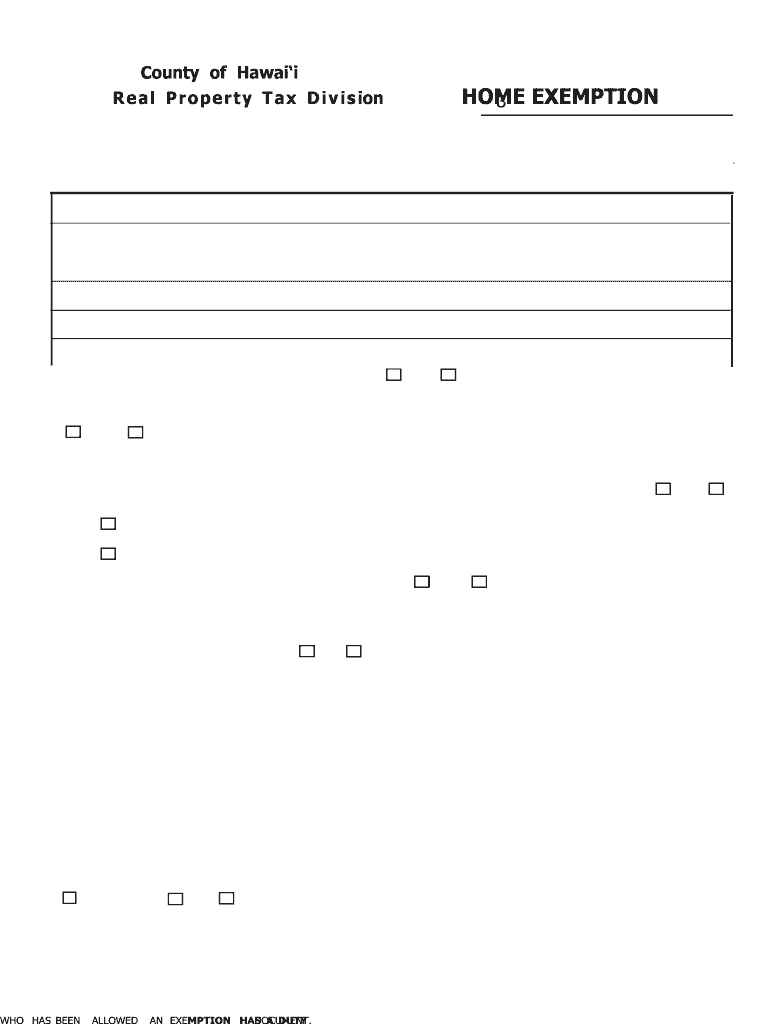

Hawaii County Exemption 2015

What is the Hawaii County Exemption

The Hawaii County Exemption is a property tax benefit designed to reduce the tax burden for eligible homeowners in Hawaii County. This exemption applies to residential properties and is intended to provide financial relief to those who qualify, such as senior citizens, disabled individuals, and low-income households. By reducing the assessed value of the property, the exemption can significantly lower annual property tax bills, making homeownership more affordable for residents.

Eligibility Criteria

To qualify for the Hawaii County Exemption, applicants must meet specific criteria set forth by local regulations. Generally, eligibility includes:

- Ownership of the property as a primary residence.

- Meeting income limits, which may vary based on household size.

- Being a senior citizen or a person with disabilities, in some cases.

It is essential for applicants to review the detailed eligibility requirements to ensure compliance and maximize their chances of approval.

Steps to Complete the Hawaii County Exemption

Completing the Hawaii County Exemption involves several straightforward steps:

- Gather necessary documentation, including proof of ownership and income verification.

- Obtain the exemption application form, which can be found on the county's official website or local offices.

- Fill out the application form accurately, ensuring all required information is included.

- Submit the completed form along with any supporting documents to the appropriate county office.

Following these steps carefully can help streamline the application process and increase the likelihood of approval.

Required Documents

When applying for the Hawaii County Exemption, applicants must provide certain documents to support their claims. Commonly required documents include:

- Proof of property ownership, such as a deed or title.

- Income statements, including tax returns or pay stubs, to verify eligibility.

- Identification documents, such as a driver's license or state ID.

Having these documents ready can facilitate a smoother application process and ensure that all necessary information is provided to the county.

Form Submission Methods

The Hawaii County Exemption application can be submitted through various methods, offering flexibility to applicants. These methods include:

- Online submission via the county's official website, if available.

- Mailing the completed application to the designated county office.

- In-person submission at local government offices during business hours.

Each method has its advantages, and applicants should choose the one that best suits their needs and circumstances.

Legal Use of the Hawaii County Exemption

The Hawaii County Exemption is governed by state and local laws, ensuring its legal validity. To maintain compliance, applicants must adhere to the guidelines outlined by the county. This includes submitting accurate information, meeting deadlines, and reapplying if necessary, particularly in cases of changes in ownership or income status. Understanding the legal framework surrounding the exemption can help applicants navigate the process effectively and avoid potential issues.

Quick guide on how to complete hawaii county exemption

Complete Hawaii County Exemption with ease on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without any hold-ups. Handle Hawaii County Exemption on any device using airSlate SignNow's Android or iOS applications and simplify any document-oriented procedure today.

How to edit and electronically sign Hawaii County Exemption effortlessly

- Locate Hawaii County Exemption and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Hawaii County Exemption to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hawaii county exemption

Create this form in 5 minutes!

How to create an eSignature for the hawaii county exemption

How to generate an electronic signature for your PDF file in the online mode

How to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is the Hawaii Form 19 71 and how can it be used?

The Hawaii Form 19 71 is a document used for various business purposes in Hawaii. With airSlate SignNow, you can easily create, send, and eSign this form, streamlining your documentation process and ensuring compliance.

-

How much does airSlate SignNow cost for using Hawaii Form 19 71?

The pricing for airSlate SignNow varies based on your business needs, but it remains a cost-effective solution for eSigning the Hawaii Form 19 71. You can choose from several subscription plans that cater to different user requirements and document handling.

-

What features does airSlate SignNow offer for completing Hawaii Form 19 71?

airSlate SignNow offers a range of features for managing the Hawaii Form 19 71, including customizable templates, a secure signing process, and real-time tracking of document status. This ensures that your forms are completed efficiently and securely.

-

Is it easy to integrate airSlate SignNow with other tools when working on Hawaii Form 19 71?

Yes, airSlate SignNow provides seamless integrations with various business tools, making it easy to incorporate the Hawaii Form 19 71 into your existing workflows. This helps in enhancing productivity while ensuring that all your documents are properly executed.

-

What benefits does airSlate SignNow provide for using the Hawaii Form 19 71?

Using airSlate SignNow for the Hawaii Form 19 71 allows for faster turnaround times and reduces paperwork errors. The digital nature of the tool ensures that your documents are stored securely and can be accessed from anywhere.

-

Can I access the Hawaii Form 19 71 on mobile devices with airSlate SignNow?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to access and eSign the Hawaii Form 19 71 from your smartphone or tablet. This ensures that you can manage your documents on the go.

-

What security features are included with airSlate SignNow for the Hawaii Form 19 71?

airSlate SignNow prioritizes your security with encryption and user authentication features, ensuring that the Hawaii Form 19 71 and other sensitive documents are protected. You can trust that your data is safe while using our platform.

Get more for Hawaii County Exemption

Find out other Hawaii County Exemption

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT