Ft 946 1046 2013

What is the Ft

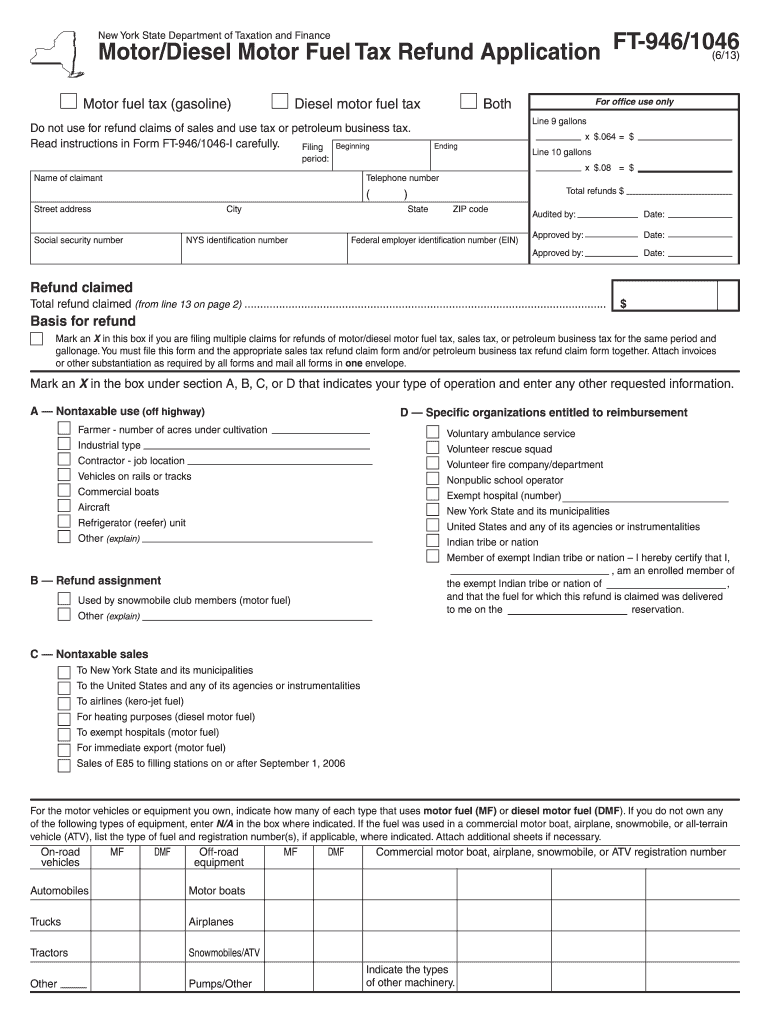

The Ft is a tax form used primarily by residents of New York State to apply for a refund of certain taxes. This form is essential for individuals or businesses seeking to reclaim overpaid taxes or to adjust their tax obligations. It is specifically designed to facilitate the refund process, ensuring that applicants provide all necessary information to support their claims. Understanding the purpose and requirements of the Ft is crucial for a successful filing.

Steps to complete the Ft

Completing the Ft involves several important steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of tax payments and identification. Next, fill out the form with accurate personal and financial information, ensuring that all sections are completed. Pay close attention to any specific instructions related to your situation, as incorrect information may delay processing. Finally, review the form for any errors before submission to avoid complications.

Legal use of the Ft

The Ft must be used in accordance with state regulations to ensure its legal validity. This includes adhering to deadlines for submission and providing accurate information. The form is legally binding when completed correctly and submitted to the appropriate state tax authority. It is important to understand the legal implications of the information provided, as inaccuracies can lead to penalties or denial of refund requests.

Required Documents

When filing the Ft, several documents are required to support your application. These typically include proof of identity, such as a driver's license or Social Security card, and documentation of tax payments made. Additionally, any relevant financial statements or receipts that substantiate your claim for a refund should be included. Having these documents ready will streamline the filing process and increase the likelihood of a successful outcome.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Ft to avoid missing the opportunity for a refund. Generally, the form must be submitted within a specific period following the tax year in which the overpayment occurred. Keeping track of these important dates ensures that you can file your claim in a timely manner, thus maximizing your chances of receiving a refund.

Form Submission Methods (Online / Mail / In-Person)

The Ft can be submitted through various methods, providing flexibility for applicants. You may choose to file online through the New York State Department of Taxation and Finance website, which offers a streamlined process. Alternatively, you can mail the completed form to the designated address, ensuring that it is sent well before the deadline. In-person submissions may also be possible at certain tax offices, allowing for direct assistance if needed.

Quick guide on how to complete ft 946 1046

Prepare Ft 946 1046 effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents swiftly without delays. Manage Ft 946 1046 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign Ft 946 1046 with ease

- Locate Ft 946 1046 and click Get Form to initiate the process.

- Employ the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and click the Done button to preserve your changes.

- Choose your method of delivering your form: via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Ft 946 1046 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ft 946 1046

Create this form in 5 minutes!

How to create an eSignature for the ft 946 1046

How to make an eSignature for your PDF file online

How to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What are the ft 946 instructions for using airSlate SignNow?

The ft 946 instructions for airSlate SignNow guide users on how to effectively use the platform for electronic signatures. These instructions cover step-by-step processes, including document preparation, sending for signatures, and finalizing documents. Following the ft 946 instructions ensures a smooth eSigning experience.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose. The platform offers flexible pricing options that cater to businesses of all sizes. For detailed ft 946 instructions on pricing and plan selection, visiting the website is recommended.

-

What features does airSlate SignNow offer?

airSlate SignNow offers a variety of features designed to streamline the electronic signing process. Key features include customizable templates, in-person signing, and secure document storage. For specific details, refer to the ft 946 instructions available on the site.

-

What are the benefits of using airSlate SignNow?

Using airSlate SignNow comes with several benefits including enhanced security, time savings, and improved workflow management. The platform simplifies the signature process and improves efficiency for teams. You can find more about these benefits in the ft 946 instructions.

-

Can airSlate SignNow integrate with other applications?

Yes, airSlate SignNow has integration capabilities with various applications, enhancing its functionality. This includes CRM systems, cloud storage services, and productivity tools. For detailed integration procedures, refer to the ft 946 instructions.

-

Is there a mobile app for airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows users to manage their documents and eSign on-the-go. The mobile app retains most features available on the desktop version, making it user-friendly. Access the ft 946 instructions for tips on using the app effectively.

-

How secure is airSlate SignNow for document signing?

Security is a top priority for airSlate SignNow, utilizing advanced encryption technologies to protect user data. The platform complies with industry standards to ensure document integrity and confidentiality. For more information on security measures, see the ft 946 instructions.

Get more for Ft 946 1046

Find out other Ft 946 1046

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP