4567, Michigan Business Tax Annual Return 2023-2026

What is the 4567, Michigan Business Tax Annual Return

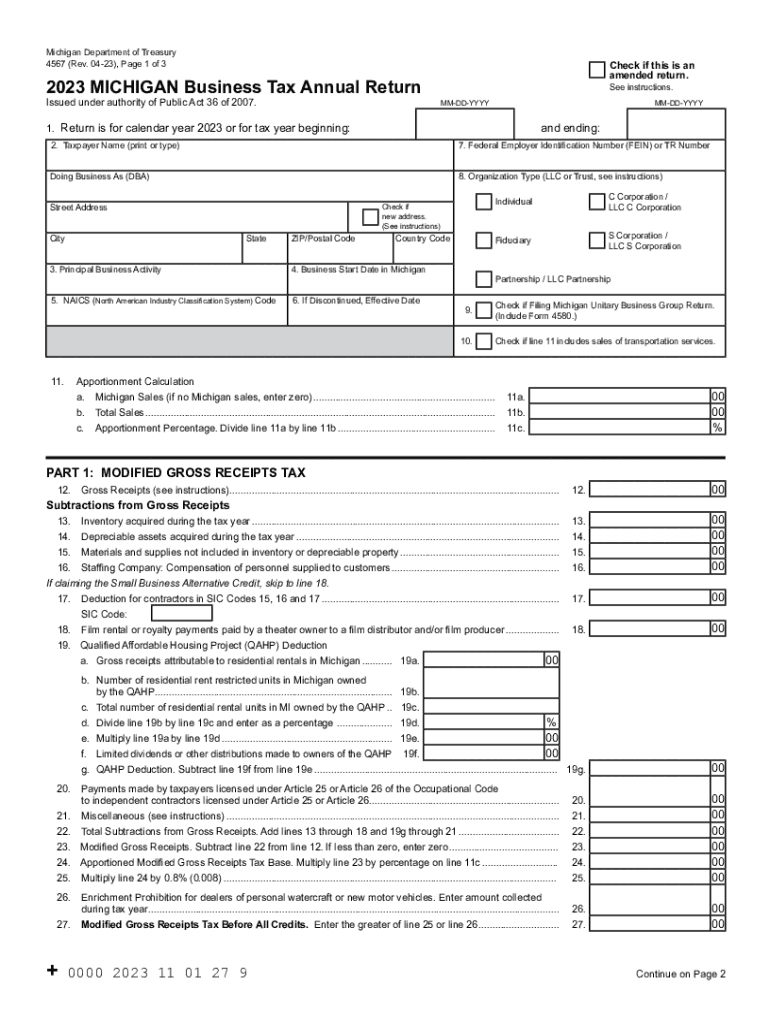

The 4567, Michigan Business Tax Annual Return, is a crucial document that businesses operating in Michigan must file to report their business income and calculate their tax liability. This form is designed for various business entities, including corporations, partnerships, and limited liability companies (LLCs). It provides the state with essential information about a business's financial performance over the previous year, ensuring compliance with Michigan tax laws.

Key elements of the 4567, Michigan Business Tax Annual Return

When completing the 4567 form, businesses need to include several key elements. These include:

- Business Information: Name, address, and federal Employer Identification Number (EIN).

- Income Reporting: Total revenue, cost of goods sold, and other income sources.

- Deductions: Allowable deductions that can reduce taxable income, such as business expenses.

- Tax Calculation: The method used to calculate the business tax owed based on the reported income.

- Signature: An authorized representative must sign the return to validate the information provided.

Steps to complete the 4567, Michigan Business Tax Annual Return

Filing the 4567 form involves several steps to ensure accuracy and compliance:

- Gather all necessary financial documents, including income statements and expense records.

- Complete the form by entering the required business information and financial data.

- Calculate the total tax liability based on the provided income and applicable deductions.

- Review the completed form for accuracy and ensure all sections are filled out correctly.

- Submit the form electronically or via mail by the designated filing deadline.

Filing Deadlines / Important Dates

It is essential for businesses to be aware of the filing deadlines associated with the 4567 form. Typically, the annual return is due on the last day of the fourth month following the end of the business's tax year. For example, if a business operates on a calendar year, the deadline would be April 30 of the following year. Late submissions may result in penalties and interest, so timely filing is crucial.

Form Submission Methods (Online / Mail / In-Person)

Businesses have multiple options for submitting the 4567 form. These methods include:

- Online Submission: Many businesses opt to file electronically through the Michigan Department of Treasury's online portal, which offers a streamlined process.

- Mail: The completed form can be printed and mailed to the appropriate address provided in the form instructions.

- In-Person: Some businesses may choose to deliver the form in person at local tax offices, although this method is less common.

Penalties for Non-Compliance

Failing to file the 4567 Michigan Business Tax Annual Return on time can result in significant penalties. Businesses may incur late filing fees, which can accumulate over time. Additionally, interest may be charged on any unpaid taxes. It is important for businesses to understand these consequences and adhere to filing requirements to avoid unnecessary costs.

Quick guide on how to complete 4567 michigan business tax annual return

Complete 4567, Michigan Business Tax Annual Return effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any hold-ups. Manage 4567, Michigan Business Tax Annual Return on any device with airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign 4567, Michigan Business Tax Annual Return without any hassle

- Find 4567, Michigan Business Tax Annual Return and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or mask sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign 4567, Michigan Business Tax Annual Return to ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4567 michigan business tax annual return

Create this form in 5 minutes!

How to create an eSignature for the 4567 michigan business tax annual return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan business tax annual return?

The Michigan business tax annual return is a required filing for businesses operating in Michigan. It outlines the business's income, expenses, and taxation obligations. Completing this return accurately is essential to ensure compliance and avoid penalties.

-

How can airSlate SignNow assist with the Michigan business tax annual return?

airSlate SignNow simplifies the process of preparing and submitting your Michigan business tax annual return. With our electronic signature capabilities, you can efficiently gather required signatures on financial documents. This saves time and helps maintain compliance with tax obligations.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as template creation, document collaboration, and secure eSigning that facilitate the management of tax documents, including the Michigan business tax annual return. These features enhance efficiency and ensure that all documents are stored securely and accessible when needed.

-

Is airSlate SignNow cost-effective for businesses handling the Michigan business tax annual return?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses. By reducing the time and resources needed to process documents for the Michigan business tax annual return, your business can save on both operational costs and potential tax penalties.

-

Can I integrate airSlate SignNow with accounting software for my business tax needs?

Absolutely! airSlate SignNow can integrate seamlessly with various accounting software, making it easier to manage your Michigan business tax annual return and other financial documents. This integration ensures data consistency and reduces the risk of errors in your tax filings.

-

What are the benefits of using airSlate SignNow for tax preparation?

Using airSlate SignNow for tax preparation provides numerous benefits, including increased efficiency, enhanced security, and improved document management. By streamlining the preparation of the Michigan business tax annual return, you can focus on what matters most—growing your business.

-

How does eSigning with airSlate SignNow work for the Michigan business tax annual return?

eSigning with airSlate SignNow enables you to sign your Michigan business tax annual return electronically in just a few clicks. This eliminates the need for printing and scanning, providing a quick and secure way to get signatures. It's an easy solution for busy professionals.

Get more for 4567, Michigan Business Tax Annual Return

- Peled plastic surgery headache history form docplayernet

- Hypertension nephrology form

- Ohio employer questionnaire form

- Microbiology requisition cleveland clinic laboratories form

- Integris shadowing form

- Student health history form 2015 16 norman public school

- Applied behavior analysis aba form

- Thank you for your interest in the integris health student shadowing program form

Find out other 4567, Michigan Business Tax Annual Return

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement