M1, Individual Income Tax Return 2023

What is the M1, Individual Income Tax Return

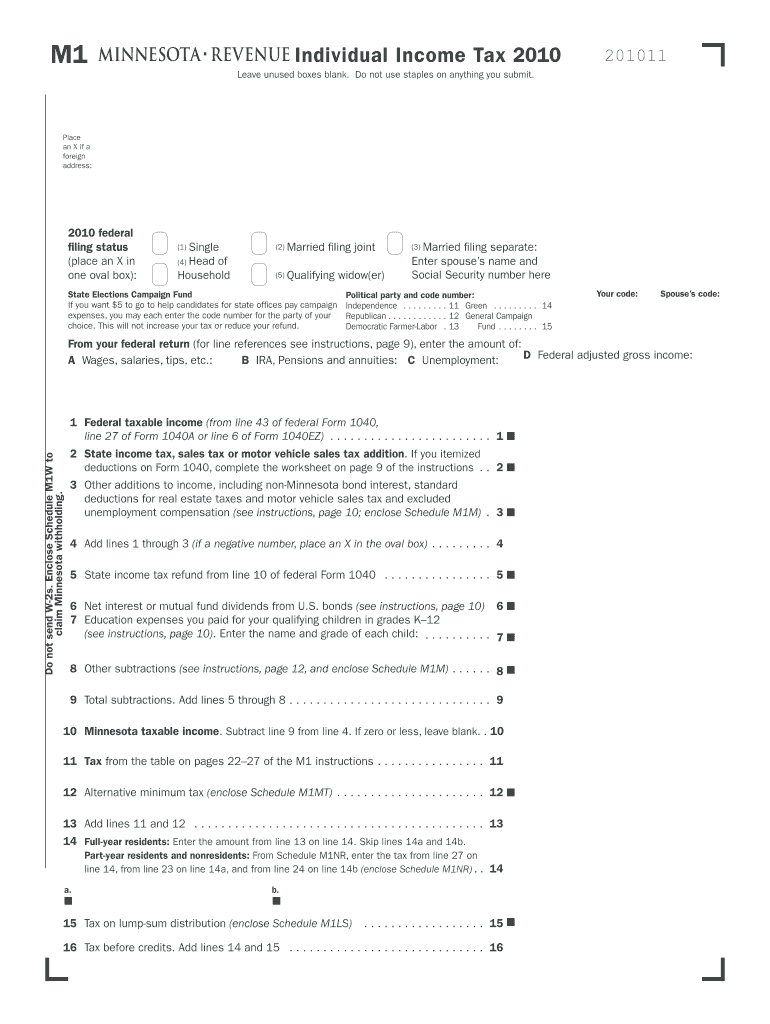

The M1 form, officially known as the Individual Income Tax Return, is a crucial document for Minnesota residents. It is used to report income, calculate tax liability, and determine eligibility for various credits and deductions. This form is essential for individuals who earned income during the tax year and need to fulfill their state tax obligations. Understanding the M1 form is vital for accurate tax reporting and compliance with Minnesota tax laws.

Steps to complete the M1, Individual Income Tax Return

Completing the M1 form involves several key steps. First, gather all necessary documentation, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering personal information, such as your name, address, and Social Security number. Then, report your income from various sources, including wages, interest, and dividends. After calculating your total income, apply any deductions or credits you qualify for. Finally, review the completed form for accuracy before submitting it to the Minnesota Department of Revenue.

Required Documents

To accurately complete the M1 form, certain documents are essential. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for deductions, such as mortgage interest statements

- Records of any tax credits claimed

- Previous year's tax return for reference

Having these documents on hand will streamline the process and ensure that all income and deductions are accurately reported.

Filing Deadlines / Important Dates

It is important to be aware of key deadlines when filing the M1 form. Typically, the deadline for submitting the M1 for the previous tax year is April fifteenth. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you need more time, you can file for an extension, but it is crucial to pay any owed taxes by the original deadline to avoid penalties.

Form Submission Methods

The M1 form can be submitted in several ways, providing flexibility for taxpayers. You can file the form online through the Minnesota Department of Revenue's e-filing system, which is often the quickest option. Alternatively, you can mail a paper version of the form to the appropriate address provided on the form's instructions. In-person submission is also available at designated tax offices, allowing for direct assistance if needed.

Eligibility Criteria

Eligibility to file the M1 form generally includes individuals who are residents of Minnesota and have earned income during the tax year. Specific criteria may vary based on factors such as age, filing status, and income level. It is essential to review these criteria to ensure compliance and determine if additional forms or schedules are required based on individual circumstances.

Quick guide on how to complete m1 individual income tax return

Manage M1, Individual Income Tax Return effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without any hold-ups. Handle M1, Individual Income Tax Return on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

Steps to modify and eSign M1, Individual Income Tax Return with ease

- Locate M1, Individual Income Tax Return and click Get Form to commence.

- Employ the tools we offer to fill out your document.

- Mark relevant sections of your documents or blackout sensitive information with tools that airSlate SignNow offers for that specific purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to preserve your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form navigation, or mistakes necessitating the printing of new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Modify and eSign M1, Individual Income Tax Return to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct m1 individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the m1 individual income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Minnesota Form M1 instructions for 2016?

The Minnesota Form M1 instructions for 2016 provide detailed guidance on how to complete your state income tax return. This includes information on eligibility, deductions, and credits available for that tax year. Following these instructions carefully ensures accurate filing and compliance with state regulations.

-

How can airSlate SignNow help with filing Minnesota Form M1 for 2016?

airSlate SignNow simplifies the process of filing Minnesota Form M1 for 2016 by allowing users to eSign and send documents securely. Our platform ensures that all necessary forms are completed accurately and can be submitted electronically, saving time and reducing errors. This makes tax filing more efficient and stress-free.

-

What features does airSlate SignNow offer for document management related to Minnesota Form M1 instructions 2016?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing Minnesota Form M1 instructions for 2016. These tools help users streamline their document workflows and ensure that all necessary paperwork is handled efficiently. Additionally, our platform integrates seamlessly with various applications for enhanced productivity.

-

Is there a cost associated with using airSlate SignNow for Minnesota Form M1 instructions 2016?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including those looking to manage Minnesota Form M1 instructions for 2016. Our plans are designed to be cost-effective, providing excellent value for the features and support offered. You can choose a plan that best fits your requirements and budget.

-

Can I integrate airSlate SignNow with other software for handling Minnesota Form M1 instructions 2016?

Absolutely! airSlate SignNow supports integrations with a variety of software applications, making it easy to manage Minnesota Form M1 instructions for 2016 alongside your existing tools. This allows for a seamless workflow, enabling users to connect their document management processes with accounting software, CRMs, and more.

-

What are the benefits of using airSlate SignNow for Minnesota Form M1 instructions 2016?

Using airSlate SignNow for Minnesota Form M1 instructions for 2016 offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved accuracy. Our platform allows for quick eSigning and document sharing, which accelerates the filing process. Additionally, users can access their documents anytime, anywhere, ensuring flexibility and convenience.

-

How secure is airSlate SignNow when handling Minnesota Form M1 instructions 2016?

Security is a top priority at airSlate SignNow. When handling Minnesota Form M1 instructions for 2016, our platform employs advanced encryption and security protocols to protect sensitive information. Users can trust that their documents are safe and secure throughout the signing and submission process.

Get more for M1, Individual Income Tax Return

Find out other M1, Individual Income Tax Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors