assets form

- Essential documents for the organized traveler package missouri form

- Essential documents for the organized traveler package with personal organizer missouri form

- Postnuptial agreements package missouri form

- Letters of recommendation package missouri form

- Missouri mechanics form

- Missouri construction or mechanics lien package corporation missouri form

Find out other INCOME TAX RETURN

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself