Form 5076 Small Business Property Tax Exemption Claim 2021

What is the Form 5076 Small Business Property Tax Exemption Claim

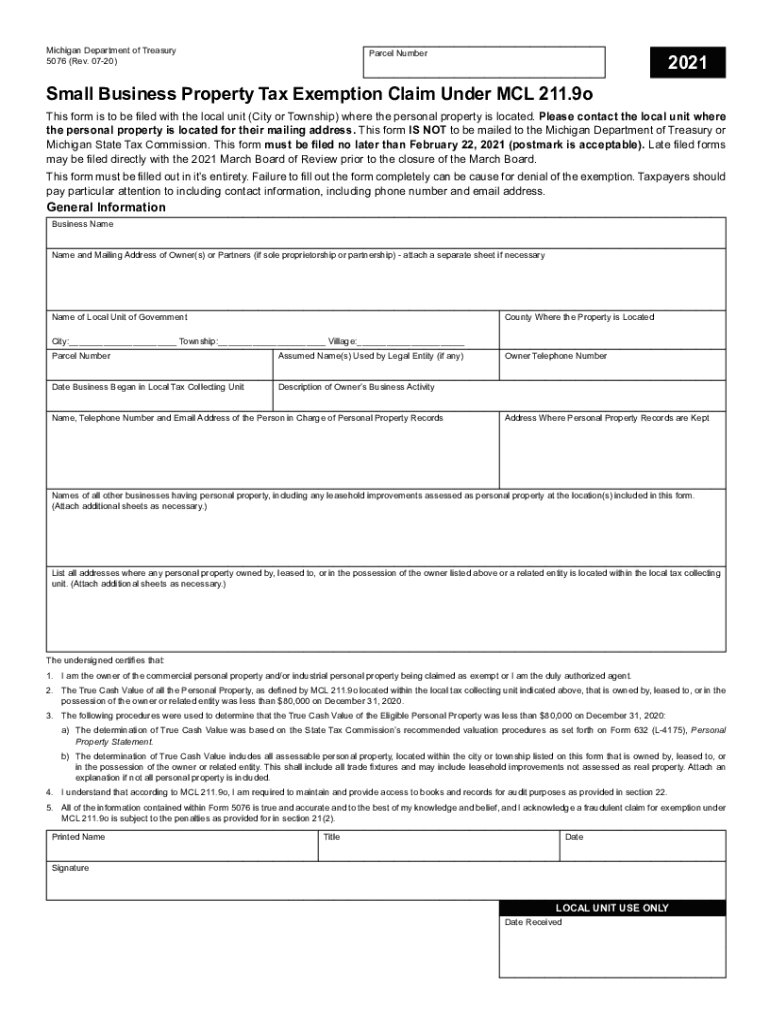

The Form 5076, known as the Small Business Property Tax Exemption Claim, is a crucial document for small businesses in Michigan seeking to claim an exemption from personal property taxes. This form is specifically designed to assist qualifying businesses in reducing their tax liabilities, thereby promoting economic growth and sustainability within the state. By completing this form, businesses can potentially exempt themselves from taxes on eligible personal property, which can include equipment and machinery used in their operations.

Eligibility Criteria for the Form 5076

To qualify for the Small Business Property Tax Exemption Claim, certain eligibility criteria must be met. Businesses must be classified as small businesses, typically defined by having a specific number of employees or gross receipts below a designated threshold. Additionally, the property for which the exemption is claimed must be used for business purposes and must not exceed the value limit set by the state. It is essential for applicants to review these criteria carefully to ensure they meet all requirements before submitting the form.

Steps to Complete the Form 5076 Small Business Property Tax Exemption Claim

Completing the Form 5076 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your business, including identification details, property descriptions, and financial data. Next, fill out the form with precise information, ensuring that all sections are completed. It is important to double-check for any errors or omissions that could delay processing. After completing the form, it should be signed and dated by an authorized representative of the business before submission.

How to Submit the Form 5076 Small Business Property Tax Exemption Claim

The submission of the Form 5076 can be done through various methods, including online, by mail, or in person. For online submissions, businesses should visit the appropriate state website to access the electronic filing system. If submitting by mail, ensure the form is sent to the correct local tax authority and allow sufficient time for processing. In-person submissions can be made at designated offices, where staff can assist with any questions regarding the form.

Required Documents for the Form 5076

When submitting the Form 5076, certain supporting documents may be required to validate the claim. These documents typically include proof of business registration, financial statements, and any additional information that demonstrates eligibility for the exemption. It is advisable to include copies of these documents rather than originals to avoid loss. Ensuring that all required documentation is submitted will help facilitate a smoother review process by the tax authority.

Legal Use of the Form 5076 Small Business Property Tax Exemption Claim

The legal use of the Form 5076 is governed by state tax laws that outline the parameters for property tax exemptions. Businesses must adhere to these regulations to ensure that their claims are valid and enforceable. Misuse of the form or providing false information can lead to penalties, including the denial of the exemption and potential legal repercussions. Therefore, it is crucial for businesses to understand their obligations and ensure compliance with all relevant laws when filing this form.

Quick guide on how to complete form 5076 small business property tax exemption claim

Complete Form 5076 Small Business Property Tax Exemption Claim effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the suitable form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without any hold-ups. Manage Form 5076 Small Business Property Tax Exemption Claim on any platform with airSlate SignNow apps for Android or iOS and simplify any document-related procedure today.

The easiest way to modify and eSign Form 5076 Small Business Property Tax Exemption Claim without hassle

- Locate Form 5076 Small Business Property Tax Exemption Claim and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Select your delivery method for the form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 5076 Small Business Property Tax Exemption Claim while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5076 small business property tax exemption claim

Create this form in 5 minutes!

How to create an eSignature for the form 5076 small business property tax exemption claim

The way to make an eSignature for a PDF online

The way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

How to make an eSignature for a PDF document on Android

People also ask

-

What is the significance of the 2019 5076 regulation?

The 2019 5076 regulation emphasizes electronic signatures and document management solutions in business operations. By following this regulation, organizations can streamline their workflows while ensuring compliance. airSlate SignNow is designed to meet and surpass the requirements set by the 2019 5076.

-

How does airSlate SignNow help with compliance to the 2019 5076 regulation?

airSlate SignNow supports businesses in adhering to the 2019 5076 regulation through its secure eSignature capabilities. Our platform ensures that all electronic signatures are legally binding and compliant with industry standards. By utilizing airSlate SignNow, companies can confidently meet the requirements of the 2019 5076.

-

What pricing plans are available for airSlate SignNow regarding the 2019 5076?

airSlate SignNow offers flexible pricing plans that cater to different business needs, especially in relation to the 2019 5076 requirements. Our plans include various features such as unlimited eSignatures and advanced document integrations. Contact our sales team to find the plan that best fits your compliance with the 2019 5076.

-

What features does airSlate SignNow offer for managing documents under the 2019 5076?

Our platform offers many features including secure electronic signatures, document tracking, and customizable workflows that are in line with the 2019 5076 standard. Users can easily create, manage, and send documents, ensuring that they stay compliant while enhancing productivity. airSlate SignNow's robust toolset simplifies document management under the 2019 5076.

-

What are the benefits of using airSlate SignNow related to the 2019 5076?

By using airSlate SignNow, businesses can enhance efficiency, reduce paperwork, and ensure compliance with the 2019 5076 regulation. Our user-friendly interface allows for quick setup and deployment of eSigning processes. This leads to signNow time savings and improved customer satisfaction.

-

Can airSlate SignNow integrate with other tools relevant to the 2019 5076?

Yes, airSlate SignNow seamlessly integrates with various third-party applications that businesses may be using, making it easier to meet the 2019 5076 requirements. This includes popular CRMs, cloud storage services, and project management tools. Our integrations help businesses maintain compliance without disrupting their existing workflows.

-

Is there customer support available for airSlate SignNow users regarding the 2019 5076?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any questions related to the 2019 5076 regulation. Our knowledgeable team can guide you through setup, compliance issues, and platform features to ensure you maximize your use of our service.

Get more for Form 5076 Small Business Property Tax Exemption Claim

- How to cancel medicaid in missouri form

- Masjid registration form

- Cupping form coffee amp crema

- Ma standard vacation recreational lease form

- Part submission warrent form

- Certificate of completion for insurance claim 10616920 form

- Unclaimed funds letter fill online printable fillable blank form

- Casc ontario region medical form casc on

Find out other Form 5076 Small Business Property Tax Exemption Claim

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form