RP FORM 19 71 Rev 02 DEPT of FINANCE CASE 2024-2026

Understanding the Hawaii Property Tax Exemption Form

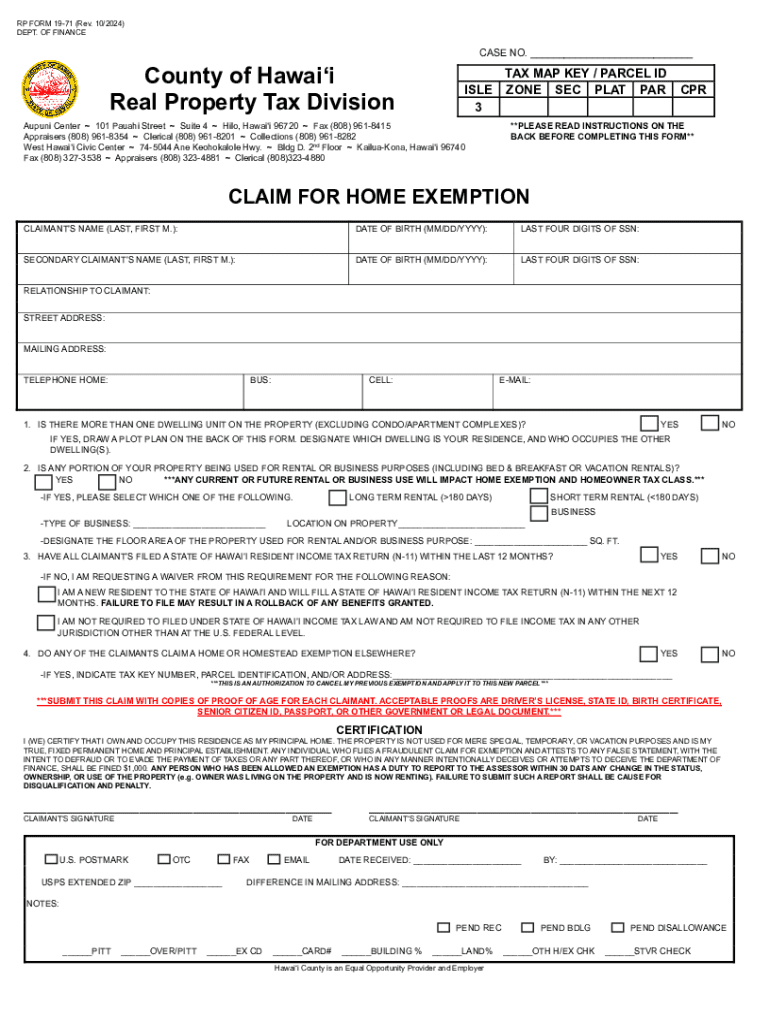

The Hawaii property tax exemption form, known as the RP FORM 19 71, is a crucial document for homeowners seeking tax relief. This form allows eligible property owners to apply for various exemptions that can significantly reduce their property tax burden. The exemptions may include those for homeowners, veterans, and individuals with disabilities. Understanding the purpose and benefits of this form can help property owners take advantage of available tax reductions.

Steps to Complete the Hawaii Property Tax Exemption Form

Completing the RP FORM 19 71 involves several important steps. First, gather all necessary information, including your property details, ownership status, and any relevant documentation supporting your eligibility for exemptions. Next, fill out the form accurately, ensuring that all sections are completed. Pay special attention to the eligibility criteria and provide any required supporting documents, such as proof of residency or disability status. Finally, review the completed form for accuracy before submission.

Eligibility Criteria for the Hawaii Property Tax Exemption

To qualify for the exemptions available through the Hawaii property tax exemption form, applicants must meet specific eligibility criteria. Generally, homeowners must occupy the property as their primary residence. Additional exemptions may be available for senior citizens, veterans, and individuals with disabilities, each with its own set of requirements. It is essential to review these criteria carefully to ensure compliance and maximize potential tax savings.

Required Documents for Submission

When submitting the RP FORM 19 71, certain documents are typically required to support your application. These may include proof of identification, such as a driver's license or state ID, as well as documentation verifying your residency and eligibility for specific exemptions. For example, veterans may need to provide a copy of their discharge papers, while individuals with disabilities may need medical documentation. Collecting these documents in advance can streamline the application process.

Form Submission Methods

The Hawaii property tax exemption form can be submitted through various methods, including online, by mail, or in person at your local tax office. Each method has its own advantages, such as convenience for online submissions or the ability to ask questions in person. When submitting by mail, ensure that you send the form to the correct address and consider using certified mail for tracking purposes. Online submission may require creating an account on the appropriate government website.

Important Filing Deadlines

Awareness of filing deadlines is crucial for property owners wishing to take advantage of tax exemptions. The deadlines for submitting the Hawaii property tax exemption form can vary by county, so it is important to check with your local tax office for specific dates. Generally, applications must be submitted before the end of the tax year to be considered for exemptions for that year. Missing the deadline could result in the loss of potential tax savings.

Create this form in 5 minutes or less

Find and fill out the correct rp form 19 71 rev 02 dept of finance case

Create this form in 5 minutes!

How to create an eSignature for the rp form 19 71 rev 02 dept of finance case

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Hawaii property tax exemption form?

The Hawaii property tax exemption form is a document that allows eligible property owners in Hawaii to apply for exemptions that can reduce their property tax liability. By completing this form, homeowners can benefit from various exemptions, such as those for primary residences or for individuals with disabilities.

-

How can I obtain the Hawaii property tax exemption form?

You can obtain the Hawaii property tax exemption form from your local county tax office or download it from their official website. Additionally, airSlate SignNow provides a streamlined process for filling out and eSigning this form, making it easier for you to submit your application.

-

What are the benefits of using airSlate SignNow for the Hawaii property tax exemption form?

Using airSlate SignNow for the Hawaii property tax exemption form offers several benefits, including an easy-to-use interface, secure eSigning capabilities, and the ability to track your document's status. This ensures that your application is submitted accurately and efficiently, saving you time and effort.

-

Is there a cost associated with using airSlate SignNow for the Hawaii property tax exemption form?

While airSlate SignNow offers various pricing plans, many users find it to be a cost-effective solution for managing documents, including the Hawaii property tax exemption form. You can choose a plan that fits your needs, and there may be free trials available to help you get started.

-

Can I integrate airSlate SignNow with other applications for the Hawaii property tax exemption form?

Yes, airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when completing the Hawaii property tax exemption form. This means you can connect with tools you already use, enhancing your overall efficiency.

-

What features does airSlate SignNow provide for managing the Hawaii property tax exemption form?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and real-time collaboration for managing the Hawaii property tax exemption form. These features help ensure that your documents are organized and accessible whenever you need them.

-

How long does it take to process the Hawaii property tax exemption form?

The processing time for the Hawaii property tax exemption form can vary depending on the county and the completeness of your application. However, using airSlate SignNow can help expedite the process by ensuring that your form is filled out correctly and submitted promptly.

Get more for RP FORM 19 71 Rev 02 DEPT OF FINANCE CASE

- Employers occupational disease form

- Washington case 497429731 form

- Consultation referral washington form

- Pre job modification accommodation assistant application washington form

- Work plan 497429734 form

- 1st 52 week period training plan cost encumbrance washington form

- 1st 52 week period board and room cost encumbrance washington form

- 2nd 52 weeks training washington form

Find out other RP FORM 19 71 Rev 02 DEPT OF FINANCE CASE

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample