Michigan Property Tax Forms " Keyword Found Websites 2022

Understanding the Michigan Property Tax Exemption Form

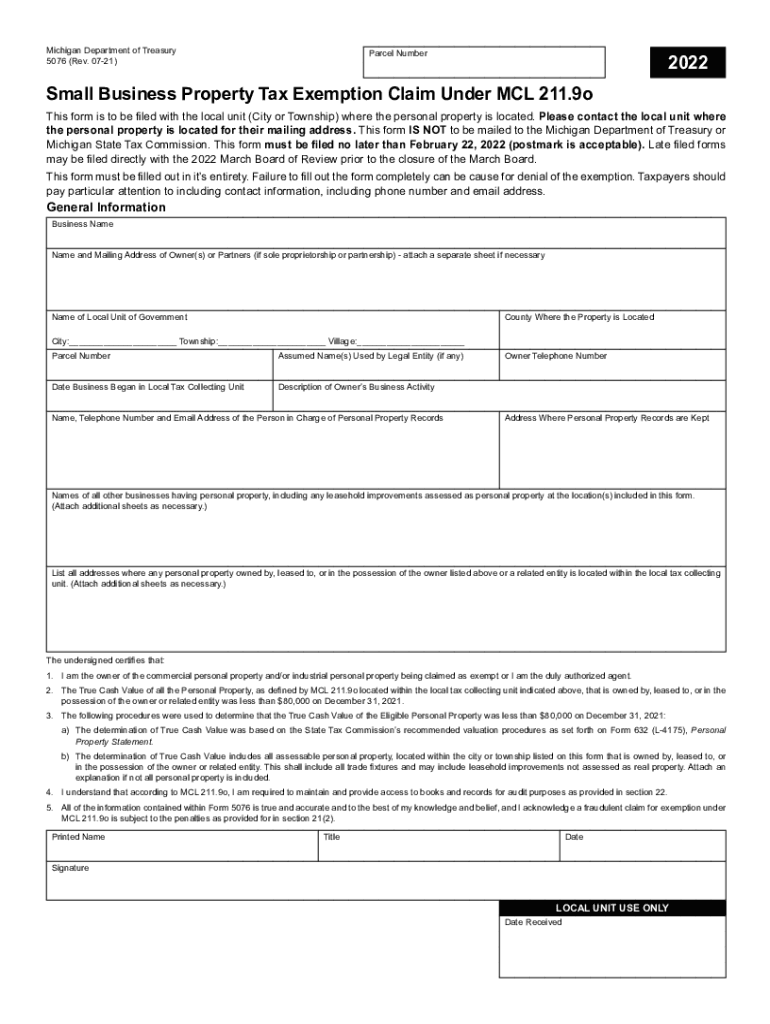

The Michigan property tax exemption form, commonly referred to as the MI exemption form, is essential for homeowners seeking to reduce their property tax burden. This form allows eligible residents to claim exemptions based on specific criteria set by the Michigan Department of Treasury. Understanding the nuances of this form can help ensure that homeowners maximize their tax benefits while remaining compliant with state regulations.

Steps to Complete the MI Exemption Form

Completing the MI exemption form involves several key steps to ensure accuracy and compliance. First, gather necessary documentation, including proof of residency and any relevant financial information. Next, accurately fill out the form, ensuring that all required fields are completed. After completing the form, review it for any errors or omissions before submission. Finally, submit the form to your local tax assessor’s office by the designated deadline to ensure your exemption is processed in a timely manner.

Eligibility Criteria for the MI Exemption

To qualify for the MI exemption, applicants must meet specific eligibility criteria established by the state. Generally, homeowners must occupy the property as their primary residence and may need to demonstrate financial need or meet certain age or disability requirements. It is important to review the detailed eligibility guidelines provided by the Michigan Department of Treasury to determine if you qualify for this exemption.

Required Documents for Submission

When submitting the MI exemption form, several documents may be required to support your application. These can include proof of ownership, such as a deed or mortgage statement, and documentation proving residency, like utility bills or bank statements. Additionally, if applicable, you may need to provide evidence of income or disability status. Ensuring you have all necessary documentation ready can facilitate a smoother application process.

Form Submission Methods

The MI exemption form can be submitted through various methods, depending on local regulations. Homeowners typically have the option to submit the form online, via mail, or in person at their local tax assessor’s office. Each method has its own advantages, such as immediate processing for online submissions or the ability to ask questions in person. It is advisable to check with your local office for specific submission guidelines and preferred methods.

Legal Use of the MI Exemption Form

The MI exemption form is legally binding once properly completed and submitted. This means that any information provided must be accurate and truthful, as misrepresentation can lead to penalties or denial of the exemption. Understanding the legal implications of the form is crucial for homeowners to ensure compliance with Michigan tax laws and to protect their rights as property owners.

Quick guide on how to complete michigan property tax forms 2021ampquot keyword found websites

Effortlessly prepare Michigan Property Tax Forms " Keyword Found Websites on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with everything necessary to create, modify, and electronically sign your documents quickly and without interruption. Handle Michigan Property Tax Forms " Keyword Found Websites on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related procedure today.

Easy methods to edit and electronically sign Michigan Property Tax Forms " Keyword Found Websites with minimal effort

- Find Michigan Property Tax Forms " Keyword Found Websites and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to deliver your form, either via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Michigan Property Tax Forms " Keyword Found Websites to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct michigan property tax forms 2021ampquot keyword found websites

Create this form in 5 minutes!

How to create an eSignature for the michigan property tax forms 2021ampquot keyword found websites

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to create an e-signature from your smartphone

How to create an e-signature for a PDF file on iOS devices

How to create an e-signature for a PDF file on Android

People also ask

-

What is the mi exemption and how can airSlate SignNow assist with it?

The mi exemption refers to a specific tax exemption in Michigan that certain individuals can claim. airSlate SignNow supports businesses in handling documentation related to the mi exemption efficiently, allowing users to create, send, and eSign necessary forms securely online.

-

How much does airSlate SignNow cost for handling mi exemption documents?

airSlate SignNow offers various pricing plans designed to fit different business needs, starting from affordable monthly options. By using our service, businesses can manage the paperwork for mi exemption efficiently, saving both time and resources. You can check our website for the latest pricing details.

-

What features does airSlate SignNow provide for mi exemption documentation?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSignatures to streamline the mi exemption document process. These tools help users manage their documentation more effectively, ensuring compliance and accuracy in all submissions.

-

Can I integrate airSlate SignNow with other software for mi exemption processes?

Yes, airSlate SignNow seamlessly integrates with a variety of software platforms, enabling smoother workflows for mi exemption applications. By connecting with tools like CRM systems and cloud storage services, businesses can enhance their document management process and improve productivity.

-

How can airSlate SignNow improve my business's efficiency in handling mi exemption documents?

By utilizing airSlate SignNow, businesses can signNowly reduce the time spent on paperwork related to the mi exemption. Our platform automates key processes, eliminates manual errors, and offers a user-friendly experience, leading to quicker turnaround times and improved operational efficiency.

-

Are there any security measures in place for mi exemption documents handled through SignNow?

Absolutely! AirSlate SignNow prioritizes the security of all documents, including those related to the mi exemption. We utilize advanced encryption protocols, two-factor authentication, and compliance with industry standards to ensure your sensitive information is always protected.

-

What types of businesses benefit the most from using airSlate SignNow for mi exemption?

Any business that needs to manage the mi exemption effectively can benefit from airSlate SignNow. Small to medium-sized enterprises, as well as larger organizations, find our platform essential for simplifying document management, enhancing compliance, and optimizing their workflows.

Get more for Michigan Property Tax Forms " Keyword Found Websites

Find out other Michigan Property Tax Forms " Keyword Found Websites

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History