Minnesota Form M1 Individual Income Tax Return TaxFormFinderMinnesota Minnesota Individual Income Tax InstructionsMinnesota Minn 2022

What is the Minnesota Form M1 Individual Income Tax Return?

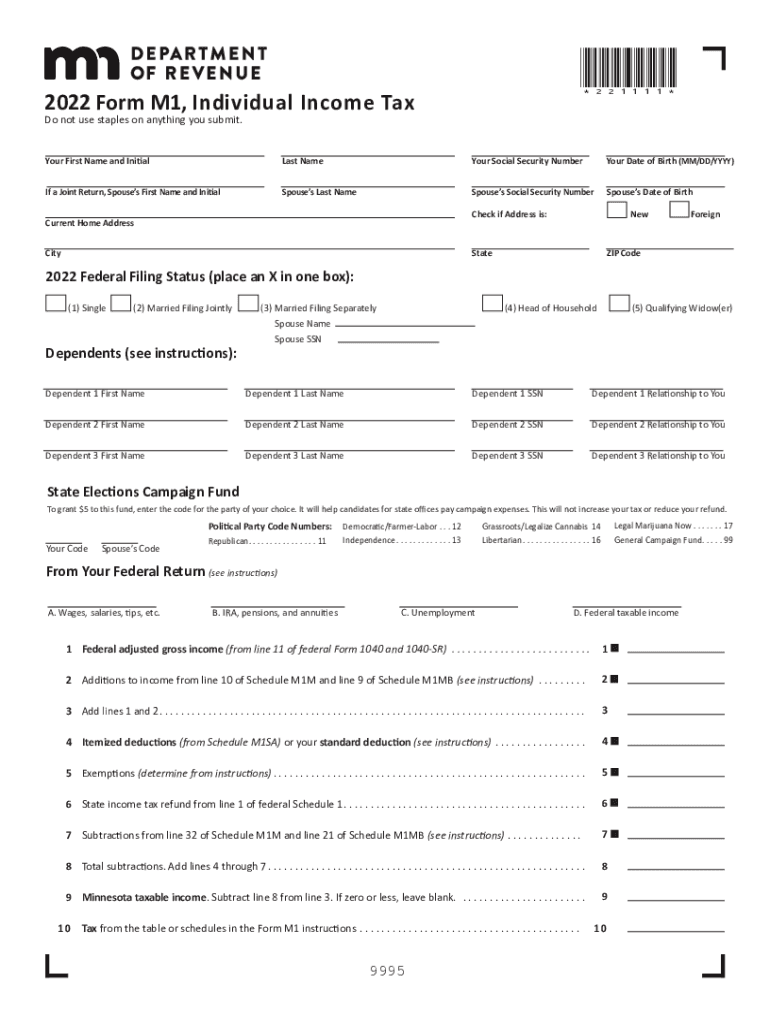

The Minnesota Form M1 is the Individual Income Tax Return used by residents of Minnesota to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state, allowing them to comply with Minnesota tax laws. The M1 form includes various sections where taxpayers can report wages, interest, dividends, and other sources of income, as well as claim deductions and credits available under Minnesota law.

Steps to Complete the Minnesota Form M1 Individual Income Tax Return

Completing the Minnesota Form M1 involves several key steps:

- Gather all necessary documents, including W-2 forms, 1099s, and records of other income.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report your total income in the designated section, ensuring accuracy to avoid discrepancies.

- Claim any deductions and credits you qualify for, which can reduce your taxable income.

- Calculate your total tax liability based on the income reported and the deductions claimed.

- Sign and date the form, certifying that the information provided is accurate to the best of your knowledge.

Key Elements of the Minnesota Form M1 Individual Income Tax Return

The Minnesota Form M1 includes several critical components:

- Personal Information: Details about the taxpayer and their dependents.

- Income Reporting: Sections for different types of income, such as wages, self-employment income, and investment income.

- Deductions and Credits: Opportunities to lower taxable income through various state-specific deductions and credits.

- Tax Calculation: A section to compute the total tax owed based on the income and deductions provided.

- Signature Line: A requirement for the taxpayer's signature, affirming the accuracy of the information submitted.

Legal Use of the Minnesota Form M1 Individual Income Tax Return

The Minnesota Form M1 is legally recognized as a valid document for filing state income taxes. It must be completed accurately and submitted by the designated deadline to avoid penalties. The form can be filed electronically or via mail, and it is essential to retain copies of the submitted form and any supporting documents for future reference, as they may be required for audits or inquiries from the Minnesota Department of Revenue.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines for the Minnesota Form M1 to ensure timely submission. Typically, the deadline for filing individual income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers may request an extension, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Form Submission Methods (Online / Mail / In-Person)

There are several methods available for submitting the Minnesota Form M1:

- Online Filing: Taxpayers can file electronically using approved tax software or through the Minnesota Department of Revenue's online portal.

- Mail Submission: Completed forms can be mailed to the appropriate address provided by the Minnesota Department of Revenue.

- In-Person Filing: Some taxpayers may choose to file in person at designated state tax offices, although this option may vary based on location and availability.

Quick guide on how to complete minnesota form m1 individual income tax return taxformfinderminnesota minnesota individual income tax instructionsminnesota

Prepare Minnesota Form M1 Individual Income Tax Return TaxFormFinderMinnesota Minnesota Individual Income Tax InstructionsMinnesota Minn effortlessly on any device

Digital document management has gained signNow traction among organizations and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents swiftly without complications. Manage Minnesota Form M1 Individual Income Tax Return TaxFormFinderMinnesota Minnesota Individual Income Tax InstructionsMinnesota Minn on any platform using airSlate SignNow mobile applications for Android or iOS, and simplify any document-related task today.

How to modify and eSign Minnesota Form M1 Individual Income Tax Return TaxFormFinderMinnesota Minnesota Individual Income Tax InstructionsMinnesota Minn with ease

- Find Minnesota Form M1 Individual Income Tax Return TaxFormFinderMinnesota Minnesota Individual Income Tax InstructionsMinnesota Minn and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize signNow sections of your documents or redact sensitive information using tools specifically available from airSlate SignNow.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign Minnesota Form M1 Individual Income Tax Return TaxFormFinderMinnesota Minnesota Individual Income Tax InstructionsMinnesota Minn and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota form m1 individual income tax return taxformfinderminnesota minnesota individual income tax instructionsminnesota

Create this form in 5 minutes!

People also ask

-

What are the Minnesota Form M1 instructions for 2022?

The Minnesota Form M1 instructions for 2022 provide detailed guidance on how to complete your state income tax return. This includes information on deductions, credits, and proper submission procedures. It’s essential to follow these instructions carefully to ensure accurate filing and avoid penalties.

-

Where can I find the Minnesota Form M1 instructions for 2022?

You can find the Minnesota Form M1 instructions for 2022 on the Minnesota Department of Revenue’s official website. They provide downloadable PDFs and online resources to help you understand the filing process. Make sure to review these materials to stay informed about any changes or updates.

-

What is the cost of using airSlate SignNow to file Minnesota Form M1 for 2022?

Using airSlate SignNow to manage your Minnesota Form M1 for 2022 is both cost-effective and efficient. Our pricing plans are designed to fit various budgets, offering features that simplify document signing and management. You can enjoy a seamless experience without breaking the bank.

-

What features does airSlate SignNow offer for signing documents related to Minnesota Form M1 instructions 2022?

airSlate SignNow offers a range of features that are perfect for handling documents related to Minnesota Form M1 instructions 2022. These include eSignature capabilities, document templates, and secure cloud storage. These tools enhance collaboration and streamline the filing process for your tax returns.

-

Are there any benefits to using airSlate SignNow for Minnesota Form M1 instructions 2022?

Yes, there are numerous benefits to using airSlate SignNow for Minnesota Form M1 instructions 2022. It accelerates the process of completing and signing documents, reduces errors, and provides easy access to your files anytime, anywhere. Plus, it helps you stay organized throughout the tax filing season.

-

Does airSlate SignNow integrate with other platforms for tax filing needs related to the Minnesota Form M1 instructions 2022?

Absolutely! airSlate SignNow integrates seamlessly with various tax software solutions and online platforms. This allows you to handle all your Minnesota Form M1 instructions 2022 needs efficiently and effectively, giving you the versatility to manage your documents and files in one place.

-

How can airSlate SignNow improve my experience with Minnesota Form M1 instructions 2022?

airSlate SignNow enhances your experience with Minnesota Form M1 instructions 2022 by simplifying the document signing process. Its user-friendly interface and powerful features help eliminate the hassle of manual paperwork. Experience a faster, more secure way to manage your tax documents.

Get more for Minnesota Form M1 Individual Income Tax Return TaxFormFinderMinnesota Minnesota Individual Income Tax InstructionsMinnesota Minn

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497318275 form

- Annual minutes nebraska nebraska form

- Notices resolutions simple stock ledger and certificate nebraska form

- Minutes for organizational meeting nebraska nebraska form

- Sample transmittal letter to secretary of states office to file articles of incorporation nebraska nebraska form

- Lead based paint disclosure for sales transaction nebraska form

- Lead based paint disclosure for rental transaction nebraska form

- Notice of lease for recording nebraska form

Find out other Minnesota Form M1 Individual Income Tax Return TaxFormFinderMinnesota Minnesota Individual Income Tax InstructionsMinnesota Minn

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy