Portal Ct GovAttorney Occupational Tax FormCurrent 472 CT GOV Connecticut's Official State Website 2022-2026

Understanding the Connecticut Attorney Occupational Tax Form 472

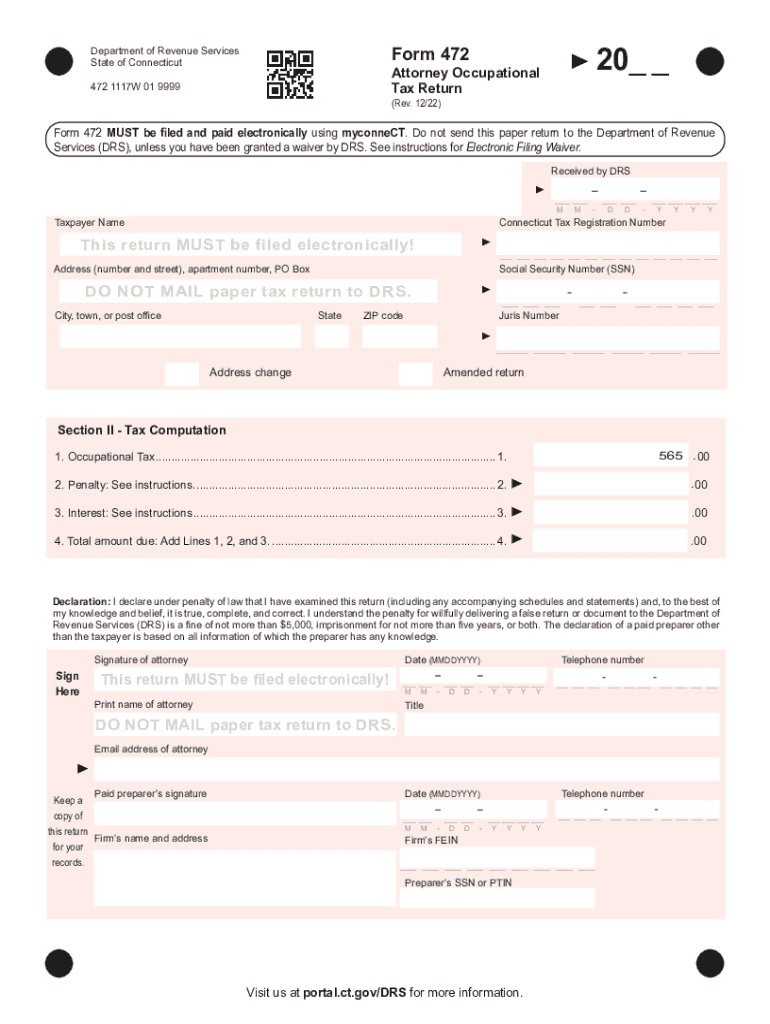

The Connecticut Attorney Occupational Tax Form 472 is a crucial document for attorneys practicing in the state. This form is used to report and pay the occupational tax imposed on attorneys. The tax is assessed annually, and it is essential for compliance with state regulations. Attorneys must ensure they are aware of the specific requirements and deadlines associated with this form to avoid penalties.

Steps to Complete the Connecticut Attorney Occupational Tax Form 472

Completing the CT Attorney Occupational Tax Form 472 involves several key steps:

- Gather necessary information, including your attorney registration number and income details.

- Access the form through the official Connecticut government website or a trusted electronic document platform.

- Fill out the required fields accurately, ensuring all information is current and complete.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or via mail, depending on your preference and the guidelines provided.

Filing Deadlines for Form 472

It is important to adhere to the filing deadlines for the Connecticut Attorney Occupational Tax Form 472. Typically, the form must be filed by July 1 of each year. Late submissions may result in penalties, so attorneys should mark their calendars and prepare their documents well in advance to ensure timely filing.

Legal Use of the Connecticut Attorney Occupational Tax Form 472

The legal use of the CT Attorney Occupational Tax Form 472 is defined by state law. This form serves as a declaration of compliance with the occupational tax requirements for attorneys. Proper completion and submission of this form not only fulfill legal obligations but also contribute to maintaining good standing with the Connecticut Bar Association.

Required Documents for Filing Form 472

When preparing to file the Connecticut Attorney Occupational Tax Form 472, attorneys should have the following documents ready:

- Proof of income for the reporting year, which may include pay stubs or tax returns.

- Your attorney registration number.

- Any prior year tax forms for reference.

Penalties for Non-Compliance with Form 472

Failure to file the Connecticut Attorney Occupational Tax Form 472 by the deadline can result in significant penalties. These may include fines or additional interest on the owed amount. It is crucial for attorneys to understand the importance of compliance and to take proactive steps to ensure that their filings are completed accurately and on time.

Quick guide on how to complete portalctgovattorney occupational tax formcurrent 472 ctgov connecticuts official state website

Effortlessly prepare Portal ct govAttorney Occupational Tax FormCurrent 472 CT GOV Connecticut's Official State Website on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, enabling you to easily access the right form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and electronically sign your documents quickly without delays. Handle Portal ct govAttorney Occupational Tax FormCurrent 472 CT GOV Connecticut's Official State Website on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-based activity today.

How to modify and electronically sign Portal ct govAttorney Occupational Tax FormCurrent 472 CT GOV Connecticut's Official State Website effortlessly

- Obtain Portal ct govAttorney Occupational Tax FormCurrent 472 CT GOV Connecticut's Official State Website and click on Get Form to get going.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or redact sensitive information with the tools provided specifically for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Portal ct govAttorney Occupational Tax FormCurrent 472 CT GOV Connecticut's Official State Website to guarantee exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct portalctgovattorney occupational tax formcurrent 472 ctgov connecticuts official state website

Create this form in 5 minutes!

People also ask

-

What is the CT attorney occupational tax form 472?

The CT attorney occupational tax form 472 is a necessary document required for attorneys practicing in Connecticut to report and pay their occupational tax. This form helps ensure compliance with state regulations, benefitting both attorneys and their clients by maintaining transparency in tax obligations.

-

How can airSlate SignNow assist with the CT attorney occupational tax form 472?

airSlate SignNow streamlines the process of completing and submitting the CT attorney occupational tax form 472 through its user-friendly eSignature platform. Our software allows attorneys to easily fill out, sign, and share the form, reducing the hassle of paperwork and ensuring timely submissions.

-

Is there a cost associated with using airSlate SignNow for the CT attorney occupational tax form 472?

Yes, there is a subscription fee for using airSlate SignNow, which offers various pricing plans based on your business needs. This cost-effective solution provides unlimited document signing capabilities, making it a worthwhile investment for attorneys needing to file the CT attorney occupational tax form 472 regularly.

-

What features does airSlate SignNow offer for managing the CT attorney occupational tax form 472?

airSlate SignNow provides a range of features for managing the CT attorney occupational tax form 472, including document templates, eSignature options, and tracking capabilities. These features simplify the workflow, ensuring that attorneys can manage their documentation efficiently and effectively.

-

Can I integrate airSlate SignNow with other software to handle the CT attorney occupational tax form 472?

Absolutely! airSlate SignNow supports integrations with various popular tools and applications, allowing you to seamlessly manage the CT attorney occupational tax form 472 alongside your existing systems. This integration capabilities help enhance your productivity and streamline your operational processes.

-

What benefits does using airSlate SignNow provide for submitting the CT attorney occupational tax form 472?

Using airSlate SignNow for the CT attorney occupational tax form 472 offers numerous benefits, such as increased efficiency, reduced errors, and improved compliance. Our platform automates the signing process and ensures that documents are securely stored, providing peace of mind for attorneys.

-

How secure is airSlate SignNow when handling sensitive data like the CT attorney occupational tax form 472?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure document storage protocols to protect sensitive information, including the CT attorney occupational tax form 472, ensuring that your data remains confidential and secure from unauthorized access.

Get more for Portal ct govAttorney Occupational Tax FormCurrent 472 CT GOV Connecticut's Official State Website

- Quitclaim deed by two individuals to llc new hampshire form

- Warranty deed from two individuals to llc new hampshire form

- Notice to financial institution of furnishing of labor or materials corporation or llc new hampshire form

- Notice to financial institution of furnishing of labor or materials railroad individual new hampshire form

- Quitclaim deed by two individuals to corporation new hampshire form

- New hampshire deed 497318599 form

- Notice to financial institution of furnishing of labor or materials railroad corporation new hampshire form

- New hampshire release form

Find out other Portal ct govAttorney Occupational Tax FormCurrent 472 CT GOV Connecticut's Official State Website

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later