Offer in Compromise DTF 4 Government of New YorkOffer in Compromise ProgramOffer in CompromiseInternal Revenue Service IRS Tax F 2022

What is the Offer in Compromise DTF 4?

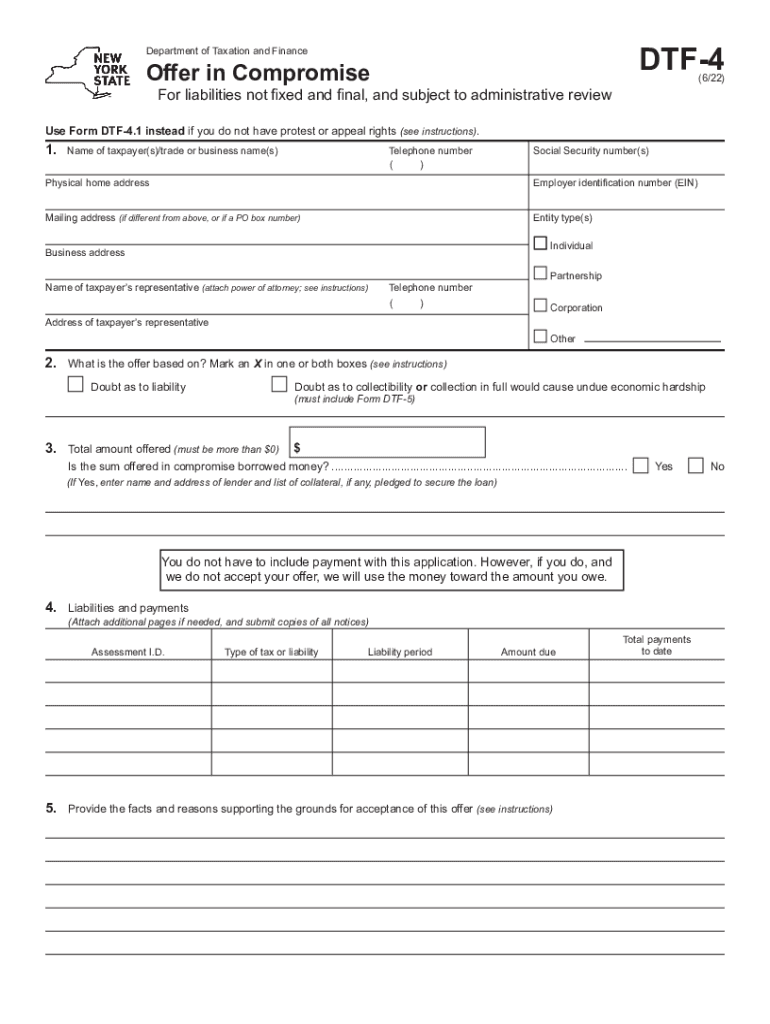

The Offer in Compromise (OIC) DTF 4 is a form used by taxpayers in New York to settle their tax liabilities for less than the full amount owed. This program is designed for individuals who are unable to pay their tax debts in full due to financial hardship. By submitting this form, taxpayers can propose a reduced amount to the state, which, if accepted, resolves their tax obligations. The OIC program aims to provide relief for those facing significant financial difficulties while ensuring that the state can still collect some revenue.

Steps to Complete the Offer in Compromise DTF 4

Completing the Offer in Compromise DTF 4 involves several key steps:

- Gather necessary financial documents, including income statements, bank statements, and expense records.

- Complete the DTF 4 form accurately, ensuring all information is current and truthful.

- Calculate your offer amount based on your financial situation and the guidelines provided by the New York Department of Taxation and Finance.

- Submit the completed form along with any required documentation to the appropriate tax authority.

- Await a response from the tax authority regarding the acceptance or rejection of your offer.

Eligibility Criteria for the Offer in Compromise DTF 4

To qualify for the Offer in Compromise DTF 4, taxpayers must meet specific eligibility criteria, including:

- Demonstrating an inability to pay the full tax liability.

- Having filed all required tax returns.

- Not being currently in bankruptcy proceedings.

- Meeting any additional state-specific requirements as outlined by the New York Department of Taxation and Finance.

Required Documents for the Offer in Compromise DTF 4

When submitting the Offer in Compromise DTF 4, taxpayers must include several key documents to support their application:

- Completed DTF 4 form.

- Financial statements detailing income, expenses, and assets.

- Copies of recent tax returns.

- Any additional documentation requested by the tax authority to substantiate the offer.

Form Submission Methods for the Offer in Compromise DTF 4

Taxpayers can submit the Offer in Compromise DTF 4 through various methods, including:

- Online submission via the New York Department of Taxation and Finance website.

- Mailing the completed form and documents to the designated tax office.

- In-person submission at local tax offices, if available.

Key Elements of the Offer in Compromise DTF 4

Understanding the key elements of the Offer in Compromise DTF 4 is crucial for a successful submission. Important aspects include:

- The total amount of tax owed and the proposed offer amount.

- Details of the taxpayer's financial situation, including income and expenses.

- Compliance with all tax filing requirements prior to submission.

- Timely response to any requests for additional information from the tax authority.

Quick guide on how to complete offer in compromise dtf 4 government of new yorkoffer in compromise programoffer in compromiseinternal revenue service irs tax

Prepare Offer In Compromise DTF 4 Government Of New YorkOffer In Compromise ProgramOffer In CompromiseInternal Revenue Service IRS Tax F seamlessly on any device

Online document organization has become widely embraced by companies and individuals alike. It offers an excellent eco-conscious substitute for conventional printed and signed documents, as you can obtain the appropriate template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without delays. Manage Offer In Compromise DTF 4 Government Of New YorkOffer In Compromise ProgramOffer In CompromiseInternal Revenue Service IRS Tax F on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and electronically sign Offer In Compromise DTF 4 Government Of New YorkOffer In Compromise ProgramOffer In CompromiseInternal Revenue Service IRS Tax F effortlessly

- Find Offer In Compromise DTF 4 Government Of New YorkOffer In Compromise ProgramOffer In CompromiseInternal Revenue Service IRS Tax F and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Put aside concerns about lost or mislaid files, time-consuming form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Offer In Compromise DTF 4 Government Of New YorkOffer In Compromise ProgramOffer In CompromiseInternal Revenue Service IRS Tax F and maintain excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct offer in compromise dtf 4 government of new yorkoffer in compromise programoffer in compromiseinternal revenue service irs tax

Create this form in 5 minutes!

People also ask

-

What is an offer NY compromise?

An offer NY compromise is a legal arrangement in New York that allows taxpayers to settle their tax debt for less than what they owe. It's a way to negotiate with the tax authorities to ease financial burdens. With airSlate SignNow, you can quickly eSign documents related to your offer NY compromise for a seamless process.

-

How can airSlate SignNow assist with my offer NY compromise documents?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your offer NY compromise documents. Our tools streamline the preparation and submission process, ensuring you meet all necessary requirements. This simplifies your transaction, saving you time and reducing stress.

-

What are the pricing options for using airSlate SignNow for an offer NY compromise?

airSlate SignNow offers various pricing plans to accommodate your needs, starting from a cost-effective basic plan to more advanced options. Our pricing is competitive and designed to help you manage your documents efficiently while working on your offer NY compromise. You can choose a plan that best fits your frequency of use.

-

Are there any features specifically designed for offer NY compromise processes?

Yes, airSlate SignNow has features that are specifically valuable for the offer NY compromise process, including templates for common forms, customizable workflows, and built-in compliance checks. These features ensure that you can manage your documents effectively while focusing on completing your offer NY compromise with ease.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, like an offer NY compromise, provides many benefits. It allows for quick remote signing, reduces paper waste, and speeds up administrative processes. The convenience and security of our platform make it easier for you to comply with tax regulations.

-

Can airSlate SignNow integrate with other platforms for my offer NY compromise?

Absolutely, airSlate SignNow integrates seamlessly with various productivity and accounting tools you may already be using, enhancing the efficiency of your offer NY compromise process. With these integrations, you can easily import and export data, ensuring all relevant information is readily accessible. This connectivity helps streamline your workflow.

-

Is there customer support for assistance with my offer NY compromise?

Yes, airSlate SignNow offers dedicated customer support to assist you with any queries related to your offer NY compromise documents. Our team is available to help you navigate the platform, address any technical issues, and ensure that you are leveraging our tools effectively. You’re never alone in this process.

Get more for Offer In Compromise DTF 4 Government Of New YorkOffer In Compromise ProgramOffer In CompromiseInternal Revenue Service IRS Tax F

- Lease purchase agreements package north dakota form

- Satisfaction cancellation or release of mortgage package north dakota form

- Premarital agreements package north dakota form

- Painting contractor package north dakota form

- Framing contractor package north dakota form

- Foundation contractor package north dakota form

- Plumbing contractor package north dakota form

- Brick mason contractor package north dakota form

Find out other Offer In Compromise DTF 4 Government Of New YorkOffer In Compromise ProgramOffer In CompromiseInternal Revenue Service IRS Tax F

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form