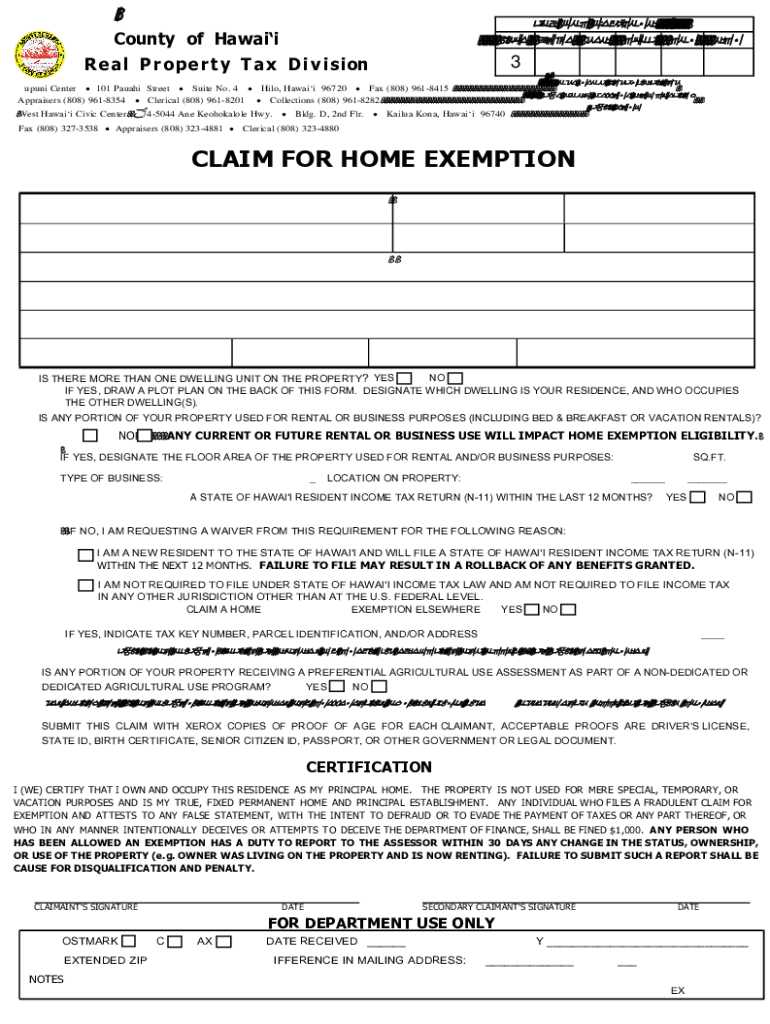

CLAIM for HOME EXEMPTION Hawaii Property Taxes 2022

What is the claim for home exemption in Hawaii property taxes?

The claim for home exemption in Hawaii is a provision that allows homeowners to reduce their property tax liability. This exemption applies to primary residences, providing significant savings on annual property taxes. Homeowners must meet specific criteria to qualify, including residency requirements and property usage. The exemption amount can vary based on the county and the assessed value of the property, making it essential for homeowners to understand the local regulations that govern this benefit.

Eligibility criteria for the claim for home exemption in Hawaii

To qualify for the claim for home exemption in Hawaii, homeowners must meet several eligibility criteria. These typically include:

- The property must be the homeowner's primary residence.

- The homeowner must be at least 18 years old.

- The homeowner must be a U.S. citizen or legal resident.

- The property must not be used for rental or business purposes.

It is crucial for applicants to verify their eligibility before submitting the Hawaii property tax exemption form to ensure compliance with local laws.

Steps to complete the claim for home exemption in Hawaii

Completing the claim for home exemption in Hawaii involves several steps to ensure proper submission and approval. The process includes:

- Gather necessary documents, such as proof of residency and identification.

- Obtain the Hawaii property tax exemption form from the local county tax office or online.

- Fill out the form accurately, providing all required information.

- Submit the completed form by the designated deadline, either online, by mail, or in person at the local tax office.

Following these steps carefully can help streamline the application process and increase the likelihood of approval.

Required documents for the claim for home exemption in Hawaii

When applying for the claim for home exemption in Hawaii, homeowners must provide specific documentation to support their application. Commonly required documents include:

- Proof of residency, such as a utility bill or lease agreement.

- A valid government-issued identification, like a driver's license or passport.

- Any additional documents requested by the local tax authority.

Having these documents ready can facilitate a smoother application process and help ensure that all necessary information is submitted.

Form submission methods for the claim for home exemption in Hawaii

Homeowners can submit the Hawaii property tax exemption form through various methods, depending on their preference and local regulations. The common submission methods include:

- Online submission through the county's tax office website.

- Mailing the completed form to the appropriate county tax office.

- In-person submission at the local tax office during business hours.

Each method has its advantages, and homeowners should choose the one that best suits their needs and ensures timely processing of their application.

Legal use of the claim for home exemption in Hawaii

The legal use of the claim for home exemption in Hawaii is governed by state and local laws. Homeowners must ensure that they meet all eligibility requirements and provide accurate information when applying. Misrepresentation or failure to comply with the regulations can result in penalties, including the loss of the exemption. It is advisable for homeowners to consult with local tax authorities or legal advisors if they have questions about the legal implications of the exemption.

Quick guide on how to complete claim for home exemption hawaii property taxes

Complete CLAIM FOR HOME EXEMPTION Hawaii Property Taxes effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Handle CLAIM FOR HOME EXEMPTION Hawaii Property Taxes on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to modify and eSign CLAIM FOR HOME EXEMPTION Hawaii Property Taxes with ease

- Locate CLAIM FOR HOME EXEMPTION Hawaii Property Taxes and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools airSlate SignNow specifically provides for that reason.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choosing. Modify and eSign CLAIM FOR HOME EXEMPTION Hawaii Property Taxes and guarantee excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct claim for home exemption hawaii property taxes

Create this form in 5 minutes!

People also ask

-

What is the Hawaii property tax exemption form and who needs it?

The Hawaii property tax exemption form is a crucial document that allows qualified homeowners to reduce their property tax burden. Homeowners, including those who are permanent residents or certain qualifying groups like veterans and the elderly, may need to fill out this form to benefit from tax exemptions.

-

How can I obtain the Hawaii property tax exemption form?

You can obtain the Hawaii property tax exemption form directly from your local county office's website or through their physical office. Many residents also find it convenient to download the form online, ensuring they have the latest version necessary for submission.

-

What are the benefits of using airSlate SignNow for the Hawaii property tax exemption form?

Using airSlate SignNow for the Hawaii property tax exemption form simplifies the eSigning process, allowing you to quickly fill, sign, and send your documents securely. This digital solution reduces administrative tasks and ensures timely submission, helping you take advantage of your property tax exemptions without delays.

-

Is there a fee for using airSlate SignNow to submit the Hawaii property tax exemption form?

airSlate SignNow offers various pricing plans, and while there may be fees associated with some features, submitting the Hawaii property tax exemption form is often included in the service. Users appreciate the cost-effective nature of our solution, providing signNow savings compared to traditional document handling.

-

Can I integrate airSlate SignNow with other tools for managing the Hawaii property tax exemption form?

Yes, airSlate SignNow integrates seamlessly with numerous applications, allowing you to connect with tools you already use. Whether it's a CRM, cloud storage, or document management systems, effortless integration enhances your workflow when managing the Hawaii property tax exemption form.

-

How secure is my information when signing the Hawaii property tax exemption form with airSlate SignNow?

airSlate SignNow prioritizes security and complies with industry standards to protect your sensitive information. When you sign the Hawaii property tax exemption form, all data is encrypted, ensuring safe storage and sharing of your documents.

-

What features does airSlate SignNow offer that assist in completing the Hawaii property tax exemption form?

airSlate SignNow provides intuitive features such as templates, in-app collaboration, and automated reminders to streamline the completion of the Hawaii property tax exemption form. These tools save time and help ensure all necessary information is accurately captured.

Get more for CLAIM FOR HOME EXEMPTION Hawaii Property Taxes

- Roofing contractor package north dakota form

- Electrical contractor package north dakota form

- Sheetrock drywall contractor package north dakota form

- Flooring contractor package north dakota form

- Trim carpentry contractor package north dakota form

- Fencing contractor package north dakota form

- Hvac contractor package north dakota form

- Landscaping contractor package north dakota form

Find out other CLAIM FOR HOME EXEMPTION Hawaii Property Taxes

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation