Interest Calculation on Tax Due After Self Assessment Amendment 2011

Understanding the Interest Calculation on Tax Due After Self-Assessment Amendment

The Interest Calculation on Tax Due After Self-Assessment Amendment is a crucial aspect for taxpayers who have amended their tax returns. This calculation determines the interest owed on any unpaid tax balance after a self-assessment amendment has been filed. The interest accrues from the original due date of the tax until the payment is made. Understanding how this interest is calculated can help taxpayers manage their finances effectively and avoid unexpected charges.

Steps to Complete the Interest Calculation on Tax Due After Self-Assessment Amendment

Completing the Interest Calculation on Tax Due involves several steps:

- Determine the original tax due date for the tax year in question.

- Identify the amount of tax owed as a result of the self-assessment amendment.

- Calculate the number of days between the original due date and the date the tax is paid.

- Apply the applicable interest rate to the unpaid tax amount for the calculated days.

By following these steps, taxpayers can accurately compute the interest owed and ensure compliance with tax obligations.

Required Documents for Interest Calculation

To perform the Interest Calculation on Tax Due After Self-Assessment Amendment, taxpayers need to gather the following documents:

- Original tax return and any amendments filed.

- Payment records for any taxes paid after the due date.

- Documentation of any correspondence with tax authorities regarding the amendment.

Having these documents on hand will facilitate a smoother calculation process and ensure accuracy in reporting.

Filing Deadlines and Important Dates

Taxpayers must be aware of key deadlines related to the Interest Calculation on Tax Due After Self-Assessment Amendment. These include:

- The original due date for the tax return.

- The date the amendment was filed.

- The deadline for making any payments to avoid additional interest charges.

Staying informed about these dates is essential for timely compliance and minimizing potential penalties.

Penalties for Non-Compliance

Failure to accurately calculate and pay the interest on tax due after a self-assessment amendment can result in significant penalties. Taxpayers may face:

- Additional interest charges on the unpaid balance.

- Fines imposed by tax authorities for late payments.

- Potential legal action for persistent non-compliance.

Understanding these consequences emphasizes the importance of accurate calculations and timely payments.

Eligibility Criteria for Interest Calculation

Eligibility for the Interest Calculation on Tax Due After Self-Assessment Amendment typically includes:

- Taxpayers who have filed an amended return.

- Individuals or businesses with an outstanding tax balance after the amendment.

- Those who have not made full payment by the original due date.

Meeting these criteria is essential for ensuring that the interest calculation is applicable and accurate.

Quick guide on how to complete interest calculation on tax due after self assessment amendment

Manage Interest Calculation On Tax Due After Self Assessment Amendment effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can easily access the right form and securely keep it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents swiftly without delays. Handle Interest Calculation On Tax Due After Self Assessment Amendment on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to alter and eSign Interest Calculation On Tax Due After Self Assessment Amendment with ease

- Find Interest Calculation On Tax Due After Self Assessment Amendment and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark pertinent sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form hunting, or mistakes that necessitate printing new versions. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Edit and eSign Interest Calculation On Tax Due After Self Assessment Amendment to ensure excellent communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct interest calculation on tax due after self assessment amendment

Create this form in 5 minutes!

How to create an eSignature for the interest calculation on tax due after self assessment amendment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

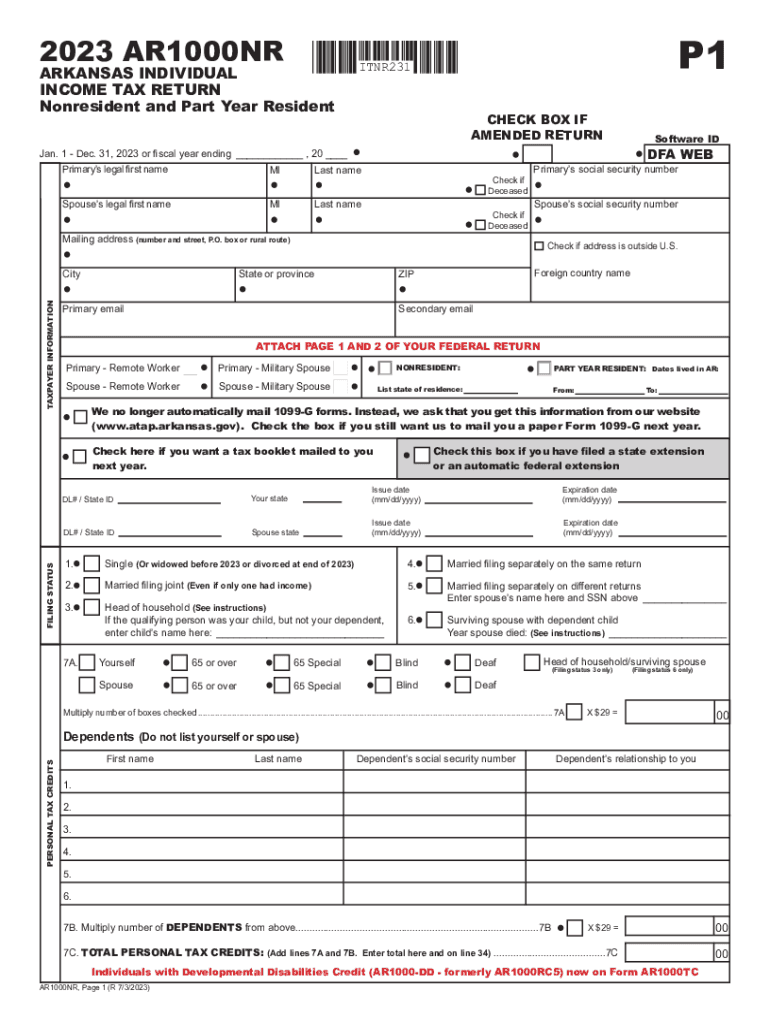

What is the ar ar1000nr form?

The ar ar1000nr form is a specific document format used within the airSlate SignNow platform. This form allows users to efficiently collect signatures, streamlining the signing process for important documents. Understanding how to utilize the ar ar1000nr form can enhance your business' efficiency with digital transactions.

-

How can I create an ar ar1000nr form using airSlate SignNow?

Creating an ar ar1000nr form is straightforward with airSlate SignNow. Simply log into your account, select 'Create Document,' and choose the ar ar1000nr form template. You can customize it to meet your specific needs before sending it out for signatures.

-

Are there any costs associated with using the ar ar1000nr form?

Using the ar ar1000nr form through airSlate SignNow varies based on your subscription plan. While there are free trials available, many comprehensive features, including the ability to work with the ar ar1000nr form, are accessible in the paid plans. Check our pricing page for detailed information.

-

What features are included with the ar ar1000nr form?

The ar ar1000nr form comes with several features designed to enhance user experience, including customizable fields, automatic signatures, and tracking options. These features ensure that the entire signing process is secure and efficient. airSlate SignNow continually updates the capabilities available with the ar ar1000nr form to meet user needs.

-

What are the benefits of using the ar ar1000nr form for my business?

The ar ar1000nr form offers multiple benefits for your business, including reduced turnaround time for document signing and increased efficiency in workflows. Implementing this form can help minimize paperwork and errors, allowing your team to focus on core business tasks. Additionally, it enhances the overall customer experience by providing a seamless signing process.

-

Can the ar ar1000nr form be integrated with other software?

Yes, the ar ar1000nr form can be easily integrated with various business software applications. airSlate SignNow supports integrations with popular tools like CRM systems, document management platforms, and cloud storage options. This enhances the usability of the ar ar1000nr form, making it a versatile choice for businesses.

-

Is the ar ar1000nr form secure for sensitive information?

Absolutely, the ar ar1000nr form is designed with robust security measures to protect sensitive information. airSlate SignNow employs encryption and complies with industry standards such as GDPR and HIPAA. This means you can confidently use the ar ar1000nr form without worrying about data bsignNowes or unauthorized access.

Get more for Interest Calculation On Tax Due After Self Assessment Amendment

- Page 1 of 82 local rules of practice twenty first form

- Forms ampamp documentsshelby county tn official website

- Name change adult levy county clerk of court form

- The petition filed by in the above captioned matter should be form

- Circuit chancery court tennessee administrative office of form

- Court rules blount county government form

- Now on this the day of 20 the court finds that the petition form

- Tennessee fixed rate note installment payments secured commercial property form

Find out other Interest Calculation On Tax Due After Self Assessment Amendment

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free