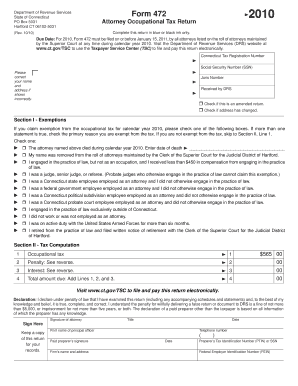

Attorney Occupational Tax Ct 2010

What is the Attorney Occupational Tax in Connecticut?

The Attorney Occupational Tax in Connecticut is a tax levied on individuals who are licensed to practice law in the state. This tax is applicable to attorneys who earn income from their legal practice and is calculated based on their gross earnings. The tax is designed to support state funding for various public services, including legal aid and court operations. Understanding the specifics of this tax is essential for compliance and financial planning for attorneys working in Connecticut.

Steps to Complete the Attorney Occupational Tax in Connecticut

Completing the Attorney Occupational Tax form involves several steps to ensure accuracy and compliance. Here is a straightforward guide:

- Gather necessary documentation, including income statements and any relevant financial records.

- Access the official form, typically referred to as CT-472, which is specifically designed for reporting this tax.

- Fill out the form with accurate income figures, ensuring that all sources of legal income are included.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or via mail, adhering to the filing deadlines set by the Connecticut Department of Revenue Services.

Legal Use of the Attorney Occupational Tax in Connecticut

The Attorney Occupational Tax serves a legal purpose by ensuring that attorneys contribute to the funding of state services that support the legal system. This includes funding for public defenders, legal aid organizations, and other essential services. Compliance with this tax is not only a legal obligation but also a civic responsibility that helps maintain the integrity of the legal profession in Connecticut.

State-Specific Rules for the Attorney Occupational Tax

Connecticut has specific rules governing the Attorney Occupational Tax that attorneys must follow. These include:

- Registration with the Connecticut Department of Revenue Services upon obtaining a law license.

- Filing the tax annually, typically by a designated deadline to avoid penalties.

- Maintaining accurate records of all income earned from legal practice to support the figures reported on the tax form.

Required Documents for the Attorney Occupational Tax

When preparing to file the Attorney Occupational Tax, attorneys should have the following documents ready:

- Income statements from all legal services provided.

- Any 1099 forms received from clients or firms.

- Records of business expenses that may be deductible.

- Previous year’s tax returns for reference, if applicable.

Penalties for Non-Compliance with the Attorney Occupational Tax

Failing to comply with the Attorney Occupational Tax requirements can result in significant penalties. These may include:

- Fines for late filing or failure to file.

- Interest on unpaid taxes, which can accumulate over time.

- Potential legal action for persistent non-compliance, which may affect an attorney's ability to practice law.

Quick guide on how to complete attorney occupational tax ct

Effortlessly Prepare Attorney Occupational Tax Ct on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and electronically sign your documents without delays. Manage Attorney Occupational Tax Ct on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Attorney Occupational Tax Ct effortlessly

- Locate Attorney Occupational Tax Ct and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your requirements in document management with just a few clicks from your chosen device. Edit and eSign Attorney Occupational Tax Ct while ensuring exceptional communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct attorney occupational tax ct

Create this form in 5 minutes!

People also ask

-

What is ct attorney occupational tax and how does it affect my business?

CT attorney occupational tax is a tax imposed on attorneys practicing in Connecticut. This tax can impact your business's financial planning and compliance obligations. It's essential to understand how this tax applies to your services and how to factor it into your operating costs.

-

How can airSlate SignNow help with managing ct attorney occupational tax documents?

AirSlate SignNow simplifies the process of sending and eSigning documents related to your ct attorney occupational tax obligations. It provides a secure platform to manage contracts, forms, and tax documents, ensuring that all paperwork is handled efficiently and accurately.

-

What features does airSlate SignNow offer for handling tax-related documents?

AirSlate SignNow includes features such as customizable templates, document tracking, and automated reminders to help you manage your ct attorney occupational tax documents. These tools enable you to streamline your administrative processes and reduce the time spent on paperwork.

-

Is airSlate SignNow affordable for small law firms managing ct attorney occupational tax?

Yes, airSlate SignNow offers cost-effective pricing plans designed for small businesses and law firms. By using our platform, you can reduce operational costs while ensuring compliance with ct attorney occupational tax requirements, making it a smart investment for your firm.

-

Can I integrate airSlate SignNow with my existing accounting software for ct attorney occupational tax?

Absolutely! AirSlate SignNow supports integrations with a variety of accounting software, allowing you to seamlessly manage your ct attorney occupational tax documents alongside your financial records. This integration ensures that you stay organized and compliant without the hassle of manual data entry.

-

What are the benefits of using airSlate SignNow for eSigning tax documents?

Using airSlate SignNow for eSigning tax documents streamlines the process, saves time, and enhances security. You can quickly obtain signatures on your ct attorney occupational tax documents, ensuring timely filing and compliance while maintaining a professional image with your clients.

-

Does airSlate SignNow offer support for ct attorney occupational tax compliance?

Yes, airSlate SignNow is designed to help law firms maintain compliance with ct attorney occupational tax guidelines. Our platform allows you to keep track of important deadlines and manage tax-related forms efficiently, reducing the risk of penalties and ensuring that your firm adheres to legal requirements.

Get more for Attorney Occupational Tax Ct

- Arkansas department of health trauma awin radio application form

- Adosh 70 notice of alleged safety or health hazards the industrial commission of arizona division of occupational safety ampamp form

- Dfeh certification of health care provider form

- Complaint for a civil caseunited states courtsfree employee complaint form pdfwordeformsfree 4 customer complaint forms in

- Title 10 department of health and mental hygiene maryland form

- Instructions for completion of state of maryland tissue bank dhmh dhmh maryland form

- Agreement for services title child care provider form

- The moos newsblog archiveproto what how to form

Find out other Attorney Occupational Tax Ct

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template