Duportal Indownload579072 Property Tax PaymentPDF Property Tax Payment Agreement Application Duportal 2022-2026

Understanding the property tax payment agreement

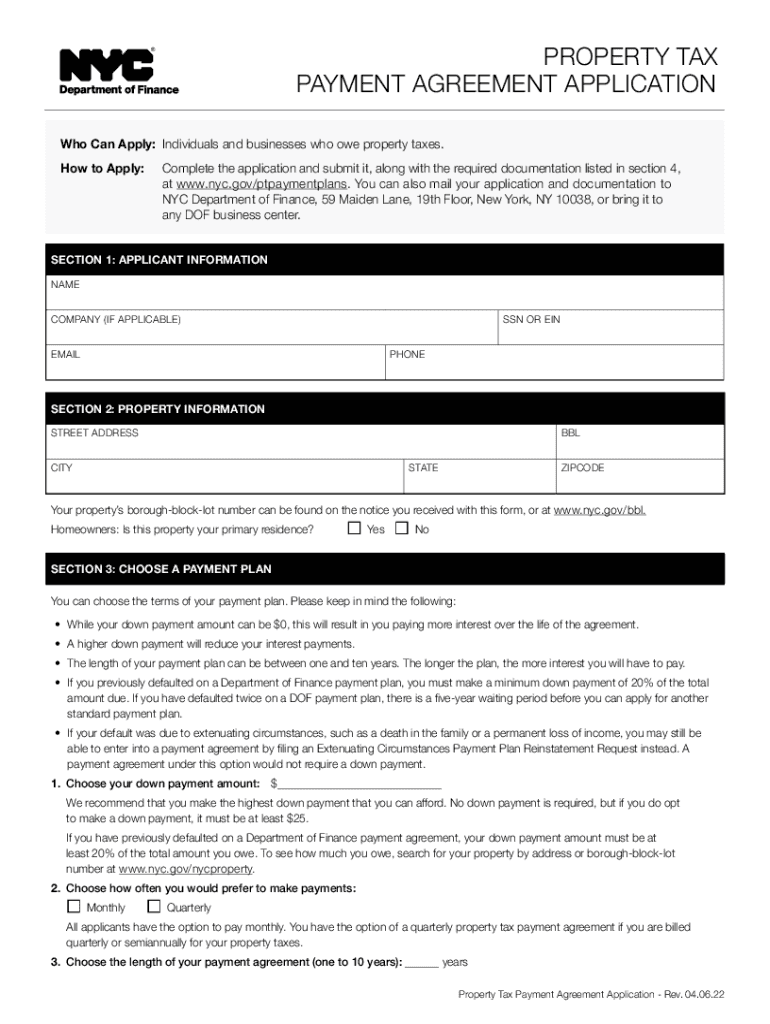

A property tax payment agreement is a formal arrangement between a property owner and the local government that allows the owner to pay their property taxes over time rather than in a lump sum. This agreement can provide financial relief for those who may struggle to meet their tax obligations in a single payment. It typically outlines the payment schedule, including the amount due and the frequency of payments, ensuring both parties are clear on the terms.

Steps to complete the property tax payment agreement

Completing a property tax payment agreement involves several key steps. First, gather all necessary documentation, including your property tax bill and any financial information that may be required. Next, fill out the property tax payment agreement form accurately, ensuring all details are correct. After completing the form, review it thoroughly before submitting it to the appropriate local government office. Finally, keep a copy of the signed agreement for your records.

Key elements of the property tax payment agreement

Several essential elements should be included in a property tax payment agreement to ensure its validity. These elements typically comprise the property owner's name and address, the tax parcel number, the total amount of taxes owed, the payment schedule, and any applicable interest or penalties. Additionally, the agreement should specify the consequences of failing to make payments as agreed, which may include liens or other legal actions.

Eligibility criteria for a property tax payment agreement

Eligibility for a property tax payment agreement can vary by jurisdiction, but common criteria include the property owner's current financial situation and their payment history. Some local governments may require proof of income or financial hardship to qualify for an installment plan. It is essential to check with your local tax authority to understand the specific requirements that apply to your situation.

Form submission methods for the property tax payment agreement

Submitting a property tax payment agreement can typically be done through various methods, including online submission, mail, or in-person delivery. Many local tax authorities offer online portals for easy submission, while others may require forms to be mailed or delivered directly to their offices. It is important to verify the submission method accepted by your local government to ensure timely processing.

Penalties for non-compliance with the property tax payment agreement

Failing to comply with the terms of a property tax payment agreement can lead to significant penalties. Common consequences include additional interest charges, late fees, and potential legal actions such as liens against the property. Understanding these penalties is crucial for property owners to avoid complications and maintain compliance with their tax obligations.

Quick guide on how to complete duportalindownload579072 property tax paymentpdf property tax payment agreement application duportal

Complete Duportal indownload579072 property tax paymentPDF Property Tax Payment Agreement Application Duportal effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary format and securely store it online. airSlate SignNow equips you with all the resources needed to create, amend, and electronically sign your documents swiftly without interruptions. Manage Duportal indownload579072 property tax paymentPDF Property Tax Payment Agreement Application Duportal on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related processes today.

The simplest way to modify and electronically sign Duportal indownload579072 property tax paymentPDF Property Tax Payment Agreement Application Duportal with ease

- Obtain Duportal indownload579072 property tax paymentPDF Property Tax Payment Agreement Application Duportal and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or redact confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors requiring new document prints. airSlate SignNow meets all your document management requirements with just a few clicks from your selected device. Modify and electronically sign Duportal indownload579072 property tax paymentPDF Property Tax Payment Agreement Application Duportal to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct duportalindownload579072 property tax paymentpdf property tax payment agreement application duportal

Create this form in 5 minutes!

People also ask

-

What is a property tax payment agreement?

A property tax payment agreement is a formal arrangement that allows property owners to pay their taxes in installments rather than as a lump sum. This can help ease financial burdens and ensure compliance with local tax regulations. Utilizing airSlate SignNow, businesses can easily create, send, and eSign these agreements electronically, streamlining the process.

-

How does airSlate SignNow facilitate property tax payment agreements?

With airSlate SignNow, creating a property tax payment agreement is simple and efficient. Users can customize templates, add necessary information, and send them out for electronic signatures. This digital process not only saves time but also eliminates the hassle of printing and mailing documents.

-

Are there any costs associated with using airSlate SignNow for property tax payment agreements?

While the basic features of airSlate SignNow come at an affordable price, specific costs may depend on the plan you choose. The pricing is transparent and includes tools tailored for creating property tax payment agreements, which can ultimately save you money on administrative expenses.

-

What features are included for managing property tax payment agreements?

airSlate SignNow offers a variety of features for managing property tax payment agreements, such as customizable templates, real-time tracking, and automated reminders. These features enhance efficiency and compliance, ensuring that important deadlines are never missed.

-

Can I integrate airSlate SignNow with other software for managing property tax payment agreements?

Yes, airSlate SignNow supports integrations with various software platforms, allowing you to manage property tax payment agreements seamlessly alongside your existing systems. This integration capability enhances workflow efficiency and data management.

-

What security measures does airSlate SignNow implement for property tax payment agreements?

Security is a key priority for airSlate SignNow, particularly for sensitive documents like property tax payment agreements. The platform employs advanced encryption protocols and secure data storage to protect your information, ensuring that your agreements remain confidential and secure.

-

How can electronic signatures expedite the property tax payment agreement process?

Electronic signatures streamline the property tax payment agreement process by eliminating the need for physical signatures, which can delay transactions. With airSlate SignNow, agreements can be signed instantly from any device, speeding up both the creation and finalization of the agreements.

Get more for Duportal indownload579072 property tax paymentPDF Property Tax Payment Agreement Application Duportal

- Nebraska transfer death form

- Quitclaim deed from corporation to husband and wife nebraska form

- Warranty deed from corporation to husband and wife nebraska form

- Quitclaim deed from corporation to individual nebraska form

- Warranty deed from corporation to individual nebraska form

- Quitclaim deed from corporation to llc nebraska form

- Quitclaim deed from corporation to corporation nebraska form

- Warranty deed from corporation to corporation nebraska form

Find out other Duportal indownload579072 property tax paymentPDF Property Tax Payment Agreement Application Duportal

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free