Colliertaxcollector Comtourist Development TaxTourist Development TaxCollier County Tax Collector 2022

Understanding the Collier County Tourist Tax

The Collier County tourist tax, also known as the tourist development tax, is a tax imposed on short-term rentals and accommodations in Collier County, Florida. This tax is typically charged to guests staying in hotels, motels, and vacation rentals for a period of six months or less. The revenue generated from this tax is used to fund tourism-related projects and initiatives within the county, enhancing the overall visitor experience.

Steps to Complete the Collier County Tourist Tax Form

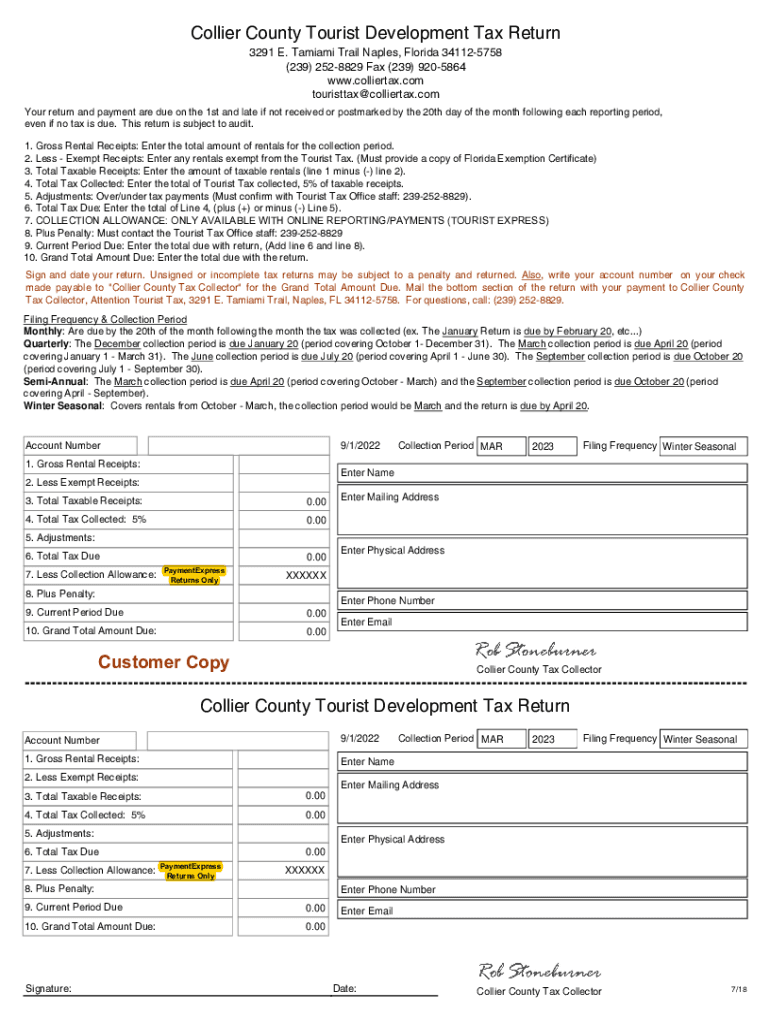

Filling out the Collier County tourist tax form involves several key steps:

- Gather necessary information, including your rental property details and the duration of each rental.

- Access the official tourist tax form through the Collier County Tax Collector's website.

- Fill in the required fields, ensuring accuracy in reporting rental income and guest information.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or via mail, depending on your preference.

Required Documents for the Collier County Tourist Tax

When completing the tourist tax form, certain documents are essential:

- Proof of rental income, such as booking confirmations or invoices.

- A copy of your rental agreement, if applicable.

- Any additional documentation that may support your tax filing, such as business licenses or permits.

Legal Use of the Collier County Tourist Tax Form

The Collier County tourist tax form must be completed in accordance with local regulations. This includes adhering to filing deadlines and ensuring that all information provided is truthful and accurate. Failure to comply with the legal requirements can result in penalties, including fines or legal action.

Filing Deadlines for the Collier County Tourist Tax

It is crucial to be aware of the filing deadlines for the Collier County tourist tax. Generally, the tax return must be filed monthly, with payments due on the first day of the month following the reporting period. Keeping track of these deadlines helps avoid late fees and ensures compliance with local tax laws.

Penalties for Non-Compliance with the Tourist Tax

Non-compliance with the Collier County tourist tax regulations can lead to significant penalties. These may include:

- Fines for late submissions or underreporting rental income.

- Interest charges on unpaid taxes.

- Potential legal action for repeated violations.

Form Submission Methods for the Collier County Tourist Tax

There are multiple methods for submitting the Collier County tourist tax form:

- Online submission through the Collier County Tax Collector's website, which is often the most efficient method.

- Mailing a physical copy of the form to the designated tax office.

- In-person submission at the local tax collector's office, if preferred.

Quick guide on how to complete colliertaxcollectorcomtourist development taxtourist development taxcollier county tax collector

Effortlessly Prepare Colliertaxcollector comtourist development taxTourist Development TaxCollier County Tax Collector on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Colliertaxcollector comtourist development taxTourist Development TaxCollier County Tax Collector on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

Edit and eSign Colliertaxcollector comtourist development taxTourist Development TaxCollier County Tax Collector with Ease

- Locate Colliertaxcollector comtourist development taxTourist Development TaxCollier County Tax Collector and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you would like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate new document prints. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Colliertaxcollector comtourist development taxTourist Development TaxCollier County Tax Collector and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct colliertaxcollectorcomtourist development taxtourist development taxcollier county tax collector

Create this form in 5 minutes!

People also ask

-

What is the Collier County tourist tax?

The Collier County tourist tax, also known as the bed tax, is a tax levied on accommodations rented to tourists in Collier County. This tax helps fund local tourism initiatives and services. Understanding this tax is important for businesses operating in the area, particularly those using airSlate SignNow for e-signing rental agreements.

-

How does airSlate SignNow help businesses manage Collier County tourist tax documentation?

airSlate SignNow facilitates easy e-signing of documents related to the Collier County tourist tax, such as rental agreements and tax forms. With its user-friendly interface, businesses can streamline tax processes and ensure compliance more efficiently. This feature is vital for those wanting to avoid potential penalties connected to mismanaged tax documents.

-

What are the pricing options for airSlate SignNow regarding Collier County tourist tax management?

airSlate SignNow offers flexible pricing plans that can accommodate businesses of all sizes managing the Collier County tourist tax. With various options available, users can choose a plan that fits their document management needs without breaking the bank. The investment in airSlate helps improve efficiency, reducing costs associated with manual paper processing.

-

Can airSlate SignNow integrate with accounting systems to manage Collier County tourist tax?

Yes, airSlate SignNow integrates seamlessly with various accounting and management software, allowing businesses to efficiently handle the Collier County tourist tax. This integration enables automatic data transfer, reducing errors that can occur with manual entry. Users can then focus on growing their business rather than managing paperwork.

-

Is airSlate SignNow secure for handling Collier County tourist tax documents?

Absolutely, airSlate SignNow prioritizes the security of all documents, including those related to the Collier County tourist tax. With advanced encryption and robust security measures in place, users can trust that their sensitive information is protected. This commitment allows businesses to confidently manage their documentation compliance.

-

How does airSlate SignNow benefit businesses in Collier County?

By using airSlate SignNow, businesses in Collier County can streamline their document signing process, especially those related to the tourist tax. This efficiency not only saves time but also allows for quicker access to essential documents. The result is a more organized approach to managing compliance with the Collier County tourist tax regulations.

-

What features does airSlate SignNow offer for Collier County tourist tax documentation?

airSlate SignNow provides several features designed for managing Collier County tourist tax documentation, including customizable templates, secure storage, and real-time tracking. These features enhance the ease of use and ensure that all parties are informed throughout the signing process. Utilizing these tools helps ensure compliance with local tax requirements.

Get more for Colliertaxcollector comtourist development taxTourist Development TaxCollier County Tax Collector

- Nc custodial form

- North carolina uniform act

- Declaration trust agreement form

- North carolina trust form

- Deed trust form nc

- Condominium lease agreement with option to purchase and rent payments to apply to purchase price rent to own condo rental north form

- Money deed trust purchase form

- Quitclaim deed two individuals to one individual north carolina form

Find out other Colliertaxcollector comtourist development taxTourist Development TaxCollier County Tax Collector

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure