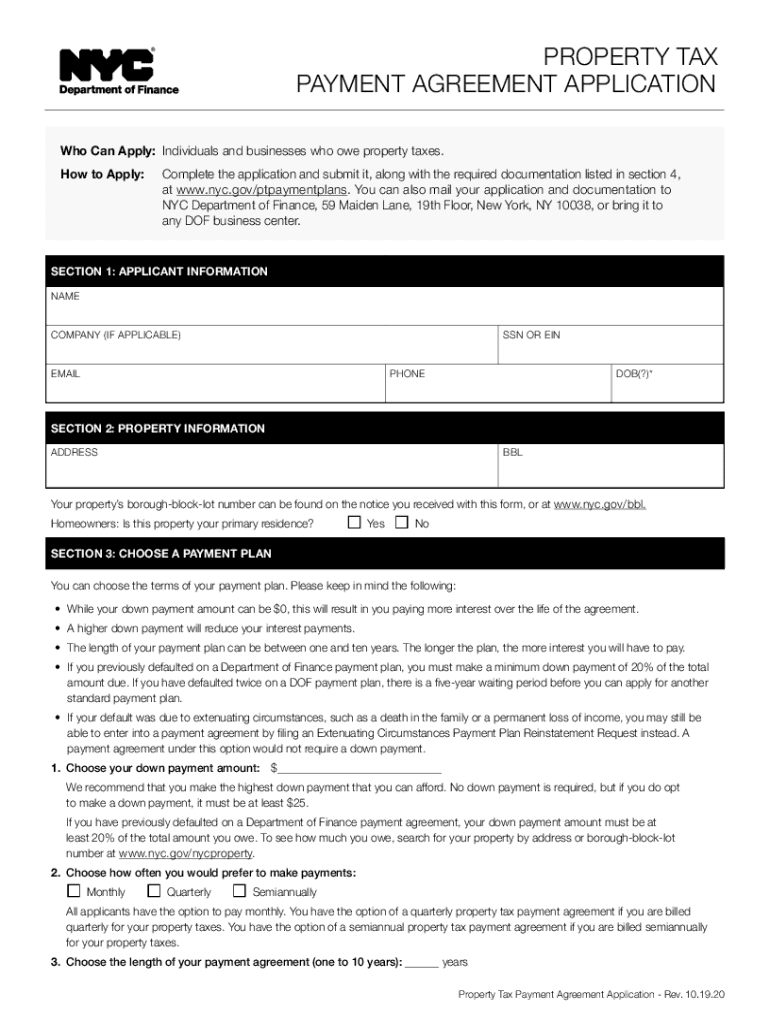

PAYMENT AGREEMENT APPLICATION 2020

Understanding the Payment Agreement Application

The Payment Agreement Application is a crucial document for taxpayers in New York City who wish to establish a payment plan for their property taxes. This application allows individuals to propose a structured payment schedule, making it easier to manage their tax obligations without facing immediate financial strain. By utilizing this application, taxpayers can avoid penalties and interest that may accrue from late payments, ensuring compliance with local tax laws.

Steps to Complete the Payment Agreement Application

Completing the Payment Agreement Application involves several key steps:

- Gather necessary documentation, including proof of income and any relevant financial statements.

- Access the application form through the NYC government website or designated tax office.

- Fill out the form accurately, providing all required information, such as personal details and tax account information.

- Submit the application either online or in person, depending on the options available.

- Await confirmation from the tax authority regarding the approval of your payment plan.

Eligibility Criteria for the Payment Agreement Application

To qualify for the Payment Agreement Application, taxpayers must meet specific criteria set by the NYC Department of Finance. These typically include:

- Being the owner of the property for which the taxes are owed.

- Demonstrating financial hardship or an inability to pay the full tax amount by the due date.

- Having no outstanding tax liens or unresolved tax issues.

Meeting these criteria is essential for the application to be considered, and applicants may need to provide additional documentation to support their claims of financial hardship.

Required Documents for the Payment Agreement Application

When applying for a payment agreement, taxpayers must submit several documents to support their application. These may include:

- Proof of income, such as pay stubs or tax returns.

- Bank statements to demonstrate financial status.

- Any relevant correspondence from the NYC Department of Finance regarding outstanding taxes.

Providing complete and accurate documentation can expedite the review process and increase the likelihood of approval.

Form Submission Methods

The Payment Agreement Application can be submitted through various methods, ensuring convenience for taxpayers. Options typically include:

- Online submission via the NYC government website, which allows for quick processing.

- Mailing the completed application to the appropriate tax office address.

- In-person submission at designated tax offices across New York City.

Choosing the right submission method can depend on individual circumstances and preferences, as well as deadlines for payment agreements.

Legal Use of the Payment Agreement Application

Utilizing the Payment Agreement Application is legally binding, provided that all information submitted is accurate and truthful. Once approved, the agreement outlines the terms of the payment plan, including the schedule and amounts due. Taxpayers are expected to adhere to the terms to avoid penalties or additional legal actions. Understanding the legal implications of this application is essential for maintaining compliance with NYC tax regulations.

Quick guide on how to complete payment agreement application

Finish PAYMENT AGREEMENT APPLICATION effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to easily find the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle PAYMENT AGREEMENT APPLICATION on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and electronically sign PAYMENT AGREEMENT APPLICATION without stress

- Find PAYMENT AGREEMENT APPLICATION and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to apply your changes.

- Select your preferred method of delivering your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors requiring new copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign PAYMENT AGREEMENT APPLICATION and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct payment agreement application

Create this form in 5 minutes!

How to create an eSignature for the payment agreement application

The way to make an eSignature for your PDF file online

The way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to nyc gov tax?

airSlate SignNow is an eSignature solution that enables businesses to send and sign documents electronically. By using airSlate SignNow, businesses in New York City can simplify their document workflows while ensuring compliance with nyc gov tax regulations.

-

How can airSlate SignNow assist in managing nyc gov tax documents?

With airSlate SignNow, you can easily create, send, and sign essential tax documents required for compliance with nyc gov tax laws. The platform streamlines the process, reducing paperwork and facilitating easier future audits.

-

Is airSlate SignNow a cost-effective solution for businesses dealing with nyc gov tax?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it a cost-effective option for managing documents related to nyc gov tax. You'll save on printing and mailing costs while ensuring timely submissions.

-

What features does airSlate SignNow provide for handling nyc gov tax forms?

airSlate SignNow includes powerful features such as templates for common nyc gov tax forms, real-time tracking, and secure storage. These features enhance document efficiency and ensure that your tax forms are always up-to-date.

-

Can airSlate SignNow integrate with other software for better nyc gov tax management?

Absolutely! airSlate SignNow can integrate with various CRM and accounting software, allowing for seamless management of nyc gov tax forms and data. This integration facilitates better overall tax reporting and compliance.

-

What benefits does airSlate SignNow offer for businesses regarding nyc gov tax compliance?

By using airSlate SignNow, businesses can enhance their compliance with nyc gov tax requirements. The platform minimizes errors through automated workflows and provides an audit trail for transparency and legal protection.

-

How secure is airSlate SignNow when handling sensitive nyc gov tax documents?

Security is a top priority for airSlate SignNow. When dealing with nyc gov tax documents, the platform employs advanced encryption and compliance with industry standards to ensure that your sensitive information remains protected.

Get more for PAYMENT AGREEMENT APPLICATION

Find out other PAYMENT AGREEMENT APPLICATION

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed