Form M1 Individual Income Tax Return Printable 2020

What is the Form M1 Individual Income Tax Return Printable

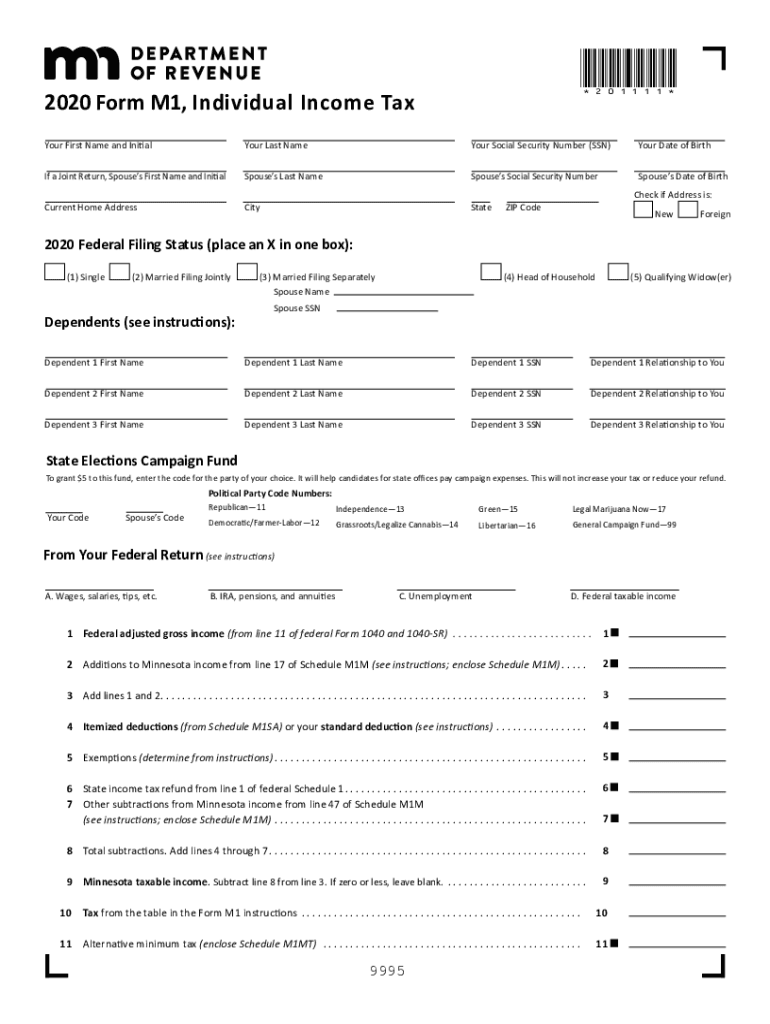

The Form M1 is the Individual Income Tax Return for residents of Minnesota. This form is used to report income, claim deductions, and calculate tax liability for individuals. It is essential for residents who earn income within the state to ensure compliance with Minnesota tax laws. The printable version of the form allows taxpayers to fill it out manually or digitally, providing flexibility in how it is completed and submitted. Understanding the specific requirements of the Form M1 is crucial for accurate reporting and avoiding potential penalties.

How to use the Form M1 Individual Income Tax Return Printable

Using the Form M1 involves several steps to ensure proper completion and submission. Taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. Once the form is obtained, individuals can fill it out by entering their personal information, income details, and deductions. It is important to follow the instructions carefully to avoid errors that could lead to delays or penalties. After completing the form, taxpayers can submit it either electronically or by mail, depending on their preference.

Steps to complete the Form M1 Individual Income Tax Return Printable

Completing the Form M1 requires attention to detail. Here are the essential steps:

- Gather all income documents, such as W-2s and 1099s.

- Obtain the Form M1 from a reliable source.

- Fill in personal information, including name, address, and Social Security number.

- Report all sources of income accurately.

- Claim any deductions for which you are eligible.

- Calculate the total tax owed or refund due.

- Review the completed form for accuracy.

- Submit the form by the appropriate deadline.

Legal use of the Form M1 Individual Income Tax Return Printable

The Form M1 is legally recognized for filing state income taxes in Minnesota. To ensure its legal validity, taxpayers must adhere to all relevant guidelines and regulations set forth by the Minnesota Department of Revenue. This includes providing accurate information and signing the form where required. Electronic signatures are acceptable as long as they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other applicable laws. Proper use of the form helps maintain compliance and avoids potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form M1 are crucial for taxpayers to avoid penalties. Typically, the deadline for submitting the Form M1 is April 15 of each year, unless it falls on a weekend or holiday, in which case the deadline may be extended. Taxpayers should also be aware of any potential extensions that may be available, allowing additional time to file. Staying informed about these important dates ensures that individuals can complete their tax obligations in a timely manner.

Required Documents

To successfully complete the Form M1, several documents are required. These typically include:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Documentation for any deductions claimed, such as receipts for charitable contributions or medical expenses.

- Previous year’s tax return for reference.

Having these documents ready simplifies the process of filling out the Form M1 and helps ensure accuracy in reporting income and deductions.

Quick guide on how to complete free form m1 individual income tax return printable free

Effortlessly Prepare Form M1 Individual Income Tax Return Printable on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed papers, as you can locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly and painlessly. Manage Form M1 Individual Income Tax Return Printable on any platform using the airSlate SignNow Android or iOS applications and enhance your document-driven processes today.

The Easiest Way to Edit and Electronically Sign Form M1 Individual Income Tax Return Printable with Ease

- Locate Form M1 Individual Income Tax Return Printable and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically designed for this by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misplaced paperwork, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs within a few clicks from any device you prefer. Modify and electronically sign Form M1 Individual Income Tax Return Printable to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct free form m1 individual income tax return printable free

Create this form in 5 minutes!

How to create an eSignature for the free form m1 individual income tax return printable free

The way to create an eSignature for a PDF in the online mode

The way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is form m1 and how can it benefit my business?

Form m1 is a customizable document form that simplifies the process of gathering signatures and approvals. By utilizing form m1, your business can streamline workflows, reduce paperwork, and improve efficiency in document management.

-

How much does it cost to use form m1 with airSlate SignNow?

The pricing for form m1 with airSlate SignNow varies based on the subscription plan chosen. Our pricing models are designed to be cost-effective, ensuring that your business receives maximum value while leveraging the features of form m1 for your document signing needs.

-

Can I integrate form m1 with other applications I use?

Yes, airSlate SignNow allows for seamless integration of form m1 with a variety of applications, including CRM systems and cloud storage services. This ensures that your document workflows are connected, efficient, and enhance productivity across your business.

-

What features are included with form m1?

Form m1 includes features like customizable templates, automated reminders, and status tracking for your documents. These capabilities help ensure that your documents are managed effectively and that signatories can easily complete their tasks.

-

How does form m1 improve document signing speed?

With form m1, airSlate SignNow reduces the time required for document signing by allowing users to complete and send documents electronically. This not only accelerates the signing process but also minimizes delays that are common with paper-based methods.

-

Is form m1 secure for sensitive documents?

Absolutely! Form m1 on airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect your sensitive documents. You can confidently use form m1 knowing that your data is secure throughout the signing process.

-

What kind of customer support do I get for using form m1?

AirSlate SignNow provides dedicated customer support for users of form m1. Our support team is available to assist you with any questions or issues you may encounter, ensuring that you can utilize form m1 effectively without interruptions.

Get more for Form M1 Individual Income Tax Return Printable

- Transfer on death quitclaim deed from individual to individual without provision for successor beneficiary washington form

- Wa appeal form

- Quitclaim deed from corporation to husband and wife washington form

- Warranty deed from corporation to husband and wife washington form

- Quitclaim deed from corporation to individual washington form

- Warranty deed from corporation to individual washington form

- Quitclaim deed from corporation to llc washington form

- Quitclaim deed from corporation to corporation washington form

Find out other Form M1 Individual Income Tax Return Printable

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile