M11H, Insurance Premium Tax Return for HMOs M11H, Insurance Premium Tax Return for HMOs 2022-2026

What is the M11H, Insurance Premium Tax Return For HMOs

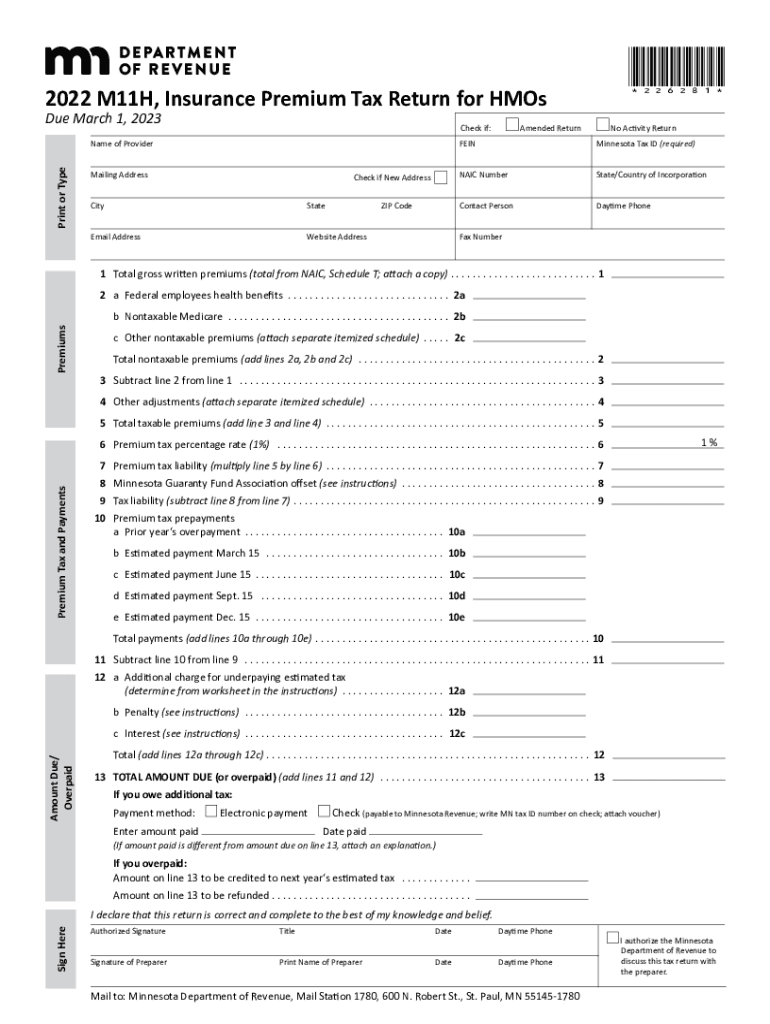

The M11H form is specifically designed for reporting insurance premium taxes for Health Maintenance Organizations (HMOs) in the United States. This form is crucial for HMOs to comply with state regulations regarding the taxation of insurance premiums. It captures essential data regarding the premiums collected and ensures that the organization meets its tax obligations. Understanding the purpose and requirements of the M11H is vital for HMOs to maintain compliance and avoid potential penalties.

How to use the M11H, Insurance Premium Tax Return For HMOs

Using the M11H form involves several key steps that ensure accurate reporting of insurance premium taxes. HMOs should begin by gathering all necessary financial data related to premiums collected during the reporting period. Once the data is compiled, the form can be filled out, ensuring that all sections are completed accurately. It is advisable to review the form for any errors before submission to prevent delays or issues with compliance.

Steps to complete the M11H, Insurance Premium Tax Return For HMOs

Completing the M11H form requires a systematic approach:

- Gather all relevant financial records, including premium collections and any applicable deductions.

- Access the M11H form from the appropriate state agency or regulatory body.

- Fill out the form, ensuring that all required fields are completed with accurate information.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, either electronically or via mail, as specified by state regulations.

Legal use of the M11H, Insurance Premium Tax Return For HMOs

The M11H form is legally binding when filled out and submitted according to state laws. It is essential for HMOs to understand the legal implications of the information provided on the form. Accurate reporting ensures compliance with tax regulations and helps avoid penalties. Moreover, electronic signatures on the M11H can enhance the legal validity of the submission, provided that all eSignature laws are adhered to.

Filing Deadlines / Important Dates

HMOs must be aware of the specific filing deadlines associated with the M11H form to avoid late penalties. Typically, the deadlines coincide with the end of the fiscal year or specific state-mandated dates. It is advisable to check with the relevant state agency for the exact dates and ensure timely submission of the M11H to maintain compliance.

Required Documents

To complete the M11H form, HMOs need to have several documents ready:

- Records of all premiums collected during the reporting period.

- Documentation of any deductions or exemptions that may apply.

- Previous M11H submissions for reference, if applicable.

Having these documents organized will facilitate a smoother completion process and ensure accuracy in reporting.

Quick guide on how to complete 2022 m11h insurance premium tax return for hmos 2022 m11h insurance premium tax return for hmos

Complete M11H, Insurance Premium Tax Return For HMOs M11H, Insurance Premium Tax Return For HMOs with ease on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers a fantastic environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, adjust, and electronically sign your documents quickly and efficiently. Manage M11H, Insurance Premium Tax Return For HMOs M11H, Insurance Premium Tax Return For HMOs on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to adjust and electronically sign M11H, Insurance Premium Tax Return For HMOs M11H, Insurance Premium Tax Return For HMOs effortlessly

- Locate M11H, Insurance Premium Tax Return For HMOs M11H, Insurance Premium Tax Return For HMOs and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management in a few clicks from any device you prefer. Edit and electronically sign M11H, Insurance Premium Tax Return For HMOs M11H, Insurance Premium Tax Return For HMOs and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 m11h insurance premium tax return for hmos 2022 m11h insurance premium tax return for hmos

Create this form in 5 minutes!

People also ask

-

What is the m11h feature in airSlate SignNow?

The m11h feature in airSlate SignNow allows users to streamline their document signing process through a user-friendly interface. With m11h, you can easily send, receive, and manage electronic signatures, making document workflows faster and more efficient.

-

How does m11h help reduce document processing time?

By utilizing the m11h capabilities, airSlate SignNow signNowly reduces the time it takes to process documents. Automated notifications and customizable templates save users valuable hours that can be spent on more important tasks.

-

What are the pricing options for m11h on airSlate SignNow?

airSlate SignNow offers various pricing tiers tailored to meet the needs of different businesses. The m11h feature is included in each package, allowing you to choose the option that best suits your organization’s budget while reaping the benefits of efficient document management.

-

Can I integrate m11h with other applications?

Yes, airSlate SignNow supports integrations with a wide range of applications, enhancing the utility of the m11h feature. Users can connect with CRM systems, cloud storage services, and more, ensuring a seamless workflow across platforms.

-

What types of businesses benefit the most from using m11h?

Small to medium-sized enterprises and large organizations alike can benefit from the m11h feature provided by airSlate SignNow. Any business that regularly deals with contracts, agreements, or forms can enhance efficiency and reduce turnaround times using m11h.

-

Is m11h secure for sensitive document signing?

Absolutely! The m11h feature in airSlate SignNow is designed with robust security measures, ensuring that sensitive documents are protected. With encryption, secure access, and audit trails, users can confidently manage their eSignatures.

-

What support is available for m11h users?

airSlate SignNow provides comprehensive support for users of the m11h feature, including tutorials, FAQ sections, and customer service assistance. Whether you need help setting up or have specific questions, support is readily available to ensure a smooth experience.

Get more for M11H, Insurance Premium Tax Return For HMOs M11H, Insurance Premium Tax Return For HMOs

- Agreed cancellation of lease nebraska form

- Amendment of residential lease nebraska form

- Agreement for payment of unpaid rent nebraska form

- Commercial lease assignment from tenant to new tenant nebraska form

- Tenant consent to background and reference check nebraska form

- Residential lease or rental agreement for month to month nebraska form

- Residential rental lease agreement nebraska form

- Tenant welcome letter nebraska form

Find out other M11H, Insurance Premium Tax Return For HMOs M11H, Insurance Premium Tax Return For HMOs

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter