Www Revenue State Mn Us2021 12m12102021 Form M1, Individual Income Tax Return 2021

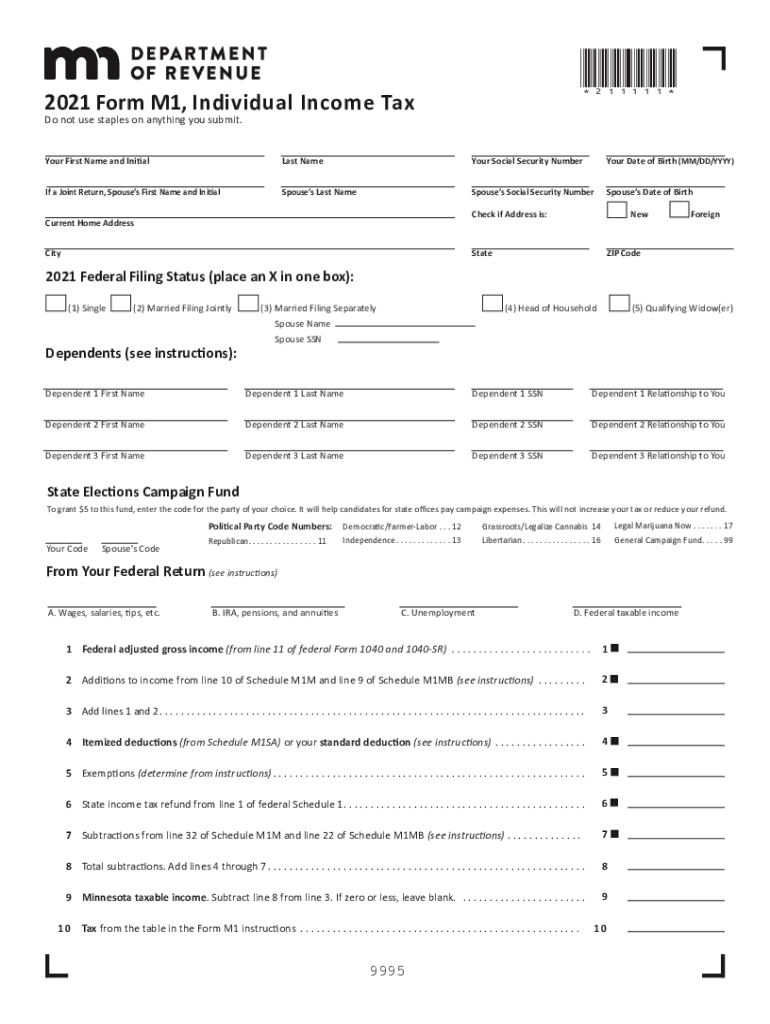

What is the Minnesota Form M1, Individual Income Tax Return?

The Minnesota Form M1 is the state's individual income tax return form. It is used by residents to report their income, calculate their tax liability, and determine any refunds or payments due. This form is essential for anyone who earns income in Minnesota, including wages, self-employment income, and other sources. Understanding the purpose and requirements of the Form M1 is crucial for accurate tax filing.

Steps to Complete the Minnesota Form M1

Completing the Minnesota Form M1 involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, dividends, and any other taxable income.

- Calculate your deductions and credits to determine your taxable income.

- Compute your tax liability based on the Minnesota tax rates.

- Determine if you owe taxes or are due a refund.

- Sign and date the form before submitting it.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Minnesota Form M1. Typically, the deadline for filing individual income tax returns is April 15 of the following year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, taxpayers may request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Form Submission Methods

The Minnesota Form M1 can be submitted through various methods:

- Online: Taxpayers can file electronically using approved e-filing software or through the Minnesota Department of Revenue's online portal.

- Mail: Completed forms can be printed and mailed to the appropriate address provided by the Minnesota Department of Revenue.

- In-Person: Taxpayers may also choose to deliver their forms in person at designated state offices.

Required Documents for Filing

To complete the Minnesota Form M1, taxpayers need to gather specific documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions, such as mortgage interest statements or charitable contributions

- Any additional documentation related to credits or adjustments

Legal Use of the Minnesota Form M1

The Minnesota Form M1 is legally binding once it is signed and submitted. It is important to ensure that all information provided is accurate and complete, as any discrepancies may lead to audits or penalties. The form must comply with state tax laws and regulations, including proper calculations of income and tax owed. Utilizing a reliable platform for electronic signatures can enhance the legitimacy of the submission.

Quick guide on how to complete wwwrevenuestatemnus2021 12m12102021 form m1 individual income tax return

Complete Www revenue state mn us2021 12m12102021 Form M1, Individual Income Tax Return effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, enabling you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Www revenue state mn us2021 12m12102021 Form M1, Individual Income Tax Return on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign Www revenue state mn us2021 12m12102021 Form M1, Individual Income Tax Return without hassle

- Find Www revenue state mn us2021 12m12102021 Form M1, Individual Income Tax Return and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about misplaced or lost files, tiring form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choice. Modify and eSign Www revenue state mn us2021 12m12102021 Form M1, Individual Income Tax Return and ensure outstanding communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwrevenuestatemnus2021 12m12102021 form m1 individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the wwwrevenuestatemnus2021 12m12102021 form m1 individual income tax return

The best way to make an e-signature for your PDF in the online mode

The best way to make an e-signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to Minnesota tax?

airSlate SignNow is an easy-to-use platform that allows businesses to send and eSign documents efficiently. For companies dealing with Minnesota tax matters, our solution provides a streamlined approach to handle forms and contracts, ensuring compliance and fast processing.

-

How does airSlate SignNow help with Minnesota tax documentation?

With airSlate SignNow, you can create, send, and eSign essential Minnesota tax documents in minutes. Our platform allows for real-time collaboration, ensuring that all parties can review and approve tax-related forms without delays.

-

What pricing options are available for airSlate SignNow related to Minnesota tax services?

Our pricing plans are designed to be cost-effective while catering to your Minnesota tax needs. We offer flexible subscription options to fit different business sizes, ensuring you only pay for the features you need to manage your tax documentation efficiently.

-

What features does airSlate SignNow offer for managing Minnesota tax forms?

airSlate SignNow provides various features, such as custom templates, automated reminders, and secure storage for Minnesota tax forms. These tools enhance workflow efficiency, reducing the time spent on paperwork and allowing you to focus on important tasks.

-

Is airSlate SignNow compliant with Minnesota tax laws?

Yes, airSlate SignNow is designed to comply with the regulations surrounding Minnesota tax processes. Our platform ensures that all eSignatures and document transactions meet legal requirements, giving you peace of mind in your tax dealings.

-

Can I integrate airSlate SignNow with my current accounting software for Minnesota tax purposes?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software that can simplify your Minnesota tax calculations. These integrations enable smooth data transfer, helping you maintain accuracy in your financial documents.

-

What benefits does airSlate SignNow provide for Minnesota tax professionals?

For tax professionals in Minnesota, airSlate SignNow enhances efficiency by speeding up the signing process and reducing paperwork. You'll save time and resources, allowing you to manage more clients and focus on providing excellent service without the hassle of traditional document handling.

Get more for Www revenue state mn us2021 12m12102021 Form M1, Individual Income Tax Return

- Escrow agreement between limited partnerships mississippi form

- Escrow agreement involving bank loan mississippi form

- Notice of satisfaction of escrow agreement mississippi form

- Escrow release mississippi form

- Ms eviction form

- Debtor form

- Application for writ of garnishment mississippi form

- Ms writ garnishment form

Find out other Www revenue state mn us2021 12m12102021 Form M1, Individual Income Tax Return

- eSign Utah Commercial Lease Agreement Template Online

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application