5076 Small Business Property Tax Exemption Claim under MCL 2023

What is the 5076 Small Business Property Tax Exemption Claim Under MCL

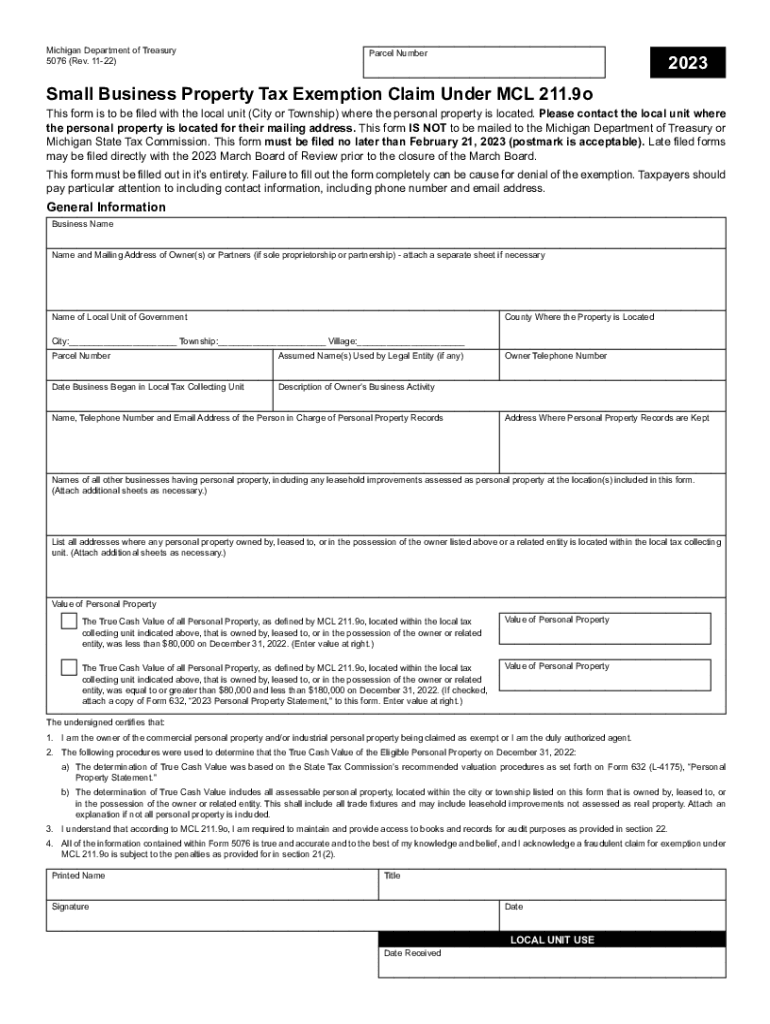

The 5076 Small Business Property Tax Exemption Claim, as outlined under the Michigan Compiled Laws (MCL), is designed to provide tax relief to small businesses in Michigan. This exemption allows eligible businesses to claim a reduction in property taxes on certain personal property. The aim is to support small enterprises by alleviating some of their financial burdens, thereby fostering growth and sustainability within the local economy.

Eligibility Criteria

To qualify for the 5076 Small Business Property Tax Exemption, a business must meet specific criteria. These include:

- The business must be classified as a small business under Michigan law.

- The property in question must be personal property used for business purposes.

- The total taxable value of the property must not exceed a certain threshold, which is subject to change based on state regulations.

It is essential for businesses to review these criteria carefully to ensure they qualify before submitting their claim.

Steps to Complete the 5076 Small Business Property Tax Exemption Claim Under MCL

Completing the 5076 Small Business Property Tax Exemption Claim involves several steps:

- Gather necessary documentation, including proof of business ownership and property details.

- Obtain the 5076 form from the appropriate local tax authority or download it from official state resources.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the completed form along with any supporting documents to the local assessor's office by the specified deadline.

Following these steps carefully can help ensure a smooth application process.

Required Documents

When filing the 5076 Small Business Property Tax Exemption Claim, businesses must prepare several key documents:

- Proof of business ownership, such as articles of incorporation or a business license.

- Documentation of the personal property for which the exemption is being claimed.

- Financial statements that demonstrate the business's eligibility as a small business.

Having these documents ready can facilitate the claim process and improve the chances of approval.

Form Submission Methods

The 5076 Small Business Property Tax Exemption Claim can be submitted through various methods, including:

- Online submission via the local assessor's office portal, if available.

- Mailing the completed form and documents to the local tax authority.

- In-person delivery at the local assessor's office during business hours.

Choosing the appropriate submission method can depend on the urgency and convenience for the business owner.

Penalties for Non-Compliance

Failing to comply with the requirements for the 5076 Small Business Property Tax Exemption Claim can result in penalties. These may include:

- Loss of the exemption for the current tax year.

- Potential fines imposed by the local tax authority.

- Increased scrutiny on future claims, which may complicate the application process.

Understanding these penalties can motivate businesses to adhere strictly to the guidelines and deadlines.

Quick guide on how to complete 5076 small business property tax exemption claim under mcl

Complete 5076 Small Business Property Tax Exemption Claim Under MCL effortlessly on any device

Web-based document management has gained popularity among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely archive it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without delays. Handle 5076 Small Business Property Tax Exemption Claim Under MCL on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to alter and eSign 5076 Small Business Property Tax Exemption Claim Under MCL without hassle

- Locate 5076 Small Business Property Tax Exemption Claim Under MCL and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs within a few clicks from any device you choose. Modify and eSign 5076 Small Business Property Tax Exemption Claim Under MCL and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 5076 small business property tax exemption claim under mcl

Create this form in 5 minutes!

People also ask

-

What is the 2019 mi exemption in relation to document signing?

The 2019 mi exemption refers to a specific legislative provision that allows certain businesses to benefit from simplified eSignature processes. By using airSlate SignNow, you can easily leverage this exemption to streamline document signing, ensuring compliance and efficiency in your transactions.

-

How does airSlate SignNow help with the 2019 mi exemption?

airSlate SignNow automates the eSigning process, making it easier for businesses to utilize the 2019 mi exemption. Our platform ensures that documents are signed and stored securely, making it simple for you to take advantage of this exemption without technical headaches.

-

Is there a cost associated with using airSlate SignNow for the 2019 mi exemption?

Yes, airSlate SignNow offers various pricing plans that provide excellent value for businesses looking to utilize the 2019 mi exemption. We have options suited for both small and large organizations, ensuring that you can find a plan that fits your budget while accessing all the necessary features.

-

What features does airSlate SignNow offer to enhance the 2019 mi exemption process?

Our platform includes features like customizable templates, real-time tracking, and automated reminders that enhance the 2019 mi exemption process. These tools not only streamline your workflow but also enhance compliance and reduce time spent on document management.

-

Can airSlate SignNow integrate with other tools to support the 2019 mi exemption?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing you to manage your documents while utilizing the 2019 mi exemption. Whether it’s CRM software or project management tools, our integrations enhance productivity and keep everything connected.

-

What are the benefits of using airSlate SignNow for the 2019 mi exemption?

Using airSlate SignNow for the 2019 mi exemption simplifies your document signing process, reduces turnaround times, and increases compliance. Additionally, you can maintain audit trails and document histories, ensuring that all your transactions are legally enforceable and well-organized.

-

Is there customer support available for questions related to the 2019 mi exemption?

Yes, airSlate SignNow provides dedicated customer support to assist you with any inquiries regarding the 2019 mi exemption. Our knowledgeable team is here to help you navigate the eSigning process, ensuring you fully understand how to leverage the exemption effectively.

Get more for 5076 Small Business Property Tax Exemption Claim Under MCL

- Mutual wills package with last wills and testaments for married couple with adult children north dakota form

- Mutual wills package with last wills and testaments for married couple with no children north dakota form

- Mutual wills package with last wills and testaments for married couple with minor children north dakota form

- North dakota will 497317881 form

- North dakota legal 497317882 form

- North dakota minor form

- Nd amendments form

- Legal last will and testament form for married person with adult and minor children from prior marriage north dakota

Find out other 5076 Small Business Property Tax Exemption Claim Under MCL

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself