Instructions for Form PT 350 Petroleum Business Tax Return for Fuel Consumption Commercial Vessels Revised 922 2022-2026

Understanding the Instructions for Form PT 350

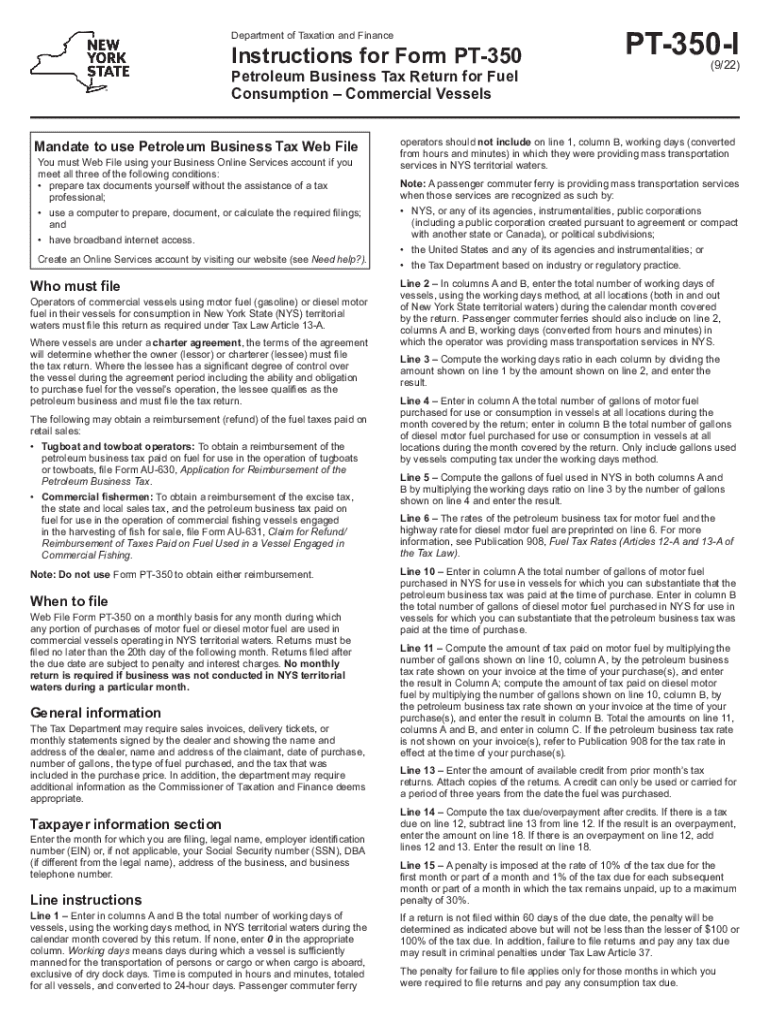

The Instructions for Form PT 350 Petroleum Business Tax Return for Fuel Consumption Commercial Vessels Revised 922 provide essential guidance for businesses involved in the petroleum industry. This form is specifically designed for reporting fuel consumption by commercial vessels, ensuring compliance with state regulations. It outlines the necessary steps for accurately completing the return, which is crucial for maintaining legal and financial accountability.

Steps to Complete the Form

Completing the Instructions for Form PT 350 involves several key steps:

- Gather all relevant information regarding fuel consumption for the reporting period.

- Review the specific sections of the instructions to understand the requirements for each line item.

- Accurately fill out the form, ensuring that all data is correct and complete.

- Double-check calculations and totals to avoid errors that could lead to penalties.

- Sign and date the form, ensuring that all necessary signatures are included.

Legal Use of the Instructions

The Instructions for Form PT 350 are legally binding when completed correctly. To ensure compliance, businesses must adhere to eSignature laws, which validate electronic signatures under the ESIGN and UETA acts. Using a reliable digital solution to sign and submit the form can enhance its legal standing, making it essential to choose a platform that offers secure eSignature options.

Filing Deadlines and Important Dates

It is important to be aware of filing deadlines associated with Form PT 350. Typically, the form must be submitted by the end of the reporting period, which can vary based on state regulations. Missing these deadlines can result in penalties, so businesses should mark their calendars and prepare their documentation in advance to ensure timely submission.

Required Documents for Submission

When completing the Instructions for Form PT 350, it is essential to have the following documents ready:

- Records of fuel purchases and consumption for the reporting period.

- Previous tax returns, if applicable, for reference.

- Any correspondence from state tax authorities regarding fuel consumption regulations.

Form Submission Methods

Businesses have several options for submitting Form PT 350. The form can be filed online using a secure e-filing system, mailed to the appropriate state tax office, or delivered in person. Each method has its own advantages, and businesses should choose the one that best fits their operational needs while ensuring compliance with submission guidelines.

Quick guide on how to complete instructions for form pt 350 petroleum business tax return for fuel consumption commercial vessels revised 922

Effortlessly prepare Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922 on any device

The management of online documents has become increasingly popular with both businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922 on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The simplest way to modify and eSign Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922 with ease

- Locate Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922 and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow has specially designed for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks, on any device you choose. Modify and eSign Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922 and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form pt 350 petroleum business tax return for fuel consumption commercial vessels revised 922

Create this form in 5 minutes!

People also ask

-

What are the key features of the Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922?

The Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922 provide detailed guidance on how to complete your tax return accurately. Key features include clear step-by-step instructions, specific requirements for commercial vessels, and definitions of fuel consumption metrics. This ensures that taxpayers can comply with regulatory standards efficiently.

-

How can airSlate SignNow help with the Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922?

airSlate SignNow simplifies the process of handling the Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922 by allowing you to easily send and eSign documents. Our platform streamlines document management, making it easy to complete and submit your tax return. This reduces the risk of errors and accelerates the compliance process.

-

Is there a cost involved in using airSlate SignNow for the Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922?

Yes, there is a cost associated with using airSlate SignNow for the Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922, but it is designed to be cost-effective. We offer flexible pricing plans to accommodate various business needs. Investing in our solution allows for time savings and enhanced accuracy in document handling.

-

What benefits does airSlate SignNow offer when dealing with the Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922?

The main benefits of using airSlate SignNow for the Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922 include ease of use, accessibility from any device, and legal compliance. Additionally, our solution offers powerful features like automated reminders and tracking for document status, ensuring you meet your deadlines effectively. This enhances productivity and reduces stress during tax season.

-

Can airSlate SignNow integrate with other software for the Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922?

Absolutely! airSlate SignNow can seamlessly integrate with various ERP and accounting software, enhancing your workflow when managing the Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922. This integration ensures that all relevant data is synced correctly, further streamlining your processes. Users can enjoy a more cohesive experience while handling their tax returns.

-

Who can benefit from the Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922?

Businesses involved in the petroleum industry, specifically those operating commercial vessels, will find the Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922 particularly beneficial. These guidelines are crucial for compliance and to avoid penalties. Additionally, accountants and tax professionals can leverage these instructions to better assist their clients in navigating complex tax regulations.

-

What is the process for completing the Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922 with airSlate SignNow?

The process begins with accessing the Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922 through airSlate SignNow. Users can fill out the necessary information directly in our platform, add e-signatures, and send the document for review or submission. Our user-friendly interface ensures that even those unfamiliar with digital forms can manage their submissions effectively.

Get more for Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922

- Option to purchase addendum to residential lease lease or rent to own nebraska form

- Nebraska premarital agreement uniform premarital agreement act with financial statements nebraska

- Nebraska prenuptial agreement form

- Amendment to prenuptial or premarital agreement nebraska form

- Financial statements only in connection with prenuptial premarital agreement nebraska form

- Revocation of premarital or prenuptial agreement nebraska form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497317956 form

- Ne incorporation form

Find out other Instructions For Form PT 350 Petroleum Business Tax Return For Fuel Consumption Commercial Vessels Revised 922

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF