Dtf4 2016

What is the DTF-4?

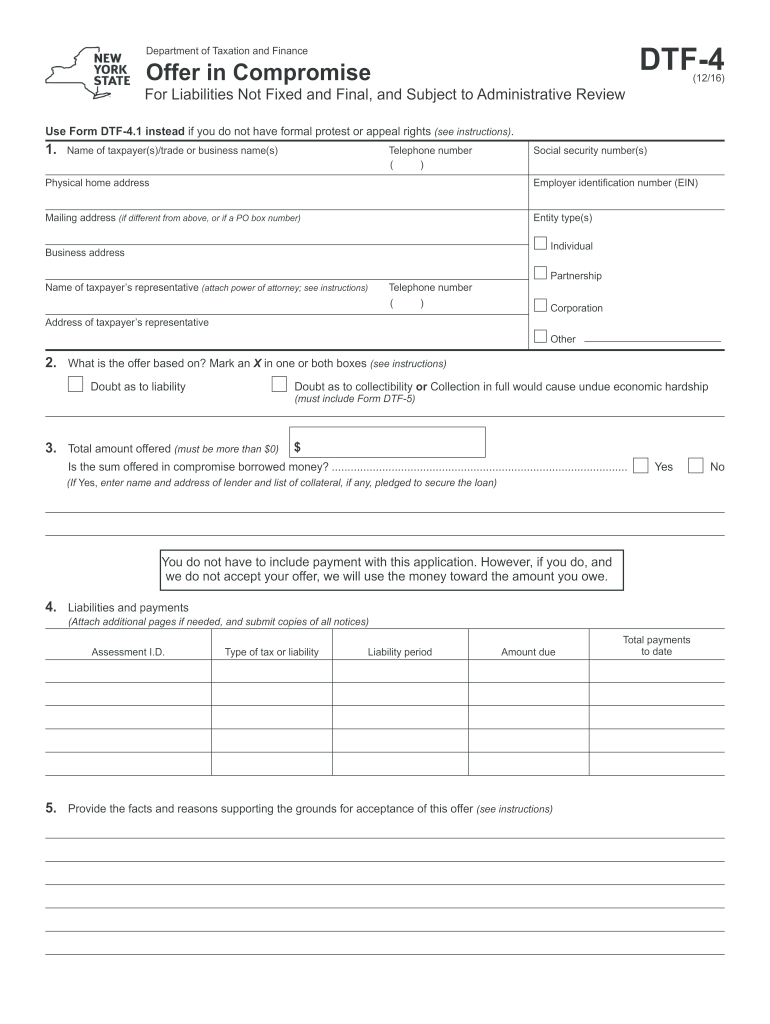

The DTF-4 form, also known as the New York State Sales Tax Offer in Compromise, is a document that allows taxpayers to settle their sales tax liabilities for less than the full amount owed. This form is specifically designed for individuals and businesses facing financial hardship, enabling them to propose a reduced payment to resolve their tax debts. The DTF-4 is an essential tool for those looking to manage their tax obligations while alleviating financial strain.

Steps to Complete the DTF-4

Completing the DTF-4 requires careful attention to detail to ensure accuracy and compliance with New York State regulations. Here are the key steps:

- Gather necessary financial documents, including income statements, bank statements, and expense records.

- Fill out the DTF-4 form accurately, providing all required information about your tax liability and financial situation.

- Clearly outline the reasons for your offer, demonstrating your inability to pay the full amount.

- Submit the completed form along with any supporting documentation to the appropriate New York State tax authority.

- Await a response from the tax authority regarding the acceptance or denial of your offer.

Eligibility Criteria

To qualify for submitting a DTF-4, taxpayers must meet specific eligibility criteria. Generally, this includes:

- Demonstrating financial hardship, such as low income or significant expenses.

- Having outstanding sales tax liabilities with the New York State Department of Taxation and Finance.

- Being compliant with all other tax obligations, including filing returns and making payments on time.

Required Documents

When submitting the DTF-4, it is crucial to include all required documents to support your offer. These typically include:

- Proof of income, such as pay stubs or tax returns.

- Bank statements showing your financial situation.

- Documentation of monthly expenses, including bills and other obligations.

Form Submission Methods

The DTF-4 can be submitted through various methods, allowing taxpayers flexibility in how they resolve their tax issues. The available submission methods include:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing the completed form and documents to the designated tax office.

- In-person submission at local tax offices, if applicable.

Legal Use of the DTF-4

The DTF-4 is a legally recognized form that allows taxpayers to negotiate their tax liabilities within the framework of New York State law. It is essential to use the form correctly to ensure compliance and avoid potential penalties. Taxpayers should be aware that submitting a DTF-4 does not guarantee acceptance; all offers are subject to review and approval by the tax authority.

Quick guide on how to complete dtf 4 2016 2019 form

Your assistance manual on how to prepare your Dtf4

If you’re wondering how to generate and submit your Dtf4, here are some brief instructions to simplify the tax filing process.

Initially, you just need to sign up for your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, create, and finalize your tax paperwork effortlessly. Through its editor, you can toggle between text, check boxes, and eSignatures and return to amend responses as necessary. Enhance your tax administration with superior PDF editing, eSigning, and intuitive sharing.

Follow these steps to finalize your Dtf4 in no time:

- Create your account and start working on PDFs within moments.

- Utilize our directory to find any IRS tax form; navigate through various versions and schedules.

- Click Get form to access your Dtf4 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and correct any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper may increase error rates and delay refunds. Naturally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct dtf 4 2016 2019 form

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How do I fill up the ITR 4 form?

Guidance to File ITR 4Below are mentioned few common guidelines to consider while filing your ITR 4 form:If any schedule is not relevant/applicable to you, just strike it out and write —NA— across itIf any item/particular is not applicable/relevant to you, just write NA against itIndicate nil figures by writing “Nil” across it.Kindly, put a “-” sign prior to any negative figure.All figures shall be rounded off to the nearest one rupee except figures for total income/loss and tax payable. Those shall be rounded off to the nearest multiple of ten.If you are an Employer individual, then you must mark Government if you are a Central/State Government employee. You should tick PSU if you are working in a public sector company of the Central/State Government.Sequence to fill ITR 4 formThe easiest way to fill out your ITR-4 Form is to follow this order:Part AAll the schedulesPart BVerificationModes to file ITR 4 FormYou can submit your ITR-4 Form either online or offline. It is compulsory to file ITR in India electronically (either through Mode 3 or Mode 4) for the following assesses:Those whose earning exceeds Rs. 5 lakhs per yearThose possessing any assets outside the boundary of India (including financial interest in any entity) or signing authority in any account outside India.Those claiming relief under Section 90/90A/91 to whom Schedule FSI and Schedule TR applyOffline:By furnishing a return in a tangible l paper formBy furnishing a bar-coded returnThe Income Tax Department will issue you an acknowledgment as a form of response/reply at the time of submission of your tangible paper return.Online/Electronically:By furnishing the return electronically using digital signature certificate.By sending the data electronically and then submitting the confirmation of the return in Return Form ITR-VIf you submit your ITR-4 Form by electronic means under digital signature, the acknowledgment/response will be sent to your registered email id. You can even download it manually from the official income tax website. For this, you are first required to sign it and send it to the Income Tax Department’s CPC office in Bangalore within 120 days of e-filing.Keep in mind that ITR-4 is an annexure-less form. It means you don’t have to attach any documents when you send it.TaxRaahi is your income tax return filing online companion. Get complete assistance and tax saving tips from experts.

-

How can I fill out the BITSAT Application Form 2019?

BITSAT 2019 Application Forms are available online. Students who are eligible for the admission test can apply online before 20 March 2018, 5 pm.Click here to apply for BITSAT 2019Step 1: Follow the link given aboveStep 2: Fill online application formPersonal Details12th Examination DetailsTest Centre PreferencesStep 3: Upload scanned photograph (4 kb to 50 kb) and signature ( 1 kb to 30 kb).Step 4: Pay application fee either through online payment mode or through e-challan (ICICI Bank)BITSAT-2019 Application FeeMale Candidates - Rs. 3150/-Female Candidates - Rs. 2650/-Thanks!

-

How can I fill out the COMEDK 2019 application form?

COMEDK 2019 application is fully online based and there is no need to send the application by post or by any other method. Check the below-mentioned guidelines to register for the COMEDK 2019 exam:Step 1 Visit the official website of the COMEDK UGET- comedk.orgStep 2 Click on “Engineering Application”.Step 3 After that click on “Login or Register” button.Step 4 You will be asked to enter the Application SEQ Number/User ID and Password. But since you have not registered. You need to click on the “Click here for Registration”.Step 5 Fill in the required details like “Full Name”, “DOB”, “Unique Photo ID Proof”, “Photo ID Proof Number”, “Email ID” and “Mobile Number”.Step 6 Then click on the “Generate OTP”Step 7 After that you need to enter the captcha code and then an OTP will be sent to the mobile number that you have provided.Step 8 A new window having your previously entered registration details will open where you need to enter the OTP.Step 9 Re-check all the details, enter the captcha code and click on the “Register” button.Step 10 After that a page will appear where you will be having the User ID and all the details that you entered. Also, you will be notified that you have successfully registered yourself and a User ID and Password will be sent to your mobile number and email ID.COMEDK 2019 Notification | Steps To Apply For COMEDK UGET ExamCheck the below-mentioned guidelines to fill COMEDK Application Form after COMEDK Login.Step 1 Using your User ID and Password. Log in using the User ID and passwordStep 2 You will be shown that your application form is incomplete. So you need to go to the topmost right corner and click on the “Go to application” tab.Step 3 Go to the COMEDK official website and login with these credentials.Step 4 After that click on “Go to application form”.Step 5 Select your preferred stream and course.Step 6 Click on “Save and Continue”.Step 7 Carefully enter your Personal, Category and Academic details.Step 8 Upload your Photograph and Signature, Parents Signature, your ID Proof, and Declaration.Step 9 Enter your “Payment Mode” and “Amount”.Step 10 Enter “Security code”.Step 11 Tick the “I Agree” checkbox.Step 12 Click on the “Submit” button.

Create this form in 5 minutes!

How to create an eSignature for the dtf 4 2016 2019 form

How to make an electronic signature for your Dtf 4 2016 2019 Form in the online mode

How to create an electronic signature for the Dtf 4 2016 2019 Form in Chrome

How to create an electronic signature for signing the Dtf 4 2016 2019 Form in Gmail

How to make an eSignature for the Dtf 4 2016 2019 Form straight from your smartphone

How to make an electronic signature for the Dtf 4 2016 2019 Form on iOS devices

How to generate an electronic signature for the Dtf 4 2016 2019 Form on Android devices

People also ask

-

What is Dtf4 and how does it relate to airSlate SignNow?

Dtf4 is a powerful feature within airSlate SignNow that enhances the document signing experience. It allows users to efficiently manage and track document workflows, making eSigning quick and straightforward. By integrating Dtf4 into your workflow, you can streamline processes and reduce turnaround times.

-

How much does airSlate SignNow with Dtf4 cost?

airSlate SignNow offers competitive pricing plans that include the Dtf4 feature, ensuring businesses of all sizes can afford its benefits. Pricing varies based on the number of users and features selected, but it remains a cost-effective solution for document management and eSigning. Visit our pricing page for detailed information on plans that include Dtf4.

-

What are the key features of Dtf4 in airSlate SignNow?

The Dtf4 feature in airSlate SignNow includes advanced document tracking, customizable templates, and real-time notifications. These features help users manage their documents more effectively, ensuring that every step of the signing process is monitored. Dtf4 is designed to improve workflow efficiency and enhance user experience.

-

What benefits does Dtf4 provide for businesses using airSlate SignNow?

Dtf4 offers numerous benefits, including increased efficiency, improved document security, and the ability to track document statuses in real-time. Businesses can save time and reduce errors with Dtf4, leading to more streamlined operations. By utilizing Dtf4, companies can accelerate their document workflows and enhance client satisfaction.

-

Can Dtf4 be integrated with other software tools?

Yes, Dtf4 can seamlessly integrate with various software tools and platforms, enhancing its functionality within airSlate SignNow. This integration capability allows businesses to connect their existing systems, such as CRM or project management tools, to streamline their workflows. By leveraging Dtf4 integrations, users can manage documents more efficiently.

-

Is there a free trial available for airSlate SignNow with Dtf4?

Yes, airSlate SignNow offers a free trial that includes access to the Dtf4 feature. This allows potential customers to explore the capabilities of Dtf4 and see how it can enhance their document management processes. Sign up for the free trial to experience the benefits of Dtf4 firsthand.

-

How does Dtf4 enhance user experience in airSlate SignNow?

Dtf4 enhances user experience in airSlate SignNow by providing intuitive navigation and easy access to document tools. Users can quickly create, send, and track documents without any technical difficulties. The streamlined interface paired with Dtf4 functionalities makes it user-friendly for all, regardless of technical expertise.

Get more for Dtf4

Find out other Dtf4

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile