PDF REVENUE DIVISION of DEPARTMENT of TREASURY Act 122 of 2021-2026

What is the PDF Revenue Division of Department of Treasury Act 122 Of

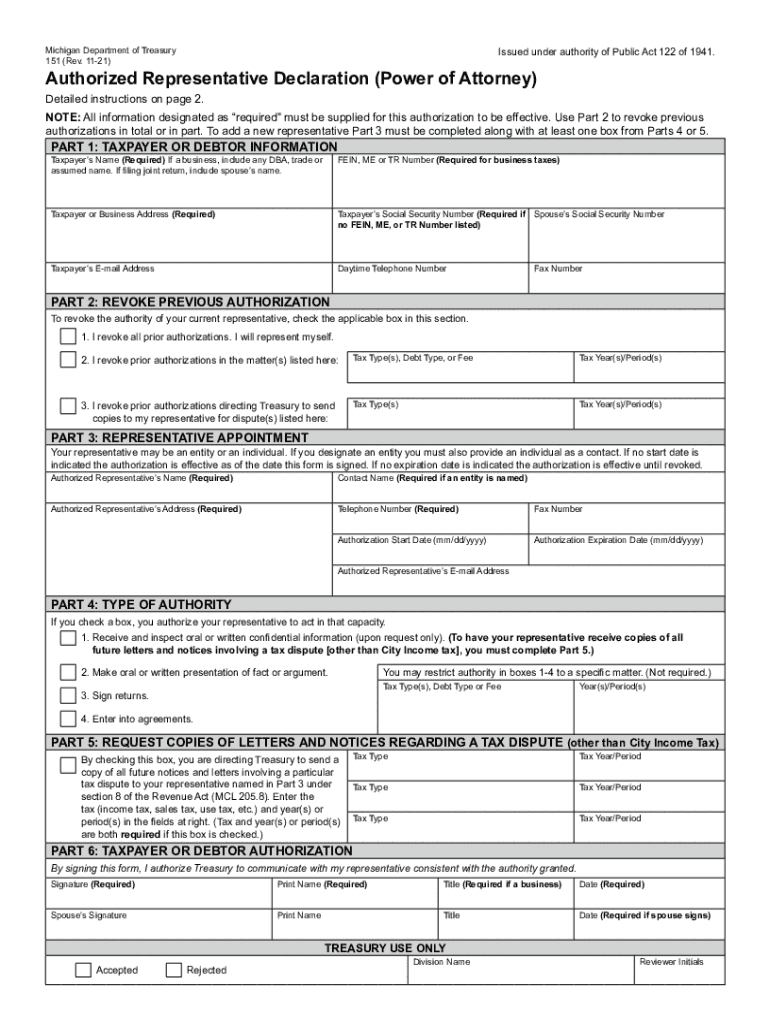

The PDF Revenue Division of Department of Treasury Act 122 Of outlines the regulations and procedures governing the management of revenue collection and distribution within the state. This act provides a legal framework for the Department of Treasury to ensure compliance with tax laws and the efficient handling of public funds. Understanding this act is crucial for individuals and businesses that interact with the state’s financial systems.

How to use the PDF Revenue Division of Department of Treasury Act 122 Of

Using the PDF Revenue Division of Department of Treasury Act 122 Of involves familiarizing oneself with the specific provisions outlined within the document. Users should read through the act carefully to understand their rights and responsibilities regarding revenue reporting and compliance. It is advisable to consult with a legal professional if there are any uncertainties about how the act applies to individual circumstances.

Steps to complete the PDF Revenue Division of Department of Treasury Act 122 Of

Completing the requirements set forth by the PDF Revenue Division of Department of Treasury Act 122 Of involves several key steps. First, individuals or businesses must gather all necessary documentation related to their revenue activities. Next, they should complete any required forms accurately, ensuring that all information is current and truthful. Finally, the completed forms should be submitted according to the guidelines specified in the act, whether online, by mail, or in person.

Legal use of the PDF Revenue Division of Department of Treasury Act 122 Of

The legal use of the PDF Revenue Division of Department of Treasury Act 122 Of is essential for ensuring that all revenue-related activities are conducted within the bounds of the law. This act provides the legal basis for enforcement actions and compliance measures taken by the Department of Treasury. Familiarity with the legal implications of the act can help individuals and businesses avoid potential penalties and ensure proper adherence to state regulations.

Key elements of the PDF Revenue Division of Department of Treasury Act 122 Of

Key elements of the PDF Revenue Division of Department of Treasury Act 122 Of include provisions for revenue collection, reporting requirements, and penalties for non-compliance. The act also outlines the authority of the Department of Treasury in enforcing tax laws and managing public funds. Understanding these elements is crucial for anyone involved in financial operations within the state.

Filing Deadlines / Important Dates

Filing deadlines and important dates associated with the PDF Revenue Division of Department of Treasury Act 122 Of are critical for compliance. Individuals and businesses must be aware of specific timelines for submitting required documents and forms to avoid penalties. It is advisable to keep a calendar of these dates to ensure timely submissions and adherence to the regulations set forth in the act.

Form Submission Methods (Online / Mail / In-Person)

Form submission methods for the PDF Revenue Division of Department of Treasury Act 122 Of include online submissions, mailing completed forms, or delivering them in person to designated offices. Each method has its own set of guidelines and requirements, which should be reviewed carefully. Choosing the appropriate submission method can help streamline the process and ensure compliance with state regulations.

Quick guide on how to complete pdf revenue division of department of treasury act 122 of

Effortlessly prepare PDF REVENUE DIVISION OF DEPARTMENT OF TREASURY Act 122 Of on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle PDF REVENUE DIVISION OF DEPARTMENT OF TREASURY Act 122 Of on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign PDF REVENUE DIVISION OF DEPARTMENT OF TREASURY Act 122 Of with ease

- Find PDF REVENUE DIVISION OF DEPARTMENT OF TREASURY Act 122 Of and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign PDF REVENUE DIVISION OF DEPARTMENT OF TREASURY Act 122 Of and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf revenue division of department of treasury act 122 of

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for treasury management?

airSlate SignNow provides a variety of features tailored for treasury management, including secure eSigning, document templates, and automated workflows. These tools streamline the signing process, enabling treasury teams to manage contracts and agreements efficiently. Additionally, users can track the status of documents in real time, ensuring that all treasury-related agreements are executed without delay.

-

How does airSlate SignNow enhance the treasury document workflow?

By implementing airSlate SignNow, treasury departments can utilize automated workflows that reduce manual effort and increase efficiency. Users can automate repetitive tasks such as document routing and reminders, allowing treasury professionals to focus on critical financial tasks. This efficiency improvement is beneficial for optimizing treasury operations and ensuring timely approvals.

-

Is airSlate SignNow cost-effective for treasury departments?

Yes, airSlate SignNow is designed to be a cost-effective solution for treasury departments of all sizes. With flexible pricing plans, businesses can select options that suit their needs without breaking the budget. The return on investment is evident as airSlate SignNow reduces the costs associated with traditional document signing and enhances overall productivity.

-

Can airSlate SignNow integrate with other treasury management systems?

Absolutely, airSlate SignNow supports integrations with various treasury management systems, enabling seamless data exchange and workflow automation. This connectivity ensures that treasury operations can be executed smoothly without compatibility issues, thus enhancing overall operational efficiency. Users can easily connect with tools they already use to optimize their treasury processes.

-

What security measures does airSlate SignNow implement for treasury documents?

AirSlate SignNow prioritizes the security of treasury documents by employing robust encryption and compliance with industry standards. With advanced security features such as access control, audit trails, and two-factor authentication, users can ensure that all treasury-related agreements are protected against unauthorized access. This focus on security helps businesses maintain trust in their treasury transactions.

-

How can Treasury professionals benefit from using airSlate SignNow?

Treasury professionals can signNowly benefit from airSlate SignNow by simplifying the document signing process and improving compliance. The platform allows teams to manage their treasury agreements conveniently, reducing delays associated with manual processes. By embracing airSlate SignNow, treasury professionals can enhance their operational efficiency and responsiveness to market changes.

-

What types of documents can be signed using airSlate SignNow in the treasury?

AirSlate SignNow allows the signing of various document types relevant to the treasury, including contracts, NDAs, and financial agreements. This versatility is crucial for treasury operations as it supports the demand for quick and secure signing of critical documents. By using airSlate SignNow, treasury teams can ensure that all necessary agreements are executed efficiently and securely.

Get more for PDF REVENUE DIVISION OF DEPARTMENT OF TREASURY Act 122 Of

- North dakota tenant 497317534 form

- North dakota law form

- North dakota notice 497317536 form

- Letter from tenant to landlord about insufficient notice of rent increase north dakota form

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase during lease north dakota form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase north dakota form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant north dakota form

- Letter from tenant to landlord containing notice to landlord to withdraw retaliatory rent increase north dakota form

Find out other PDF REVENUE DIVISION OF DEPARTMENT OF TREASURY Act 122 Of

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now