Florida Tourist Development Tax Form 2020

What is the Florida Tourist Development Tax Form

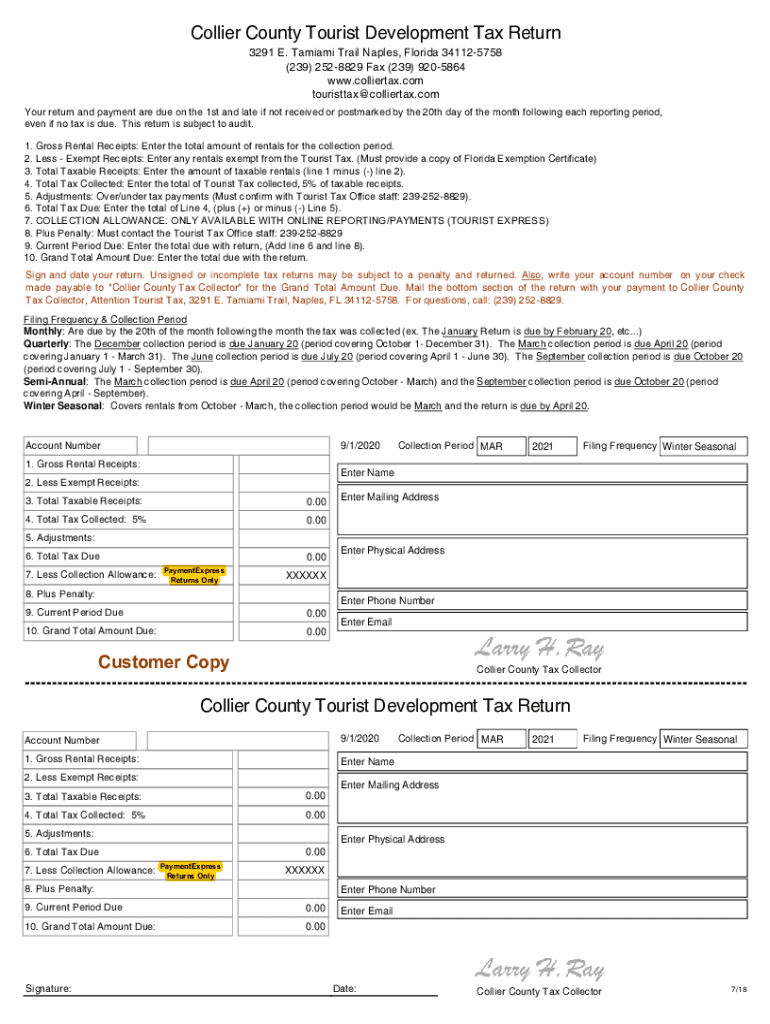

The Florida Tourist Development Tax Form is a document used by businesses and individuals in Collier County to report and remit the tourist development tax, often referred to as the tourist tax. This tax is levied on short-term rentals, such as hotels and vacation rentals, to fund tourism-related projects and initiatives. The form captures essential information about the rental activity, including the total amount collected, the duration of the rental, and the applicable tax rate. Understanding this form is crucial for compliance with local tax regulations.

Steps to complete the Florida Tourist Development Tax Form

Completing the Florida Tourist Development Tax Form involves several key steps:

- Gather necessary information, including rental income details, rental periods, and any exemptions that may apply.

- Access the form through official channels, ensuring you have the correct version for the current tax year.

- Fill out the form accurately, providing all required details such as your name, address, and tax identification number.

- Calculate the total tax due based on the collected rental income and applicable tax rates.

- Review the completed form for accuracy before submission.

How to obtain the Florida Tourist Development Tax Form

The Florida Tourist Development Tax Form can be obtained through various channels. The most reliable method is to visit the official Collier County tax collector's website. Additionally, the form may be available at local government offices or through designated tax preparation services. Ensure you are using the most current version of the form to avoid any compliance issues.

Legal use of the Florida Tourist Development Tax Form

To ensure the legal use of the Florida Tourist Development Tax Form, it is essential to adhere to state regulations governing the collection and remittance of the tourist tax. This includes accurately reporting all rental income and submitting the form by the specified deadlines. Non-compliance can result in penalties, including fines and interest on unpaid taxes. Utilizing a trusted electronic signature solution can enhance the legal validity of your submissions.

Filing Deadlines / Important Dates

Filing deadlines for the Florida Tourist Development Tax Form are typically set on a monthly basis. It is important to submit the form and remit any taxes due by the end of the month following the rental activity. For example, if rentals occurred in January, the form must be submitted by the end of February. Keeping track of these deadlines helps avoid late fees and ensures compliance with local tax laws.

Penalties for Non-Compliance

Failure to comply with the requirements of the Florida Tourist Development Tax Form can lead to significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action. It is crucial for property owners and rental businesses to understand their obligations and ensure timely and accurate submissions to avoid these consequences.

Quick guide on how to complete florida tourist development tax form

Finalize Florida Tourist Development Tax Form smoothly on any device

Web-based document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely preserve it online. airSlate SignNow provides you with all the tools necessary to generate, alter, and electronically sign your documents swiftly without delays. Handle Florida Tourist Development Tax Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Steps to modify and electronically sign Florida Tourist Development Tax Form effortlessly

- Obtain Florida Tourist Development Tax Form and click on Get Form to initiate.

- Utilize the tools we provide to finalize your document.

- Highlight relevant parts of your documents or conceal sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from a device of your choice. Modify and electronically sign Florida Tourist Development Tax Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida tourist development tax form

Create this form in 5 minutes!

How to create an eSignature for the florida tourist development tax form

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the Collier County tourist tax?

The Collier County tourist tax is a tax imposed on visitors renting accommodations in Collier County. This tax aims to promote tourism-related activities and infrastructure enhancements. Understanding this tax is essential for businesses that cater to tourists, ensuring compliance and financial planning.

-

How does the Collier County tourist tax affect my business?

If your business involves renting properties or services to tourists in Collier County, the tourist tax will directly impact your pricing strategy. You'll need to factor this tax into your costs and communicate it transparently to your customers. airSlate SignNow can help you manage your documents and contracts related to this tax efficiently.

-

What are the benefits of using airSlate SignNow for handling the Collier County tourist tax?

airSlate SignNow offers a streamlined solution for sending and eSigning documents related to the Collier County tourist tax. This means you can quickly get agreements signed, ensuring timely compliance with tax regulations. Additionally, it keeps all your documents organized and easily accessible.

-

Are there any fees associated with the Collier County tourist tax?

Yes, the Collier County tourist tax consists of a specific percentage applied to the rental cost. It's important to calculate this tax correctly to avoid penalties. airSlate SignNow can assist in generating accurate invoices that include this tax automatically.

-

Is airSlate SignNow easy to integrate with my existing systems for managing the Collier County tourist tax?

Absolutely! airSlate SignNow is designed to integrate seamlessly with various property management systems that monitor the Collier County tourist tax. This makes it easier to manage contracts and documents without disrupting your current workflow.

-

How can I ensure compliance with the Collier County tourist tax regulations?

To ensure compliance, familiarize yourself with the specific guidelines and deadlines regarding the Collier County tourist tax. Utilizing airSlate SignNow can help you keep your documents in order and ensure timely submissions of necessary paperwork required by local authorities.

-

What features does airSlate SignNow offer for managing tourism-related documents?

airSlate SignNow provides features tailored for managing all kinds of tourism-related documents, including templates for agreements that incorporate the Collier County tourist tax. Its eSigning capabilities allow for quick approval processes, which is crucial for maintaining compliance and enhancing customer management.

Get more for Florida Tourist Development Tax Form

Find out other Florida Tourist Development Tax Form

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form