Form PT 350 Petroleum Business Tax Return for Fuel 2019

What is the Form PT 350 Petroleum Business Tax Return For Fuel

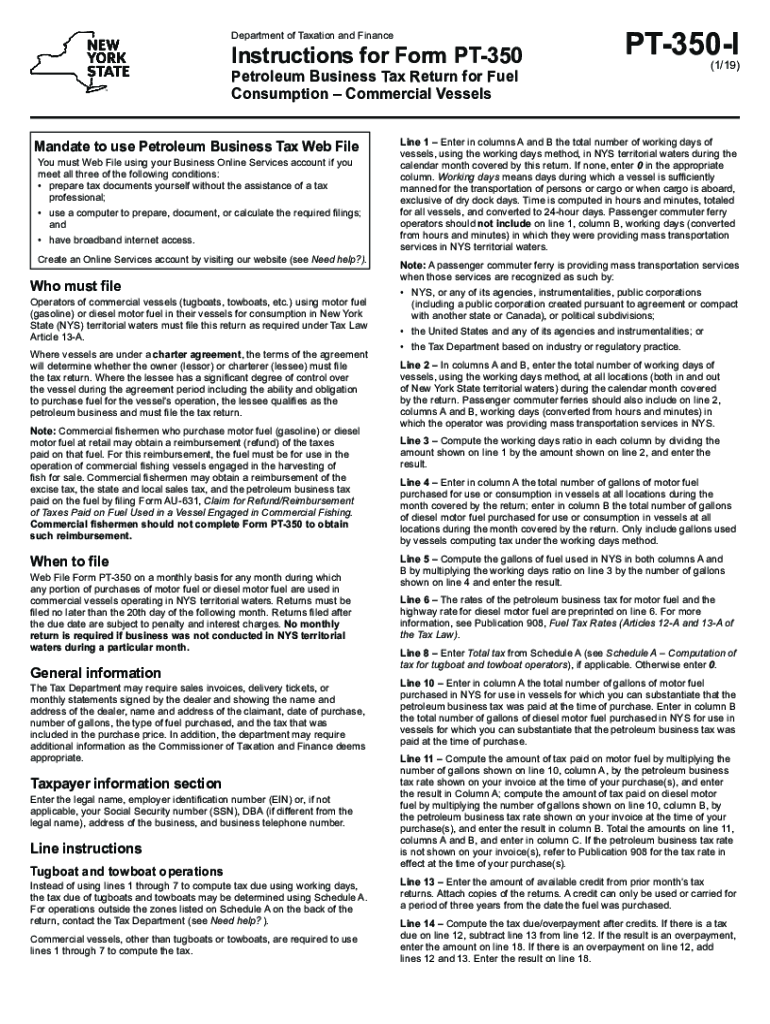

The Form PT 350 Petroleum Business Tax Return For Fuel is a specific tax document required by businesses involved in the petroleum industry. This form is used to report the tax liabilities associated with the sale and distribution of fuel products. It is essential for ensuring compliance with state and federal tax regulations, allowing businesses to accurately calculate the taxes owed on their fuel transactions.

How to use the Form PT 350 Petroleum Business Tax Return For Fuel

Using the Form PT 350 involves several key steps. First, businesses must gather all relevant financial data regarding fuel sales and purchases. This includes invoices, receipts, and any other documentation that supports the reported figures. Once the data is compiled, businesses fill out the form by entering the required information in the designated fields. It is important to review the completed form for accuracy before submission to avoid potential penalties.

Steps to complete the Form PT 350 Petroleum Business Tax Return For Fuel

Completing the Form PT 350 requires a systematic approach:

- Collect all necessary financial records related to fuel transactions.

- Fill in the business information, including name, address, and tax identification number.

- Report the total gallons of fuel sold and the corresponding tax rate.

- Calculate the total tax liability based on the reported sales.

- Review the form for accuracy and completeness.

- Submit the form by the designated deadline, ensuring compliance with all regulations.

Legal use of the Form PT 350 Petroleum Business Tax Return For Fuel

The legal use of the Form PT 350 is governed by various tax laws and regulations. To be considered valid, the form must be completed accurately and submitted on time. Additionally, businesses must ensure that all reported figures are truthful and substantiated by appropriate documentation. Failure to comply with these legal requirements can result in penalties, including fines and increased scrutiny from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form PT 350 can vary based on state regulations. Typically, businesses must submit the form on a quarterly basis, aligning with the end of each fiscal quarter. It is crucial for businesses to be aware of these deadlines to avoid late fees and penalties. Keeping a calendar of important dates related to tax filings can help ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The Form PT 350 can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through the state’s tax portal.

- Mailing a physical copy of the form to the appropriate tax authority.

- In-person submission at designated tax offices, if available.

Each method has its own requirements and processing times, so businesses should choose the method that best suits their needs.

Quick guide on how to complete form pt 350 petroleum business tax return for fuel

Effortlessly Prepare Form PT 350 Petroleum Business Tax Return For Fuel on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed materials, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to quickly create, modify, and eSign your documents without any delays. Manage Form PT 350 Petroleum Business Tax Return For Fuel across any platform with airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

Steps to Modify and eSign Form PT 350 Petroleum Business Tax Return For Fuel Effortlessly

- Obtain Form PT 350 Petroleum Business Tax Return For Fuel and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your preference. Modify and eSign Form PT 350 Petroleum Business Tax Return For Fuel and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form pt 350 petroleum business tax return for fuel

Create this form in 5 minutes!

People also ask

-

What is Form PT 350 Petroleum Business Tax Return For Fuel?

Form PT 350 Petroleum Business Tax Return For Fuel is a tax document used by businesses that deal with petroleum products. This form helps ensure compliance with state tax regulations and accurately report the business’s fuel sales. Completing this form correctly is essential for avoiding penalties and maintaining good standing.

-

How can airSlate SignNow help me with Form PT 350 Petroleum Business Tax Return For Fuel?

airSlate SignNow streamlines the process of completing and submitting Form PT 350 Petroleum Business Tax Return For Fuel by providing easy eSigning capabilities. Our platform allows you to fill out the form electronically and obtain necessary signatures without any hassle. This efficiency can save you time and reduce the likelihood of errors.

-

What features does airSlate SignNow offer for preparing Form PT 350 Petroleum Business Tax Return For Fuel?

Our platform includes features like customizable templates, cloud storage, and secure sharing options specifically designed for forms like Form PT 350 Petroleum Business Tax Return For Fuel. You can easily access your previous submissions, track changes, and collaborate with team members in real time, ensuring that everyone is on the same page.

-

Is there a free trial available for using airSlate SignNow to file Form PT 350 Petroleum Business Tax Return For Fuel?

Yes, airSlate SignNow offers a free trial that allows you to explore our features, including those for filing Form PT 350 Petroleum Business Tax Return For Fuel. This is a great opportunity to see how our solution can meet your needs before committing to a paid plan.

-

What are the pricing options for airSlate SignNow when managing Form PT 350 Petroleum Business Tax Return For Fuel?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose from monthly or annual subscriptions, with access to features specifically tailored for managing Form PT 350 Petroleum Business Tax Return For Fuel. Visit our pricing page for detailed information on each plan.

-

Can I integrate airSlate SignNow with other software while handling Form PT 350 Petroleum Business Tax Return For Fuel?

Absolutely! airSlate SignNow supports integrations with various software systems, making it easy to incorporate data into Form PT 350 Petroleum Business Tax Return For Fuel. This ensures a seamless workflow, so you can manage your documents efficiently and keep everything organized in one place.

-

What benefits will I gain from using airSlate SignNow for Form PT 350 Petroleum Business Tax Return For Fuel?

Using airSlate SignNow for Form PT 350 Petroleum Business Tax Return For Fuel can greatly enhance your document management process. The platform allows for quick access, secure signing, and convenient storage, saving you time and reducing paper usage. Moreover, our solution ensures your documents are always compliant with industry standards.

Get more for Form PT 350 Petroleum Business Tax Return For Fuel

- Revocation of anatomical gift donation nebraska form

- Employment or job termination package nebraska form

- Newly widowed individuals package nebraska form

- Employment interview package nebraska form

- Employment employee personnel file package nebraska form

- Assignment of mortgage package nebraska form

- Assignment of lease package nebraska form

- Lease purchase agreements package nebraska form

Find out other Form PT 350 Petroleum Business Tax Return For Fuel

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service