Form FT 946 1046 Fillable MotorDiesel Motor Fuel Tax 2022-2026

What is the Form FT Fillable Motor Diesel Motor Fuel Tax

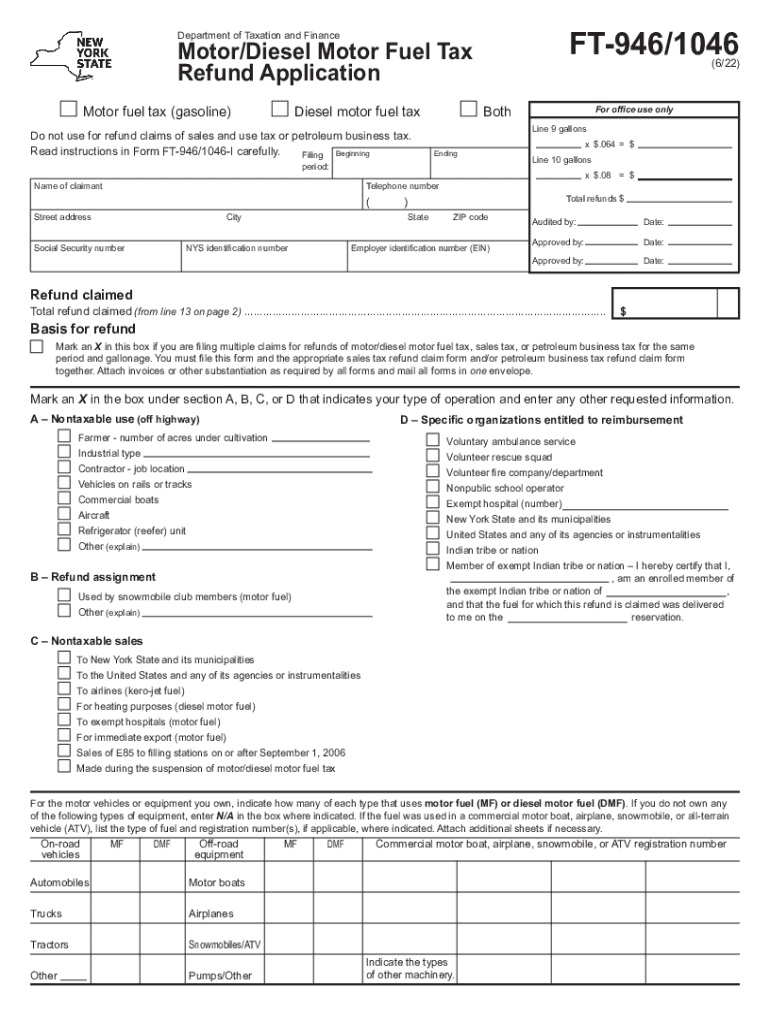

The FT form is a specialized document used for claiming a refund of the motor fuel tax in New York State. This form is specifically designed for individuals and businesses that have purchased diesel fuel for non-highway use, such as agricultural or commercial purposes. By submitting this form, taxpayers can recover taxes paid on fuel that was not used on public highways, aligning with state regulations regarding fuel tax refunds.

How to use the Form FT Fillable Motor Diesel Motor Fuel Tax

Using the FT form involves several straightforward steps. First, ensure you have the correct version of the form, which can be filled out digitally. Gather all necessary information, including your personal details, fuel purchase records, and any relevant documentation that supports your claim. Complete the form by entering the required information accurately and thoroughly. Once completed, you can submit the form either online or through traditional mail, depending on your preference.

Steps to complete the Form FT Fillable Motor Diesel Motor Fuel Tax

To complete the FT form, follow these steps:

- Download the fillable version of the FT form from the appropriate state website.

- Provide your personal information, including your name, address, and taxpayer identification number.

- Detail the amount of diesel fuel purchased and the tax paid on that fuel.

- Attach any necessary documentation, such as receipts or invoices, that validate your claim.

- Review the completed form for accuracy before submission.

Legal use of the Form FT Fillable Motor Diesel Motor Fuel Tax

The FT form is legally recognized for tax refund claims in New York State. To ensure its legal validity, it must be completed in accordance with state tax laws and regulations. This includes providing truthful information and maintaining compliance with deadlines for submission. Utilizing a trusted electronic signature solution can enhance the form's legal standing, ensuring that your submission is both secure and compliant with eSignature laws.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the FT form. Typically, claims for tax refunds must be filed within a specific timeframe after the fuel purchase. Keeping track of these deadlines helps ensure that you do not miss the opportunity to recover taxes paid on diesel fuel. Check the New York State Department of Taxation and Finance website for the most current deadlines and any updates related to the filing process.

Required Documents

When completing the FT form, certain documents are required to support your claim. These may include:

- Proof of diesel fuel purchase, such as receipts or invoices.

- Any previous correspondence with the tax authority regarding fuel tax refunds.

- Identification documents, if necessary, to verify your identity and taxpayer status.

Having these documents ready will facilitate a smoother filing process and help substantiate your claim for a refund.

Quick guide on how to complete form ft 946 1046 fillable motordiesel motor fuel tax

Effortlessly Prepare Form FT 946 1046 Fillable MotorDiesel Motor Fuel Tax on Any Device

Online document management has become increasingly popular among businesses and individuals alike. It offers a fantastic environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Form FT 946 1046 Fillable MotorDiesel Motor Fuel Tax on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Form FT 946 1046 Fillable MotorDiesel Motor Fuel Tax with Ease

- Obtain Form FT 946 1046 Fillable MotorDiesel Motor Fuel Tax and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your preference. Modify and eSign Form FT 946 1046 Fillable MotorDiesel Motor Fuel Tax and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ft 946 1046 fillable motordiesel motor fuel tax

Create this form in 5 minutes!

People also ask

-

What is ft 946 1046 in relation to airSlate SignNow?

The ft 946 1046 refers to a specific feature set within airSlate SignNow designed to streamline document signing and management. This functionality enhances user experience by making the signing process faster, ensuring your documents are secure and legally binding.

-

How does airSlate SignNow pricing work for ft 946 1046 users?

Pricing for airSlate SignNow varies based on the features included with the ft 946 1046 package. Users can benefit from competitive rates that provide value for advanced eSignature and document management capabilities, making it an affordable choice for businesses.

-

What key features does ft 946 1046 offer?

The ft 946 1046 offers several essential features, including customizable templates, real-time tracking, and automated workflows. These tools are designed to save time and increase efficiency for businesses looking to optimize their document handling.

-

Are there any benefits to using the ft 946 1046 feature set?

Yes, the ft 946 1046 feature set allows businesses to enhance their workflow efficiency, reduce turnaround time, and improve document security. With intuitive tools and comprehensive support, you can ensure smooth operations in your signing processes.

-

Can I integrate ft 946 1046 with my existing tools?

Absolutely! airSlate SignNow ft 946 1046 supports integration with many popular business applications, such as CRM systems and cloud storage solutions. This flexibility allows for seamless workflows and enhances overall productivity.

-

How secure is the ft 946 1046 signing process?

The ft 946 1046 features advanced security protocols to protect your documents and sensitive information. airSlate SignNow ensures compliance with industry standards, providing users with peace of mind while signing and storing documents electronically.

-

Is there customer support available for ft 946 1046 users?

Yes, airSlate SignNow provides dedicated customer support for users utilizing the ft 946 1046 feature set. Whether you need assistance with setup, troubleshooting, or general inquiries, our support team is here to help you every step of the way.

Get more for Form FT 946 1046 Fillable MotorDiesel Motor Fuel Tax

- Warranty deed from limited partnership or llc is the grantor or grantee north carolina form

- Quitclaim deed from one individual to two individuals as joint tenants with the right of survivorship north carolina form

- Quitclaim deed for one individual to three individuals as joint tenants with the right of survivorship north carolina form

- Relinquishment form

- Nc deed trust form

- North carolina estate form

- North carolina tort form

- Nc workers compensation form

Find out other Form FT 946 1046 Fillable MotorDiesel Motor Fuel Tax

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form