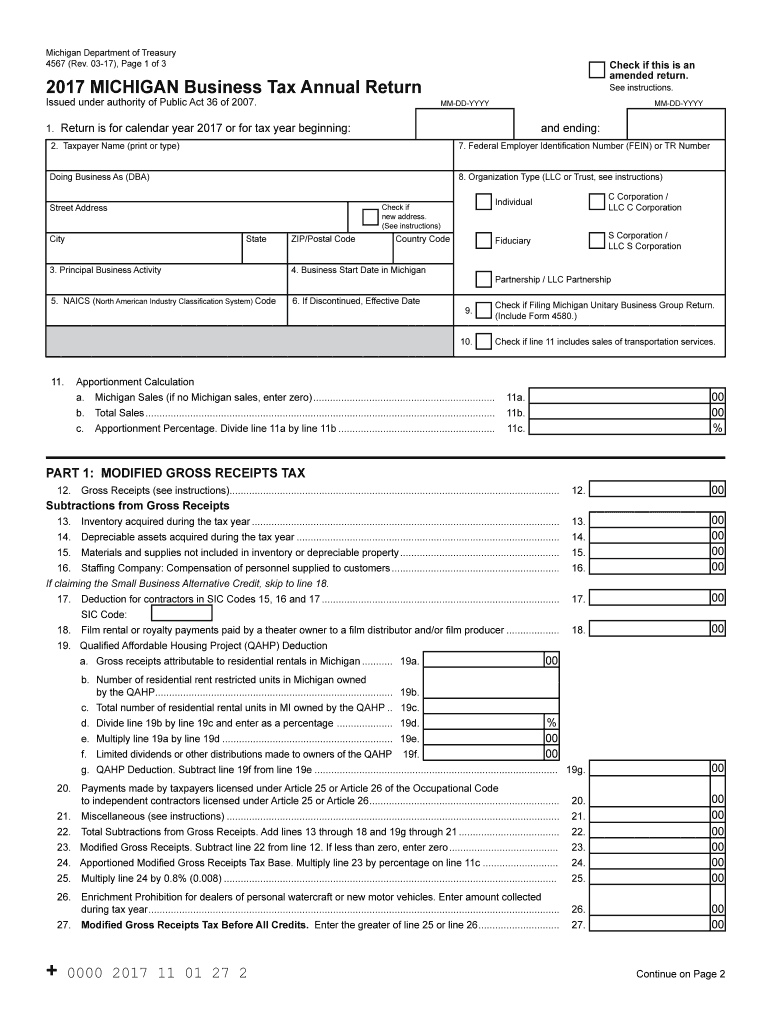

Form Michigan 2017

What is the Michigan Individual Tax Return 2010 Form?

The Michigan Individual Tax Return 2010 Form, commonly referred to as the MI-1040, is the official document used by residents of Michigan to report their income and calculate their state tax liability for the year 2010. This form is essential for individuals to fulfill their tax obligations and ensure compliance with state tax laws. It includes various sections where taxpayers disclose their income, deductions, and credits applicable to their situation.

Steps to Complete the Michigan Individual Tax Return 2010 Form

Completing the Michigan Individual Tax Return 2010 Form involves several key steps:

- Gather Necessary Documents: Collect all relevant financial documents, including W-2 forms, 1099s, and any other income statements.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: List all sources of income in the designated sections, ensuring accuracy to avoid discrepancies.

- Claim Deductions and Credits: Identify and enter any applicable deductions and credits that may reduce your taxable income.

- Calculate Tax Liability: Use the provided tax tables to determine your tax due based on your reported income.

- Sign and Date the Form: Ensure you sign and date the form before submission, as an unsigned form is considered invalid.

Filing Deadlines / Important Dates

For the 2010 tax year, the deadline to file the Michigan Individual Tax Return was April 15, 2011. It is crucial for taxpayers to adhere to this deadline to avoid penalties and interest on unpaid taxes. If you were unable to file by this date, you might have been eligible for an extension, but it is essential to check the specific rules and regulations that applied at that time.

Form Submission Methods

Taxpayers had several options for submitting the Michigan Individual Tax Return 2010 Form:

- By Mail: Completed forms could be mailed to the Michigan Department of Treasury at the address specified in the instructions.

- In-Person: Taxpayers could also submit their forms in person at designated state offices.

- Online Submission: While the 2010 form may not have been available for online filing, taxpayers were encouraged to check for electronic filing options through authorized e-file providers.

Legal Use of the Michigan Individual Tax Return 2010 Form

The Michigan Individual Tax Return 2010 Form is legally binding when completed and submitted according to state regulations. It is important for taxpayers to ensure that all information provided is accurate and truthful, as any false statements may result in legal consequences, including fines or penalties. The form serves as a record of income and taxes paid, which can be referenced in future audits or inquiries by the Michigan Department of Treasury.

Required Documents

To accurately complete the Michigan Individual Tax Return 2010 Form, taxpayers needed to gather several key documents:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Records of any tax credits claimed

- Previous year’s tax return for reference

Quick guide on how to complete michigan 4567 form 2017 2019

Complete Form Michigan effortlessly on any device

Web-based document management has become favored by both businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Form Michigan on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form Michigan with ease

- Obtain Form Michigan and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign Form Michigan and ensure exceptional communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct michigan 4567 form 2017 2019

Create this form in 5 minutes!

How to create an eSignature for the michigan 4567 form 2017 2019

How to generate an electronic signature for the Michigan 4567 Form 2017 2019 in the online mode

How to create an eSignature for the Michigan 4567 Form 2017 2019 in Google Chrome

How to create an eSignature for signing the Michigan 4567 Form 2017 2019 in Gmail

How to create an electronic signature for the Michigan 4567 Form 2017 2019 from your smart phone

How to create an eSignature for the Michigan 4567 Form 2017 2019 on iOS devices

How to make an eSignature for the Michigan 4567 Form 2017 2019 on Android devices

People also ask

-

What is the Michigan individual tax return 2010 form?

The Michigan individual tax return 2010 form is a document used by residents of Michigan to report their income and calculate their state tax obligation for the year 2010. This form is essential for ensuring compliance with state tax laws and for obtaining any potential tax refunds.

-

How can airSlate SignNow help me with my Michigan individual tax return 2010 form?

AirSlate SignNow offers a streamlined process for preparing and eSigning your Michigan individual tax return 2010 form. With our easy-to-use platform, you can complete your tax return securely and efficiently, saving you time and ensuring accuracy.

-

Is it safe to use airSlate SignNow for my Michigan individual tax return 2010 form?

Yes, using airSlate SignNow for your Michigan individual tax return 2010 form is completely safe. Our platform employs advanced encryption and security measures to protect your sensitive tax information throughout the signing and submission process.

-

What are the pricing options for using airSlate SignNow for tax forms?

AirSlate SignNow offers competitive pricing plans that make it affordable to handle your Michigan individual tax return 2010 form and other documents. We provide various subscription tiers, ensuring you find a plan that fits your needs and budget, allowing you to eSign documents without breaking the bank.

-

Can I integrate airSlate SignNow with accounting software for my tax filing?

Absolutely! AirSlate SignNow can integrate seamlessly with popular accounting software, making the process of filing your Michigan individual tax return 2010 form even easier. This integration allows for quick data transfer and collaboration, streamlining your entire tax filing experience.

-

What features does airSlate SignNow offer for managing tax documents?

AirSlate SignNow provides a range of features to help manage your tax documents, including templates for the Michigan individual tax return 2010 form, real-time collaboration, and eSigning capabilities. These tools enhance efficiency, making it easier to complete and submit your tax documents.

-

Can I file my Michigan individual tax return 2010 form electronically?

Yes, you can file your Michigan individual tax return 2010 form electronically using airSlate SignNow. Our platform enables you to prepare, sign, and submit your tax return online, ensuring a hassle-free filing experience and reducing the risk of delays or errors.

Get more for Form Michigan

- Form cm 2b fillable

- Hawaii state tax form vp1

- Form omb no 0990 0243

- Idaho code 67 300410 states the follow ing form

- Idaho bowhunter affidavit fillable form

- Idaho family law case information sheet

- Food service license application panhandle health district 1 phd1 idaho form

- High holy day child care form

Find out other Form Michigan

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast