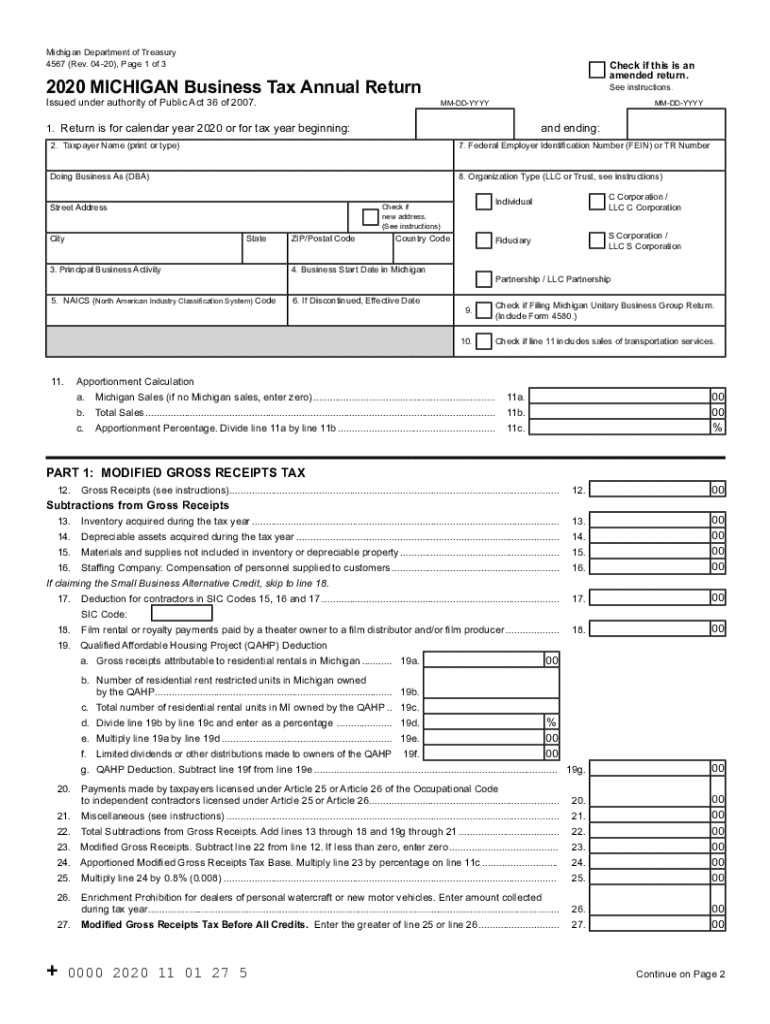

MICHIGAN Business Tax Annual Return MICHIGAN Business Tax Annual Return 2020

What is the Michigan Business Tax Annual Return?

The Michigan Business Tax Annual Return, commonly referred to as form 4567, is a tax document required for businesses operating in Michigan. This form is essential for reporting the income and tax liability of various business entities, including corporations, partnerships, and limited liability companies (LLCs). The form captures critical financial data that the state uses to assess tax obligations, ensuring compliance with Michigan tax laws.

Steps to Complete the Michigan Business Tax Annual Return

Completing the Michigan Business Tax Annual Return involves several key steps:

- Gather necessary documentation: Collect financial records, including income statements, balance sheets, and any relevant deductions.

- Fill out the form: Use the fillable form 4567 to input your business's financial information accurately.

- Review for accuracy: Double-check all entries to ensure there are no errors that could lead to penalties.

- Submit the form: File the completed form electronically or via mail by the designated deadline.

Legal Use of the Michigan Business Tax Annual Return

The Michigan Business Tax Annual Return is legally binding when filled out correctly and submitted on time. Compliance with state regulations is crucial, as failure to submit the form can result in penalties, including fines and interest on unpaid taxes. The form must be signed by an authorized representative of the business, ensuring that all information provided is accurate and complete.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Michigan Business Tax Annual Return. Typically, the form is due on the last day of the month following the close of the fiscal year. For businesses operating on a calendar year, this means the return is due by January thirty-first. Timely submission helps avoid late fees and ensures compliance with state tax laws.

Required Documents

To complete the Michigan Business Tax Annual Return, certain documents are required:

- Financial statements, including profit and loss statements.

- Balance sheets detailing assets and liabilities.

- Records of any deductions or credits claimed.

- Prior year tax returns for reference.

Who Issues the Form

The Michigan Department of Treasury is responsible for issuing the Michigan Business Tax Annual Return. This state agency oversees tax collection and compliance, providing resources and guidance for businesses to ensure they meet their tax obligations. The department also updates the form and its instructions periodically to reflect changes in tax law.

Quick guide on how to complete 2020 michigan business tax annual return 2020 michigan business tax annual return

Complete MICHIGAN Business Tax Annual Return MICHIGAN Business Tax Annual Return effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It offers a superb eco-friendly option to conventional printed and signed paperwork, as you can access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle MICHIGAN Business Tax Annual Return MICHIGAN Business Tax Annual Return on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The simplest method to modify and eSign MICHIGAN Business Tax Annual Return MICHIGAN Business Tax Annual Return with ease

- Find MICHIGAN Business Tax Annual Return MICHIGAN Business Tax Annual Return and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign MICHIGAN Business Tax Annual Return MICHIGAN Business Tax Annual Return and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 michigan business tax annual return 2020 michigan business tax annual return

Create this form in 5 minutes!

How to create an eSignature for the 2020 michigan business tax annual return 2020 michigan business tax annual return

How to create an eSignature for your PDF document online

How to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the 4567 Michigan fillable form?

The 4567 Michigan fillable form is a specific document designed for residents of Michigan to complete and submit electronically. This form allows users to fill in their information digitally, making the application process more efficient. With airSlate SignNow, you can easily create and manage such forms without any hassle.

-

How can I access the 4567 Michigan fillable form using airSlate SignNow?

To access the 4567 Michigan fillable form, simply sign up for an airSlate SignNow account and navigate to the templates section. Here, you can find the form and start filling it out instantly. airSlate SignNow provides a user-friendly interface that allows you to complete your form quickly.

-

Are there any costs associated with using the 4567 Michigan fillable form on airSlate SignNow?

Yes, airSlate SignNow offers various subscription plans, including options for individuals and businesses. Users can choose a plan that best fits their needs while using the 4567 Michigan fillable form. The cost is typically based on the number of documents sent and the features included in each plan.

-

What features does airSlate SignNow offer for the 4567 Michigan fillable form?

airSlate SignNow includes features like electronic signatures, document sharing, and real-time collaboration for the 4567 Michigan fillable form. Users can also track the document's status and receive notifications once it’s signed. These capabilities streamline the workflow and save time.

-

Can I integrate the 4567 Michigan fillable form with other software using airSlate SignNow?

Absolutely! airSlate SignNow supports numerous integrations with popular software, making it easy to use the 4567 Michigan fillable form alongside your existing tools. This adaptability enhances productivity and allows for seamless data transfer between platforms.

-

What are the benefits of using airSlate SignNow for the 4567 Michigan fillable form?

Using airSlate SignNow for the 4567 Michigan fillable form gives you access to a secure, efficient, and user-friendly electronic signature solution. It signNowly reduces paper usage and processing time, making your document management more eco-friendly and organized. Additionally, it ensures compliance and improves overall productivity.

-

Is it easy to edit the 4567 Michigan fillable form once it’s completed?

Yes, editing the 4567 Michigan fillable form is simple with airSlate SignNow. If you need to make changes, you can easily access the completed form and edit it as necessary. The platform allows you to maintain control over your documents and make adjustments whenever required.

Get more for MICHIGAN Business Tax Annual Return MICHIGAN Business Tax Annual Return

Find out other MICHIGAN Business Tax Annual Return MICHIGAN Business Tax Annual Return

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement