Www Michigan GovtaxMichigan Department of Treasury Taxes 2021

Understanding the Michigan Individual Tax Return 2010 Form

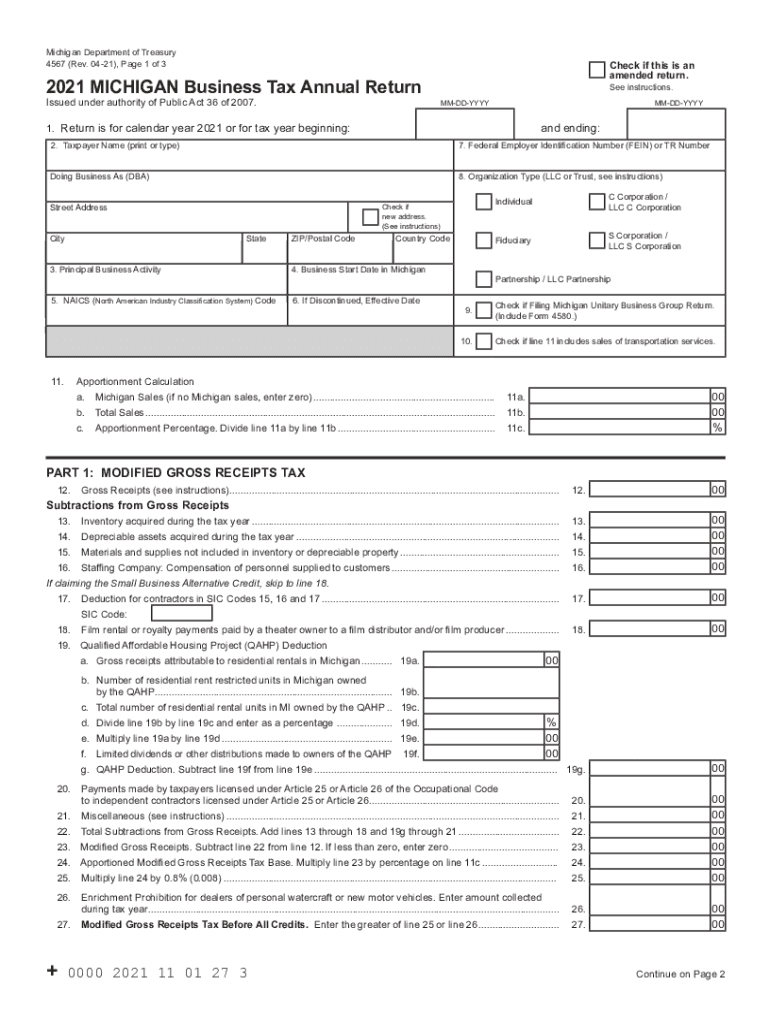

The Michigan Individual Tax Return 2010 form is a crucial document for residents of Michigan who need to report their income and calculate their state tax obligations. This form is specifically designed for individuals to report income earned during the 2010 tax year. It is essential to accurately complete this form to ensure compliance with state tax laws and avoid potential penalties.

Steps to Complete the Michigan Individual Tax Return 2010 Form

Filling out the Michigan Individual Tax Return 2010 form involves several key steps:

- Gather Documentation: Collect all necessary documents, including W-2 forms, 1099 forms, and any other income statements.

- Personal Information: Fill in your personal details, including your name, address, and Social Security number.

- Income Reporting: Report all sources of income, including wages, interest, dividends, and any other taxable income.

- Adjustments and Deductions: Apply any allowable deductions or adjustments to your income to determine your taxable income.

- Calculate Tax Liability: Use the provided tax tables or formulas to calculate the amount of tax owed.

- Sign and Date: Ensure that you sign and date the form before submission to validate it.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines for the Michigan Individual Tax Return 2010 form. Typically, the deadline for filing state tax returns is April 15 of the following year. For the 2010 tax year, the deadline would have been April 15, 2011. If you filed for an extension, ensure that you complete your form by the extended deadline to avoid penalties.

Required Documents for Filing

When preparing to file the Michigan Individual Tax Return 2010 form, certain documents are necessary to ensure accurate reporting:

- W-2 Forms: These forms report wages and taxes withheld from your employer.

- 1099 Forms: Use these for reporting income from freelance work or other non-employment sources.

- Receipts for Deductions: Keep records of any expenses that may be deductible, such as medical expenses or charitable contributions.

Form Submission Methods

The Michigan Individual Tax Return 2010 form can be submitted through various methods:

- Online Submission: Many taxpayers opt to file electronically through tax software that supports the Michigan tax forms.

- Mail: You can print the completed form and mail it to the Michigan Department of Treasury at the address specified in the form instructions.

- In-Person: Some individuals may choose to file in person at designated tax offices or during tax preparation events.

Penalties for Non-Compliance

Failing to file the Michigan Individual Tax Return 2010 form on time or inaccurately reporting your income can result in penalties. The state may impose fines, interest on unpaid taxes, and other consequences for non-compliance. It is important to ensure that your form is completed accurately and submitted by the deadline to avoid these penalties.

Quick guide on how to complete wwwmichigangovtaxmichigan department of treasury taxes

Effortlessly Prepare Www michigan govtaxMichigan Department Of Treasury Taxes on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, as you can access the needed form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your files quickly without any hold-ups. Manage Www michigan govtaxMichigan Department Of Treasury Taxes on any device using airSlate SignNow’s Android or iOS applications and simplify any document-based task today.

How to Edit and Electronically Sign Www michigan govtaxMichigan Department Of Treasury Taxes with Ease

- Find Www michigan govtaxMichigan Department Of Treasury Taxes and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Www michigan govtaxMichigan Department Of Treasury Taxes while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwmichigangovtaxmichigan department of treasury taxes

Create this form in 5 minutes!

People also ask

-

What is the michigan individual tax return 2010 form?

The michigan individual tax return 2010 form is a tax document used by residents of Michigan to report income and calculate taxes owed for the year 2010. It includes sections for personal information, income details, and deductions. Filing this form correctly is crucial for ensuring compliance with state tax laws.

-

How can I acquire the michigan individual tax return 2010 form?

You can obtain the michigan individual tax return 2010 form from the Michigan Department of Treasury's website or through reliable tax preparation services. Additionally, airSlate SignNow offers a seamless way to access and eSign all necessary tax documents, including this form.

-

What features does airSlate SignNow offer for eSigning the michigan individual tax return 2010 form?

AirSlate SignNow provides robust features for eSigning your michigan individual tax return 2010 form, including real-time tracking, secure document storage, and customizable signing workflows. This makes the eSigning process more efficient and straightforward, ensuring your taxes are submitted promptly.

-

Is there a cost associated with using airSlate SignNow for the michigan individual tax return 2010 form?

Yes, there is a subscription fee for using airSlate SignNow, which varies depending on the plan you choose. However, the cost is typically outweighed by the convenience and time savings when eSigning and managing your michigan individual tax return 2010 form electronically.

-

What are the benefits of using airSlate SignNow for my michigan individual tax return 2010 form?

Using airSlate SignNow for your michigan individual tax return 2010 form allows you to eSign documents quickly and securely, reducing the need for paper forms. Additionally, the platform provides compliance with legal regulations and improves your workflow efficiency, making tax season less stressful.

-

Can I integrate airSlate SignNow with my existing accounting software for the michigan individual tax return 2010 form?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax preparation software, allowing you to manage your michigan individual tax return 2010 form effectively. This integration ensures that all necessary information is readily available and reduces data entry errors.

-

What documents do I need in addition to the michigan individual tax return 2010 form?

In addition to the michigan individual tax return 2010 form, you may need to provide W-2 forms, 1099 forms, and any supporting documentation for deductions or credits. Having these documents ready will help streamline the filing process and ensure accuracy in your tax return.

Get more for Www michigan govtaxMichigan Department Of Treasury Taxes

- Legal last will form for a widow or widower with no children north carolina

- North carolina will form

- Legal last will and testament form for divorced and remarried person with mine yours and ours children north carolina

- Legal last will and testament form with all property to trust called a pour over will north carolina

- Written revocation of will north carolina form

- Last will and testament for other persons north carolina form

- Nc will form 497317342

- Estate planning questionnaire and worksheets north carolina form

Find out other Www michigan govtaxMichigan Department Of Treasury Taxes

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement