Property Tax Credit Chart 2022

What is the Property Tax Credit Chart

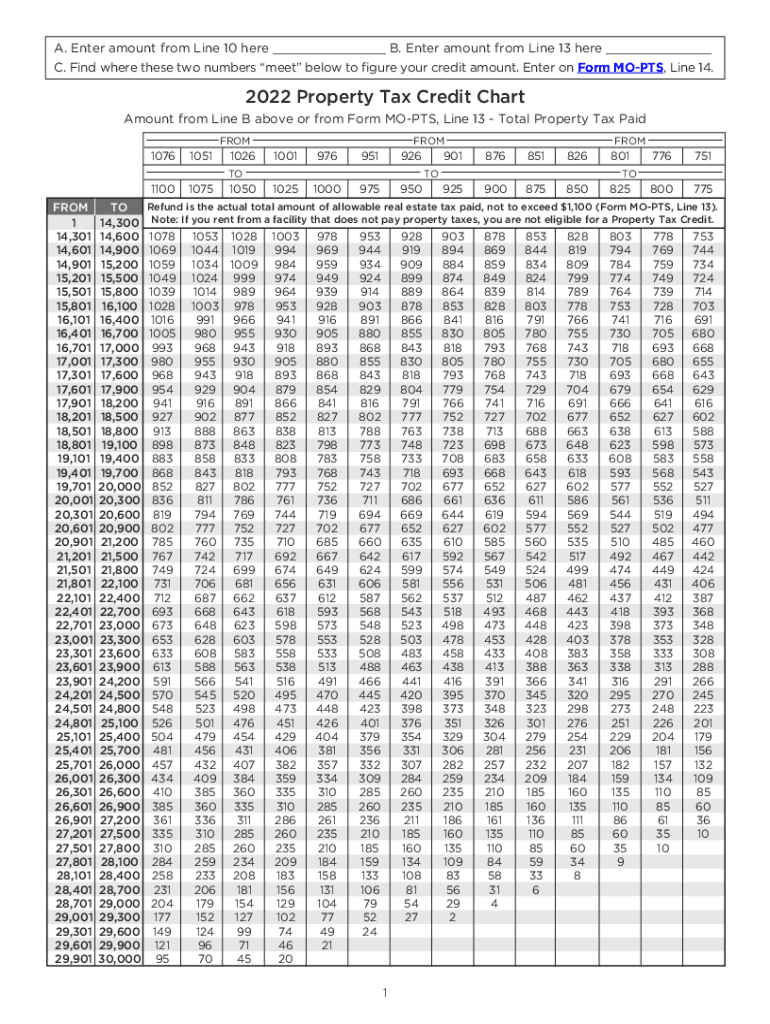

The Property Tax Credit Chart is a crucial document for residents of Missouri seeking to understand their eligibility for property tax credits. This chart outlines the various criteria and amounts available to eligible taxpayers, helping them navigate the complexities of property tax relief. It serves as a reference for individuals looking to reduce their financial burden associated with property taxes, particularly for seniors, disabled individuals, and low-income households.

How to use the Property Tax Credit Chart

Using the Property Tax Credit Chart effectively involves several steps. First, taxpayers should review the eligibility criteria outlined in the chart to determine if they qualify for any credits. Next, they should locate their specific situation within the chart, which may include categories such as age, income level, or disability status. Once the relevant information is identified, taxpayers can calculate their potential credit amount based on the guidelines provided. This process ensures that individuals maximize their benefits while adhering to state regulations.

Steps to complete the Property Tax Credit Chart

Completing the Property Tax Credit Chart requires careful attention to detail. Begin by gathering necessary documentation, such as income statements and proof of age or disability. Next, fill out the chart with accurate information, ensuring that all required fields are completed. It is essential to double-check the accuracy of the data entered, as errors could lead to delays or denial of the credit. Finally, submit the completed chart according to the specified submission methods, ensuring compliance with any deadlines.

Eligibility Criteria

Eligibility for the Property Tax Credit Chart in Missouri is defined by specific criteria. Generally, applicants must be residents of Missouri and meet certain age or income thresholds. For example, senior citizens aged sixty-five and older may qualify for additional credits. Additionally, individuals with disabilities or those who meet low-income requirements are also eligible. Understanding these criteria is vital for taxpayers to ensure they can benefit from the available property tax credits.

Required Documents

When filling out the Property Tax Credit Chart, certain documents are required to verify eligibility and support the application. These typically include proof of income, such as tax returns or pay stubs, as well as documentation confirming age or disability status. It is important to gather these documents in advance to facilitate a smooth and efficient completion of the chart. Ensuring that all required documentation is included can help prevent delays in processing the application.

Form Submission Methods

The Property Tax Credit Chart can be submitted through various methods, providing flexibility for taxpayers. Residents can choose to file the form online, which offers a quick and efficient option. Alternatively, the chart can be mailed to the appropriate state agency or submitted in person at designated locations. Each submission method has its own advantages, and individuals should select the one that best suits their needs while ensuring adherence to any deadlines.

Legal use of the Property Tax Credit Chart

The legal use of the Property Tax Credit Chart is governed by state regulations that dictate how property tax credits are applied for and administered. It is essential for taxpayers to understand that submitting the chart accurately and on time is crucial for compliance with state laws. Failure to adhere to these regulations may result in penalties or denial of the credit. Utilizing a reliable platform for eSigning and submitting the chart can help ensure that all legal requirements are met.

Quick guide on how to complete 2022 property tax credit chart

Complete Property Tax Credit Chart seamlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal sustainable alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Property Tax Credit Chart on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to alter and eSign Property Tax Credit Chart effortlessly

- Find Property Tax Credit Chart and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Property Tax Credit Chart and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 property tax credit chart

Create this form in 5 minutes!

People also ask

-

What is the mo ptc form 2023 and how does it work with airSlate SignNow?

The mo ptc form 2023 is a crucial document for businesses operating in Missouri, enabling efficient processing and submission of necessary forms. With airSlate SignNow, users can easily fill out, send, and eSign the mo ptc form 2023, streamlining your workflow and ensuring compliance. This electronic solution not only saves time but also enhances the accuracy of your submissions.

-

What are the pricing options for using airSlate SignNow for the mo ptc form 2023?

airSlate SignNow offers flexible pricing plans tailored to different business needs, starting from a competitive rate for basic features to comprehensive packages that cater to larger teams. By utilizing airSlate SignNow for the mo ptc form 2023, you can control costs while maximizing productivity. Moreover, you'll find that the investment greatly streamlines document management, providing excellent value.

-

What key features does airSlate SignNow provide for the mo ptc form 2023?

airSlate SignNow includes several essential features for handling the mo ptc form 2023, such as document templates, secure eSigning, and real-time collaboration. These tools help simplify the completion and signing process, making it faster and more efficient for users. Additionally, the user-friendly interface ensures everyone can navigate the platform easily, regardless of technical expertise.

-

How can airSlate SignNow improve the efficiency of processing the mo ptc form 2023?

By using airSlate SignNow, businesses can drastically improve their efficiency in processing the mo ptc form 2023. Automated workflows and document tracking allow for quick submissions and instant updates, eliminating bottlenecks caused by traditional paperwork. This not only reduces turnaround times but also enhances overall operational productivity.

-

Is it easy to integrate airSlate SignNow with other software for managing the mo ptc form 2023?

Absolutely! airSlate SignNow is designed to seamlessly integrate with various business applications, enhancing your existing processes when managing the mo ptc form 2023. Whether you use CRM systems, cloud storage, or other document management tools, connecting airSlate SignNow ensures that your eSigning process remains smooth and efficient.

-

Can airSlate SignNow help with compliance for the mo ptc form 2023?

Yes, airSlate SignNow is committed to helping businesses maintain compliance when submitting the mo ptc form 2023. The platform provides secure authentication methods and legally binding eSignatures, ensuring your documents align with both local and federal regulations. By utilizing this service, you can confidently manage compliance while simplifying your document workflow.

-

What benefits does airSlate SignNow offer for businesses dealing with the mo ptc form 2023?

The primary benefits of using airSlate SignNow for the mo ptc form 2023 include enhanced speed, convenience, and cost savings. With the ability to eSign and manage documents electronically, businesses can reduce their reliance on paper, minimize errors, and cut down operational costs. This provides a more environmentally-friendly approach and increases customer satisfaction through faster service.

Get more for Property Tax Credit Chart

- Warranty deed from husband and wife to an individual new hampshire form

- Nh 540 form

- Quitclaim deed two individuals to one individual new hampshire form

- New hampshire deed 497318560 form

- New hampshire form

- New hampshire interest form

- New hampshire account form

- Quitclaim deed from individual to individual new hampshire form

Find out other Property Tax Credit Chart

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself